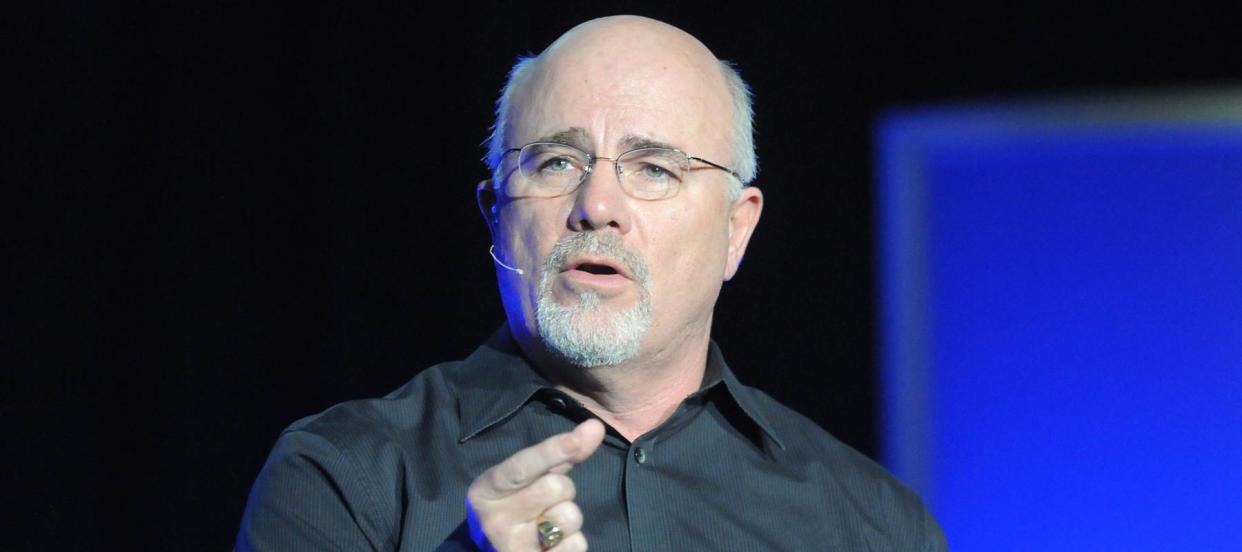

'You've screwed yourself': Dave Ramsey gets candid with a caller who cashed out her 403(b) to buy a home — here's what went wrong

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links.

Dave Ramsey isn't known for being subtle.

On a recent episode of "The Ramsey Show," the radio host and personal finance expert told an Orlando woman, bluntly, "You've screwed yourself. You've really made yourself a mess."

His response came after the woman, 28-year-old Selena, shared the details of a recent financial decision. She withdrew $26,000 from her 403(b) retirement account for a down payment on a home construction with the idea it would offer more room for her new baby than her condo.

Ramsey's reaction was less than optimistic.

Don't miss

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here's how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

Cost-of-living in America is still out of control — use these 3 'real assets' to protect your wealth today, no matter what the US Fed does or says

Car insurance rates have spiked in the US to a stunning $2,150/year — but you can be smarter than that. Here's how you can save yourself as much as $820 annually in minutes (it's 100% free)

"I'm scared for you," he said. "I hope you get out of it with your skin intact, but I'm not positive you're going to."

But in offering suggestions on how to recover, Ramsey may have overlooked some key details.

What went wrong?

By Ramsey's account, Selena faces serious consequences: a major tax bill and potentially simultaneous mortgage payments.

Listeners should note that though Ramsey offers some insights, he is not a qualified tax professional. While he advises his caller in this case to seek help from investment advisers (via his website), someone in a similar situation may be best served by a Certified Public Accountant or tax attorney.

With that in mind, here's what Ramsey says went wrong.

Impulse buying

Ramsey chastised Selena for pulling the 403(b) money to put it toward a new house before selling her current home.

Even worse, Ramsey warned, interest rates could increase in the near future, making it a tough market for sellers and leaving Selena with two home loan payments.

Instead of trying to become an Airbnb landlord and piling on this tax bill, Selena could have invested in or necessity-backed commercial real estate with First National Realty Partners or residential real estate with DLP Capital.

FNRP’s online platform gives accredited investors the chance to diversify their portfolio with necessity-based real estate without the effort it takes to find the deals yourself. They vet every deal against a set of rigorous investment criteria, so you don’t have to worry about the quality, but just enjoy the cash flow of quarterly distributions.

If you’re not an accredited investor but still want to get in on real estate cash flow, DLP Capital offers this opportunity to accredited and non accredited investors alike. DLP Capital is a private financial services and real estate investment firm — that makes investing in REITs easily accessible so you can benefit from high-return investments and solid dividends without becoming a landlord.

Read more: These 5 magic money moves will boost you up America's net worth ladder in 2024 — and you can complete each step within minutes. Here's how

Overlooking Tax Implications

By Ramsey's estimate, the retirement withdrawal was equivalent to a 40% interest loan and Selena should expect a tax bill of around $12,000.

While Ramsey did not explain how he arrived at those figures, he may have based them on these IRS charges:

10% early withdrawal penalty

Income taxes assessed on the amount withdrawn

Having a qualified financial advisor in your corner can help you make sure you’re not paying any more than you need to in taxes on your investments. And Zoe Financial— a wealth platform that connects people to fiduciaries, financial advisors and financial planners can help with this.

Zoe Financial makes it easy to find a financial advisor that can help you organize your finances and make sure no penny slips through the cracks .When you answer a few questions about yourself, Zoe Financial will match you with a curated list of financial professionals and you can book a free, no obligation consultation to see if they’re the right fit.

What was Ramsey's advice?

Selena's first priority, according to Ramsey, should be to reduce pending tax penalties by putting money back into the 403(b).

According to the IRS, taxes can generally be avoided on an early retirement withdrawal by "rolling over" the funds into another qualified retirement account, if done within 60 days. It's unclear, however, whether the penalty can be avoided by depositing money back into the account used for the withdrawal.

Selena could also choose to invest in a Gold IRA from Goldco— a reputable precious metals dealership offering IRAs and direct purchases of precious metals and coins.

With a Gold IRA, you can benefit from the inflation-hedging properties of gold alongside the tax advantages that come with a traditional IRA. Plus, Goldco’s customer service is quick to assist you if you ever feel lost in the process.

What to read next

Jeff Bezos and Oprah Winfrey invest in this asset to keep their wealth safe — you may want to do the same in 2024

Rich young Americans have lost confidence in the stock market — and are betting on these 3 assets instead. Get in now for strong long-term tailwinds

Jeff Bezos told his siblings to invest $10K in his startup called Amazon, and now their stake is worth over $1B — 3 ways to get rich without having to gamble on risky public stocks

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.