Young athletes may face financial literacy gap as their wealth-building chances grow

More and more college athletes are earning money off their name, image, or likeness (NIL) since a NCAA rules change nearly two years ago — affording them the opportunity to profit from their sport no matter if they turn pro.

But many aren’t equipped to deal with the new financial infusion.

Just under half of 30,000 college students surveyed in 2019 by EVERFI, sponsored by AIG Retirement Services, said they felt unprepared to manage their money. And only 15 states mandate or will mandate that high school students take a stand-alone personal financial course to graduate, according to a Next Gen report.

That — plus those trying to prey on athletes’ ability to monetize their NIL— could undermine these young athletes' opportunity to build wealth that can help launch them into adulthood, achieve financial milestones, and lift up their families.

“There is a lack of infrastructure to provide protections that athletes need, making them vulnerable,” Ellen Staurowsky, professor of sports media at Ithaca College, told Yahoo Finance. “These athletes are being offered endorsement deals that sign away rights to their name, image and likeness into perpetuity because they didn’t have representation and were doing this on their own. There needs to be real reform like a players association to support college athletes to have a place at the table.”

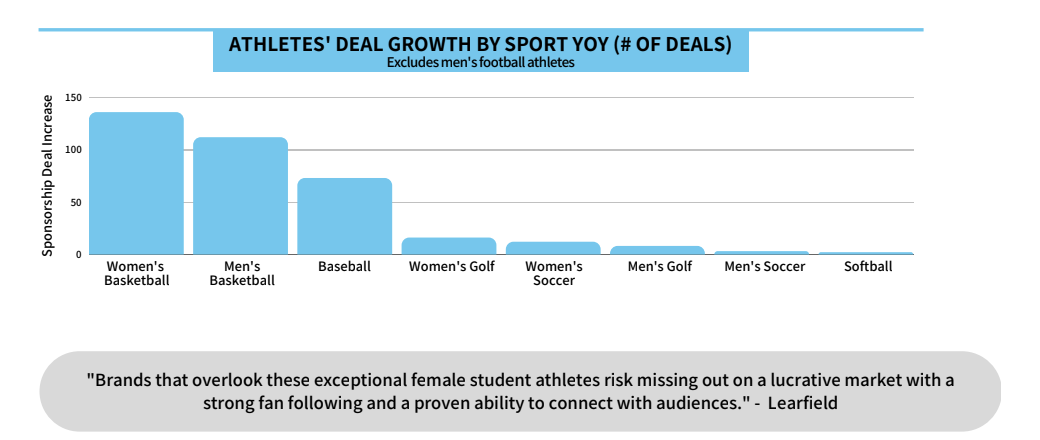

Last year, there was a 146% increase in NIL deals with almost 2,000 deals made across 16 sports, according to SponsorUnited.

That translates into real money.

“Over my three seasons in the NFL, I contributed about $50,000 to my 401(k) plan, including the employer match and today that account is worth almost $200,000, and I haven’t contributed anything since 2004,” Delvin Joyce, a former NFL athlete and financial planner at Prudential Financial, told Yahoo Finance. “NIL is providing college athletes the opportunity to start saving and taking advantage of time-compound growth four years sooner, and many of these athletes will never actually play professional sports.”

Like the average American struggling to understand the building blocks for wealth, financial literacy is key for these college athletes. Unfortunately, financial education for college athletes has been left to states and individual schools to work out, to the detriment of athletes.

“There's still a major gap in NIL education and many athletes don’t know how to even begin with NIL — and those that do either aren’t using school resources or think schools could be offering more,” according to a report by Front Office Sports.

“Players now are tasked with managing large sums of money when you combine NIL payments with the housing stipend and cost of attendance payments, so it’s imperative for colleges to provide financial literacy education to these athletes so that they understand how to create priorities with their cash flow,” Joyce said.

Even athletes are asking for this. An NCAA study found that 39% of women athletes and 42% of men athletes are looking for more education and resources on navigating NIL opportunities.

“Despite the wealth of opportunity, it hasn’t taken long for student-athletes to quickly realize they face challenges they aren’t equipped to handle on their own,” Sandra L. Richards, president of Morgan Stanley’s Global Sports & Entertainment Division, told Yahoo Finance. “This includes how to garner deals while playing a sport less popular than basketball or football, discerning what deals are worth their time, choosing a company that best represents their interests, and most importantly, how to negotiate a contract and understand the financial details of the deals.”

Female athletes can face their own unique hurdles, even as their opportunities grow. Women’s basketball, volleyball, softball, and swimming and diving have bested men’s baseball and soccer in NIL deals, according to OpenDorse.

“Although female athletes are benefiting from NIL, there’s an enormous level of neglect that has happened up to this time,” Staurowsky said. “There’s sexism in the types of endorsements women athletes are getting and some can’t find a company to support their sport programming.”

“NIL deals for women's college basketball athletes grew 186% in 2022 — the second highest percentage of new deals behind football — compared to a 67% increase in deals for men's basketball athletes,” according to SponsorUnited.

“Creating an intentional savings and investment strategy with NIL proceeds may be more important for female athletes because there are fewer opportunities to make big money in professional sports than for male athletes,” Joyce said.

The consequences for managing money correctly are profound. There are many stories about professional athletes who lost their fortunes to mismanagement and fraud. That’s the same challenge facing these young athletes, who arguably have fewer resources than their professional counterparts.

And the fallout could be even worse, given that many won’t earn a penny as a professional. This is their shot.

“Only a small percentage of college athletes will go professional, so many are using the opportunity to monetize their name, image, and likeness to build generational wealth once their collegiate careers are over,” Richards said. “The money earned from NIL deals are helping their siblings go to college or homeownership for their family.”

Ronda is a personal finance senior reporter for Yahoo Finance and attorney with experience in law, insurance, education, and government. Follow her on Twitter @writesronda

Read the latest financial and business news from Yahoo Finance