This New Yorker defended restaurant jobs in viral TikTok after getting laid off from a tech company. Could he actually be better off in the service industry?

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links.

At one time, if you wanted job stability, you’d seek out corporate work. You could post up at a desk for 30-plus years and expect to retire with a tidy nest egg.

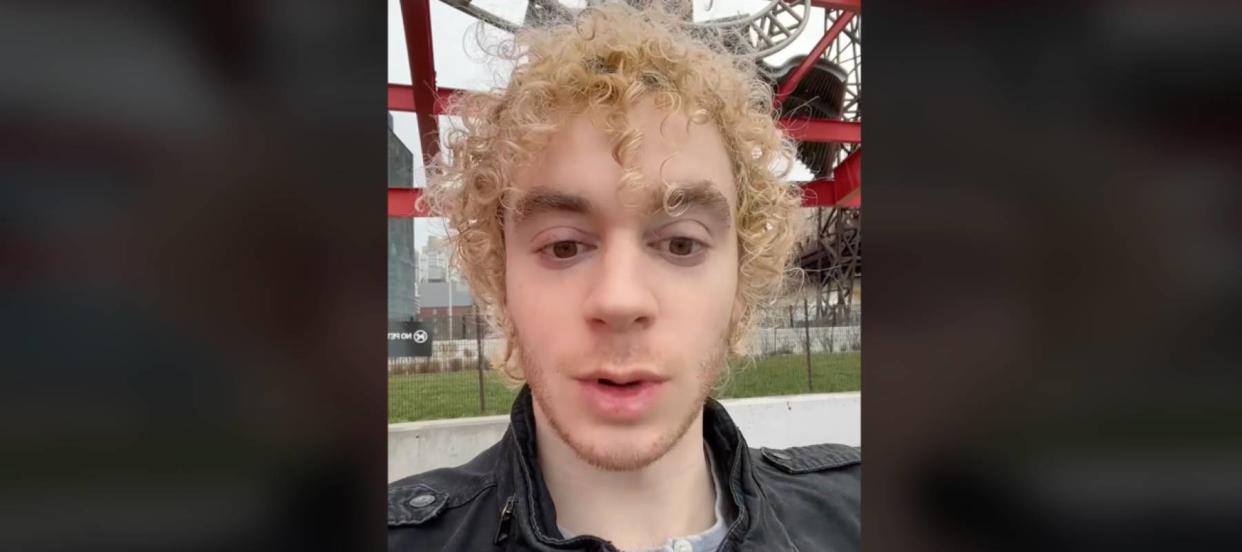

But amid layoffs and a tumultuous job market, that’s no longer the case — as one TikToker, Sean Lans, found out when he was recently laid off from his corporate position. Lans is now looking for a restaurant job to make some money until he finds his next desk job.

The response he’s gotten, which he shared in a viral video, has been surprising. Many people in his life have encouraged him not to be “embarrassed” of working in a restaurant when he has a degree from a good college and a resume full of corporate roles.

Don't miss

Worried you haven’t saved enough for retirement? Here’s how to get your savings on track

Thanks to Jeff Bezos, you can now use $100 to cash in on prime real estate — without the headache of being a landlord. Here's how

These 5 magic money moves will boost you up America's net worth ladder in 2024 — and you can complete each step within minutes. Here's how

“I wasn’t embarrassed. A job is a job,” Lans says. “I’m going to do whatever I need to do to get money. I always have and I always will.”

Lans understands that the economic realities are changing and that he needs to be flexible in his career path, but doesn’t understand why there’s any shame around this. In fact, his approach may be the one that can keep you in the green — even when times get tough.

Servers can make bank

As the commenters on Lans’ video explain, the notion that working in service is just a fall-back option or low-paying couldn’t be more wrong.

“People shame me for bartending but I make my rent in 5 hours and work 3 days a week,” one user wote.

The Bureau of Labor Statistics reports that wait staff make a median salary of $29,120 per year. But much of the money that servers bring in is from tips — which can be stressful come tax time.

With tax season soon coming to a close, It’s important to know exactly what needs to be reported and when — which is where TurboTax comes in. TurboTax is designed to simplify the tax filing process, and guide you through a series of questions to ensure you have all the necessary documents to get all the deductions and credits available to you in order to maximize your refund.

There are no exact numbers on how much servers make in tips, but it’s approximated to be $100 per shift, according to staffing platform Adia. If you’re working five shifts a week, that can amount to an extra $500 a week — or $24,000 a year. This would nearly double your $29,000 base salary to $53,000.

Whether you save up cash tips from a serving job or set aside some spare change with Acorns — an automated saving and investing app— it is possible to invest and grow your money regardless of your job title.

Getting started is easy: Just sign up and link your bank account to the app and it will automatically round up every purchase you make to the nearest dollar and put the difference into a smart investment portfolio. This way, even when you’re spending on essentials, you’re also investing for the future.

Though tech can be a lucrative industry, the median salary for a tech worker is actually less than what a server makes with tips: $43,680 per year, according to job board behemoth ZipRecruiter.

Regardless of if you find yourself in the corporate world or working in the service industry, proper budgeting can make all the difference when it comes to your account balance. Monarch Money is a budgeting app that makes this easy.

With Monarch Money, you can set and track your financial goals, enjoy access to personalized advice and track your net worth. To get started, all you need to do is download the app and sign up to start your 7 day free trial.

Read more: Generating 'passive income' through real estate is the biggest myth in investing —but here's one surefire way to do it without breaking the bank

Corporate layoffs are rampant

Lans is just one of many white-collar workers experiencing layoffs. He didn’t specify the industry he worked in, but he says that he has previously worked in equity trading at a bank and data analytics at a tech company.

It’s been a rough start for the tech industry in 2024. Nearly 50,000 employees have been laid off from 201 tech companies so far this year, according to tracking website Layoffs.fyi. Reuters reports that these companies include Google, Amazon and Twitch, with sources explaining that a focus on AI as the main reason.

If that means people can’t rely on the tech industry for job security, they may have to be more flexible in their careers, like Lans.

Finding work — especially in a different industry — can be daunting. But using a platform like ZipRecruiter can streamline your job hunt. ZipRecruiter is an online job marketplace that connects job seekers to employers and roles based on their skills and experience. By answering a few screening questions and uploading your resume, you’ve already taken a big step toward your next career move.

Even if you think it’ll never happen to you, it’s a good idea to build up a good cushion in case of an unexpected job change. A robust emergency fund (or secondary source of income) can ensure you've got a little breathing room if the worst ever happens.

By building up an emergency fund using a high yield savings account, you can earn higher interest on your stash, giving you a bigger cushion in the event of an unforeseen layoff.

For a streamlined look at what high-yield savings account is best for you, you can check out the Best High-Yield Savings Accounts of 2024.

What to read next

Are you ready for your first year of retirement? Here are 5 things you might not expect — but definitely need to prepare for

Millions of Americans are in massive debt in the face of rising costs. Here's how to get your head above water ASAP

The US dollar has lost 87% of its purchasing power since 1971 — invest in this stable asset before you lose your retirement fund

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.