Yellen warns of 'irreparable harm' if debt ceiling not raised in letter to Congress

Treasury Secretary Janet Yellen warned the formal debt limit is set to be reached next week in a letter to Congress Friday and pushed lawmakers to increase or suspend the limit in a "timely manner" to avoid far-reaching economic damage.

"Failure to meet the government's obligations would cause irreparable harm to the U.S. economy, the livelihoods of all Americans, and global financial stability," Yellen wrote.

The long-awaited milestone, after which the U.S. borrowing authority of approximately $31.4 trillion will be exhausted, is expected to kick the ongoing debate in Congress about increasing the nation's borrowing authority into a higher gear.

Many Republicans have said they will block any attempts to increase borrowing authority in the coming months without deep concessions on spending, while Democrats have vowed to refuse to negotiate over the issue at all.

The next step, which will begin on Thursday, is a process known as "extraordinary measures" whereby the Treasury Department can essentially move money around to stave off an actual default on U.S. obligations. This measure, however, only works for a short period.

"The period of time that extraordinary measures may last is subject to considerable uncertainty due to a variety of factors," Yellen wrote on Friday. Yellen would not provide an exact estimate of when the U.S. would be unable to pay its debts, but added, "it is unlikely that cash and extraordinary measures will be exhausted before early June."

'This is not a time for panic'

Other groups have projected the U.S. can maintain its borrowing authority for only slightly longer.

The Bipartisan Policy Center tracks the issue closely and has estimated that the date when extraordinary measures run out — which it calls the "X date" — is likely to fall in the third quarter of 2023. But the group cautions that the projections are dated and could change in the coming weeks depending on budget projections that are due to be released soon.

“This is not a time for a panic, we are many months away from the U.S. being unable to meet it's obligations," Shai Akabas, the center’s director of economic policy, said Friday after the letter was released.

Akabas added some compromise is likely to be needed from both parties. "It is certainly a time for policy makers to begin negotiations in earnest," Akabas said.

In her letter, Yellen outlined some of the initial extraordinary measures would impact the U.S. Government's Civil Service Retirement and Disability Fund, the Postal Service Retirees Health Benefits Fund, and the Federal Employee's Retirement System Thrift Savings Plan with immediate effect.

"These are merely accounting maneuvers that the Treasury is allowed to deploy," Akabas explained Friday, noting the maneuvers are not expected to impact anyone's retirement benefits, at least for now.

Yellen promises that after the debt limit is resolved, the three funds "will be made whole."

A House GOP determined to 'scrutinize every dollar spent'

The overall stakes likely on this issue are expected to increase by summer.

This year's coming battle is often compared to 2011, when a protracted fight over the issue led to losses in U.S. equity markets. That fight, which was resolved at the last minute, nonetheless led to the only downgrade of the United States credit rating in history, one of the "real harms" Yellen mentioned in her letter on Friday.

This time around, some experts say the effect could be even worse.

In her letter on Friday, Yellen also reminded Congress programs ranging from Social Security benefits to tax refunds to military salaries would be impacted in the event of a default.

To thwart the looming crisis, policymakers have floated different ways to short circuit a face-off from obscure congressional maneuvers to White House executive actions. But House Republicans have vowed to keep the pressure on and push negotiations as far as they can.

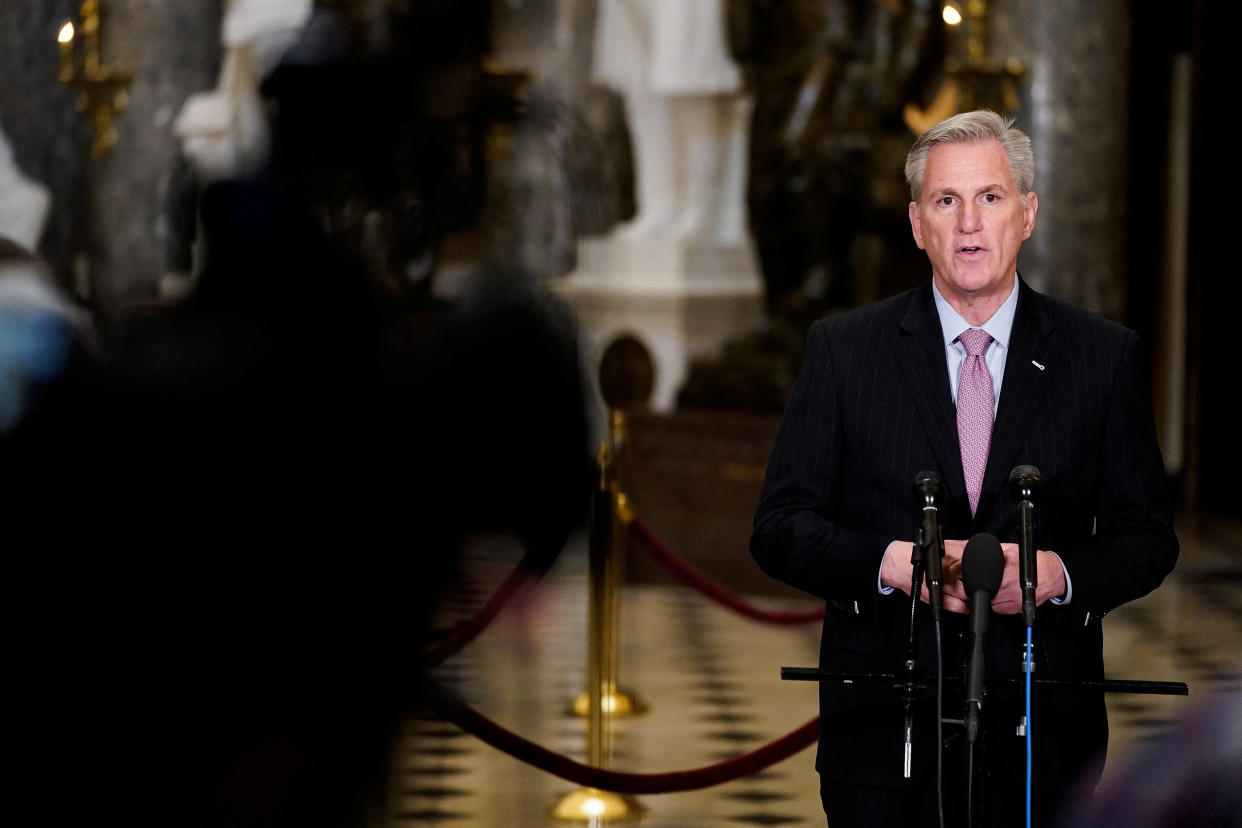

In a press conference on Thursday, Speaker Kevin McCarthy (R-CA) reiterated his plans to use the debt ceiling as leverage and vowed to "scrutinize every dollar spent" by the Biden administration in the years ahead.

On the other side of the aisle, the White House and other Democratic officials have said time and again that they will not negotiate at all on the debt limit.

One recent example of the White House ruling out negotiations came earlier this week when Press Secretary Karine Jean-Pierre told reporters, "Congress is going to need to raise the debt limit without conditions — it’s just that simple."

On Capitol Hill, Rep. Brendan F. Boyle (D-PA), the top Democrat on the House Budget Committee, blasted Republicans Friday for, "thinking it's acceptable to use our economy as a political hostage."

“I urge Congress to act promptly to protect the full faith and credit of the United States," Yellen concluded in her letter Friday.

This post has been updated with additional context.

Ben Werschkul is a Washington correspondent for Yahoo Finance.

Click here for politics news related to business and money

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube