Years Behind, Honda Rushes to Catch Up on EVs

The developed world is currently undergoing its biggest transportation revolution since the creation of the highway. Electric vehicles are already reshaping not just how we live, but the long-term ecological trajectory of the planet. It is happening faster and with more excitement than most saw coming. Sitting on a streetcorner in Tokyo, across from Honda’s global headquarters, you’d never really know.

Here it is hybrids that rule the day, microcars with gas-sipping internal combustion engines and nickel-metal battery packs. Call it 2004’s vision of the future or call it a bubble. Either way, Honda’s executives live, work, and plan in that bubble, and it’s only recently that they’ve gotten serious about fully electric vehicles. The company has a lot of catching up to do.

Why Honda’s Behind the Curve on EVs

“Until five years back, our strategy mainly was that the business would be established mainly around hybrid technologies by 2030. That was what we were anticipating,” Honda CEO Toshihiro Mibe said during a roundtable interview with Road & Track and others. “But in the last five years, battery EVs in terms of the regulations of the EU and the United States, well, there is a more proactive attitude toward BEVs.”

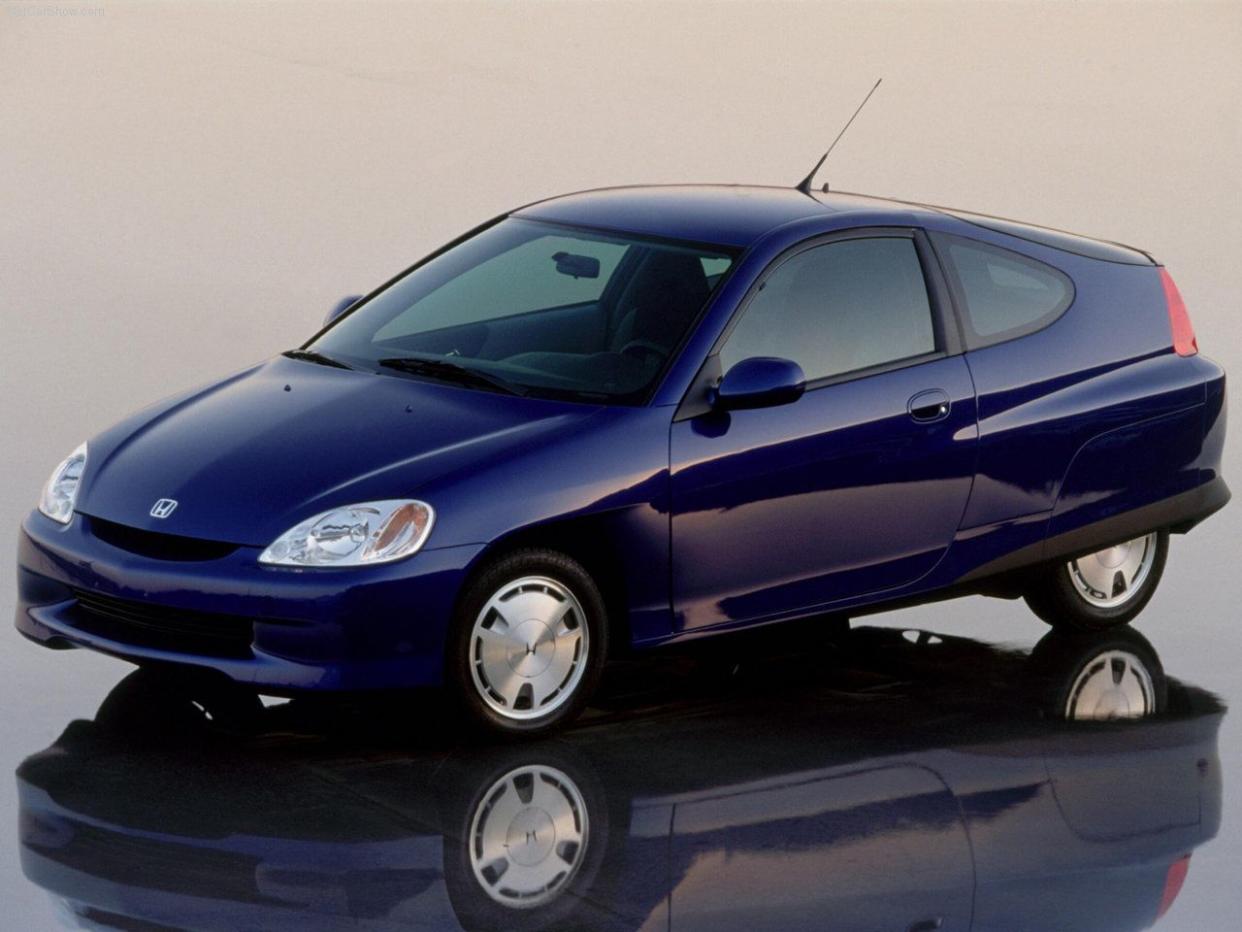

In terms of fighting emissions, Japanese car manufacturers are victims of their own success. Honda brought the first hybrid to the U.S., while Toyota popularized it. And as the rest of the world has stuck primarily with traditional internal-combustion-only motoring and the U.S. has continued to build larger and larger trucks, Japanese buyers and regulators have focused on efficiency. The International Council on Clean Transportation wrote in 2014 that, already, hybrids had achieved deep market penetration:

Hybrids now account for more than 30% of the 2.9 million standard passenger vehicles sold and about 20% of the 4.5 million passenger vehicles including minicars. Today, almost 60% of new cars in Japan are either hybrids or minicars, with the fuel economy implications shown above. In comparison, the next highest hybrid penetration that we’ve seen around the world is in the 1.7-million-per-year California auto market, which has a 7% hybrid market share.

It’s understandable that Japanese companies like Toyota, Mazda, Subaru, and Honda might feel less urgency to traditional to fully electric lineups. After all, Honda has the lowest corporate average fleet emissions of an automaker in the U.S. Still, the goal is zero emissions, not low emissions. Honda is aiming for 40 percent of its sales to be zero-emissions cars by 2030, 80 percent by 2035, and 100 percent by 2040, a slightly less aggressive timetable than some European firms are proposing. But just because Honda knows how to make hybrids doesn’t mean the transition to EVs will be easy.

Honda’s Solo EV Career: A Failure so Far

Honda has not had much success selling EVs in the United States. You’d be forgiven for assuming that’s because the company has never offered an EV here, since the one it did sell was so obscure. Back in 2017, when Honda rebooted the Clarity lineup, it had three powertrain options: a plug-in hybrid, a hydrogen fuel cell version, and a full BEV called the Clarity Electric.

The BEV could go 89 miles on a charge at a time when GM and Tesla were already selling 200-plus-mile EVs. Honda, meanwhile, would only lease Clarity Electrics to residents of California or Oregon. General opinions are hard to pin down, as we could find no mainstream outlet or video review of the Clarity Electric. Few references to it exist.

Despite not being sold in America, the company’s next EV made a much bigger impression here. Since the reveal of the adorable, tiny Honda e, diehard Honda fans have been clamoring for the company to bring it to the States. Fans in Europe seem less impressed. The microcar has been criticized for its low range—125 miles on the WLTP cycle, which typically produces much more optimistic results than the U.S. EPA cycle—and pricing that puts it in line with more practical, long-range EVs. In 2021, Honda sold just 3752 es in the EU, according to the website CarSalesBase. In the same year, Renault sold 69,136 Zoes.

Honda Pressed to Partner With GM

What Honda needs is an inexpensive long-range EV that will appeal to American buyers, who have shown much more interest in EVs than their Japanese counterparts. In the early days of the mainstream electric car era, though, the company knew it needed a partner if it wanted to get off the ground quickly. And GM could deliver one thing that was vital: scale.

“Honda has discussed [parnterships] with various auto companies and, when it comes to the question of all of them, why GM, one reason is that if we compare the company’s size on a global basis, we are similar,” Mibe said. “And we are similar in technology as well. If we compare the number of patents that we hold, it’s sort of similar between GM and Honda. So we thought that this will probably be a good partner to do a 50/50 partnership together with.”

Honda is adamant that GM and Honda are of similar size and that the two companies bring similar tech to the table. For the moment, however, the deal hardly looks 50/50. Honda and Acura will both sell large fully electric SUVs built on a GM platform using its Ultium Batteries. It’s a good solution for getting EVs out the door at scale before Honda’s battery plant co-venture with LG Energy Solutions is finished, but it certainly seems like Honda is more dependent on GM than vice versa. GM sold one and a half times as many cars as Honda worldwide in 2021, and GM’s EV advantage in the U.S. is vast. Honda argues that its overall global revenue is similar to GM’s and that its other business units will contribute to the R&D effort. But in real, practical terms, GM has a factory and an actual volume EV business established, so clearly it isn’t an equal partnership at the moment.

As the cooperation progresses, though, the companies will jointly develop an affordable EV, which we expect to have more direct influence from Honda. Plus, the combined scale of both Honda and GM’s huge American businesses will help the companies secure ever-scarcer supplies of rare earth metals at competitive prices.

“What we consider very important is not which company’s technology is better or anything like that. What we consider very important is GM and Honda working together to drive mass volume, reduce cost, and enhance cell competitiveness together, which we believe we need to do, probably, at the real inception stage of EVs, the beginning stage of it. That is the reason why we’re teaming up,” Mibe said.

Ultium Jealousy

Those familiar with GM’s large-scale ambitions for its Ultium battery tech may roll their eyes at the idea of Honda and GM contributing equally to advancing battery cell technology. Honda’s Global Officer in Charge of Electrification Shinji Aoyama, though, doesn’t think there’s anything too special about the cells themselves. It’s GM’s marketing department that he’s most impressed by.

“I’m pretty much jealous of General Motors because they’re pretty much good at branding their technologies, such as Ultium, which sounds like the ultimate lithium ion,” Aoyama said during a roundtable interview with Road & Track.

“Now then, between two technologies, current battery technologies: Ultium battery technologies and Honda’s battery technology with LG [Energy Solutions]. Are there any differences or not? Practically there is not much difference there.”

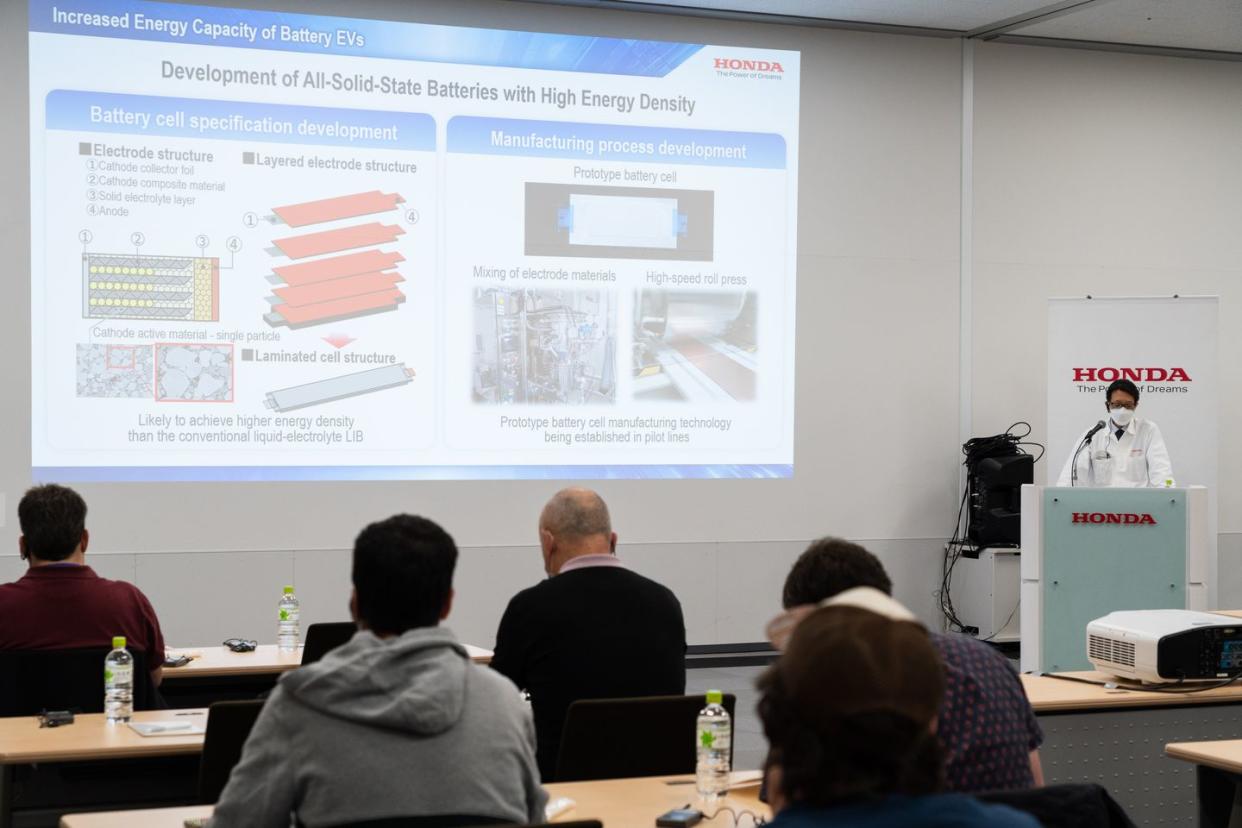

The core battery technology, he argues, is fundamentally the same across the industry. And every automaker is partnering with a company like LG ES, Samsung, or Panasonic to make its packs, because no company has completely mastered the battery from top to bottom. Aoyama and Honda’s plan is to invest heavily in what may be the next big leap for batteries: Solid-state lithium-ion batteries, which use a solid rather than a liquid electrolyte. This allows for smaller packaging, lighter weight, and higher overall energy density.

The Solid State Challenge

So far, solid state batteries on the scale of long-range EV battery packs are a thing of laboratory. Honda is investing heavily in getting them ready for mass production. At the company’s large research facility in rural Tochigi Prefecture, Japan, lab-coated scientists showed off the solid state production process that the company is refining. Aoyama says that a pilot production line will be operational in spring 2024, with solid state batteries making it to Honda products sometime in 2028 or 2029, if all goes to plan.

The benefits of being quick to transition to solid-state batteries would be significant. Solid state batteries are not just denser, they’re also much more stable than temperamental liquid lithium-ion batteries.

“Unlike industry-standard lithium-ion batteries, solid-state batteries do not contain liquids, which can cause detrimental conditions, such as overheating, fire, and loss of charge over time – issues that may sound familiar to anyone who uses large electronics,” John Gould and Diana Fitzgerald wrote in a NASA release on solid-state battery research. “ Solid-state batteries do not experience these harmful conditions, and can hold more energy and perform better in stressful environments than standard lithium-ion batteries.”

That stability has knock-on effects key for automotive applications. Current battery packs require heavy duty containment structures and underbody armor to prevent “runaway thermal events,” better known as fires. Not only do the heavier liquid lithium batteries need heavier armor, but they also need heavier cooling systems due to overheating problems. A stable solid state battery would be a game changer, if Honda—or any of the many automakers working on the tech—can get one to market.

The Sports Car Question Remains a Challenge

Honda has long used enthusiast-oriented models to stir passion for its mainstream lineup. As it builds up capacity for current-gen EV production, the company is working on developing electric sports cars. In a teaser, the company has already indicated that at least two are in the pipeline, one of which almost definitely a successor to the NSX. According to one source, it’s not a coincidence that the other one—currently identified only as a specialty sports car—has proportions somewhat similar to the S2000. Both models are just general concepts right now in early, early development. Still, mules exist, and Honda is serious about bringing EV sports cars to market quickly.

“I cannot say by when or around when whatsoever, but we are rushing on, pushing on with our development work so that we can come up with a fun to drive vehicles for the new era as soon as we can,” Mibe said through his interpreter.

Here the company faces a challenge, shared by all automakers but weighted heavily against Honda. The brand’s sports cars and sport compacts have long been defined by two components above all else: spectacular manual gearboxes and hellraising engines. How to capture the Honda wring-it-by-the-neck magic without either component remains an open question.

"We would like to say [the engine would be] replaced by great battery and great e-axles,” Aoyama told Road & Track. “We'd like to say that. But. But, at the early stage of the EV era, to differentiate significantly a product by battery and e-axle is not easy right now. While, as we are discussing like an all solid-state battery, of course high voltage, high power base battery, combined with a somehow innovative e-axle, may provide Honda products with exciting products, amazing products."

Aoyama is not the first executive that Road & Track has asked about differentiation, but he is the first to directly admit what many imply. At the moment, there’s no clear way to distinguish the experience of one electric motor—or e-axle—from another. Finding a creative innovation on the electric motor, which countless industries have refined for decades, is no small task. Honda made electric motors feel great in the second-generation NSX, at least, and has built an empire based on innovative engine building, so the company has reason to believe it can make that leap.

No Easy Road

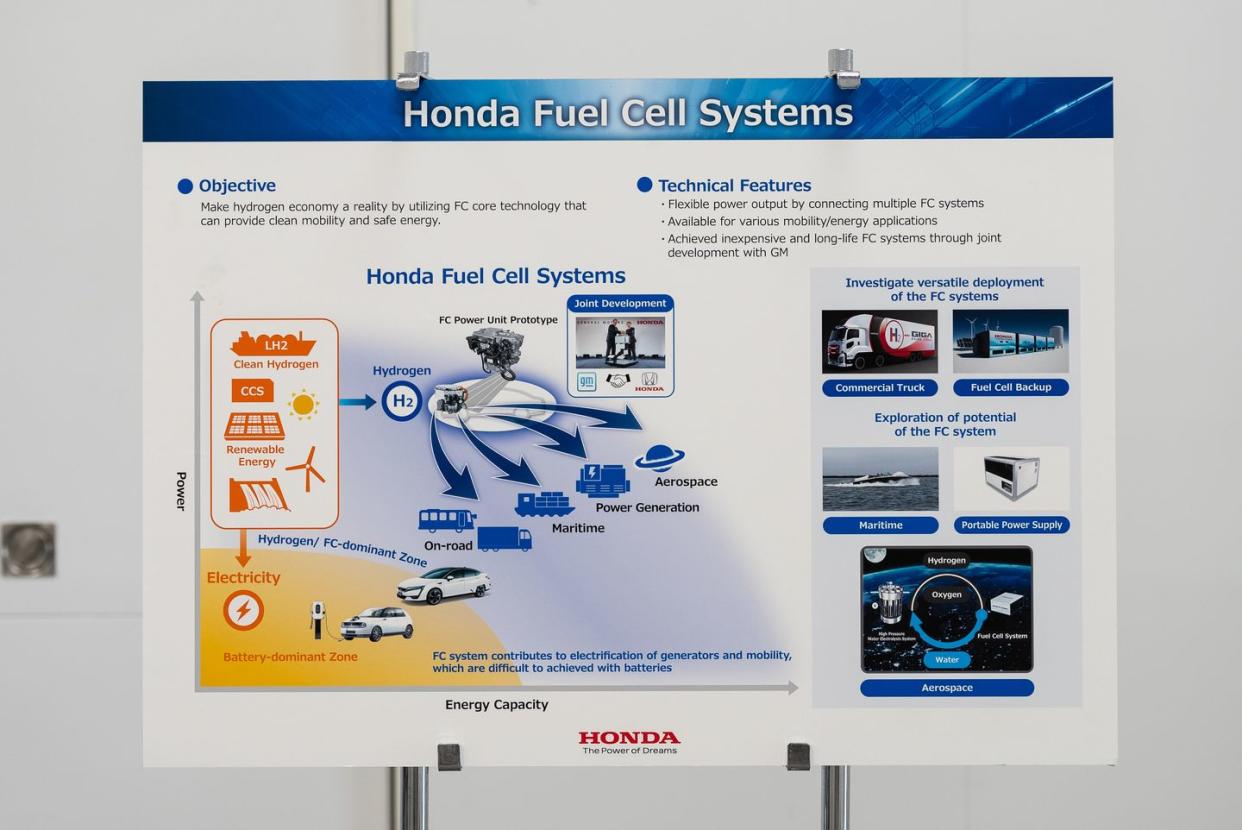

The vision Aoyama, Mibe, and a slew of Honda engineers, scientists, and spokespeople presented for 2050 was compelling. The company wants to be entirely carbon neutral by that point, recapturing carbon emissions from its HondaJet arm using airborne carbon capture and feeding it to Honda-branded genetically engineered “Dreamo” algae that can turn it into food or fuel. It wants to build swappable batteries that power your home, and then your scooter, and then your portable power source, and leverages the fact that you probably don’t need you leafblower and snowblower to have a battery on the same day. It wants to expand beyond private jets into hybrid “eVTOLS” that handle inter-city travel. It wants to put hydrogen power stations on the moon.

It is a relentlessly ambitious agenda, one that attempts to make up for five years of being behind the times with a two decades of wide-scale investment to become the world’s leading clean transportation company. But it is a world that, as of now, exists in small scale trials, or in the Japanese market only, or in a laboratory, or not at all. A world that, at the moment, we cannot see outside of a controlled, prepped environment.

Honda has taken the first big step of recognizing it has a problem, and it seems bullish that it can team up onto a level playing field for current battery tech while preparing for the next league of solid-state. Trouble is Honda has so far struggled to market its electrified products to a wide audience. The original Honda Insight and most recent NSX are brilliant in ways that feel uniquely Honda, but they were misunderstood and didn't sell. Honda's most successful hybrids are also its most plain ones, and even with their help it's still chief rival Toyota that utterly dominates the U.S. hybrid market. Honda was first to sell hybrids to Americans but remains second in sales.

The company’s plan to co-develop utilitarian and cheap EVs with GM is one of the many ways in which Honda values line up with the current EV market. When it comes to the Hondas that we love, though, the Honda spirit of light weight, bristling drive, and perfectly practical style, the company still has a lot of work to do.

You Might Also Like