Yahoo Finance's NEXT: How rivals are taking on Nvidia in the AI chip race

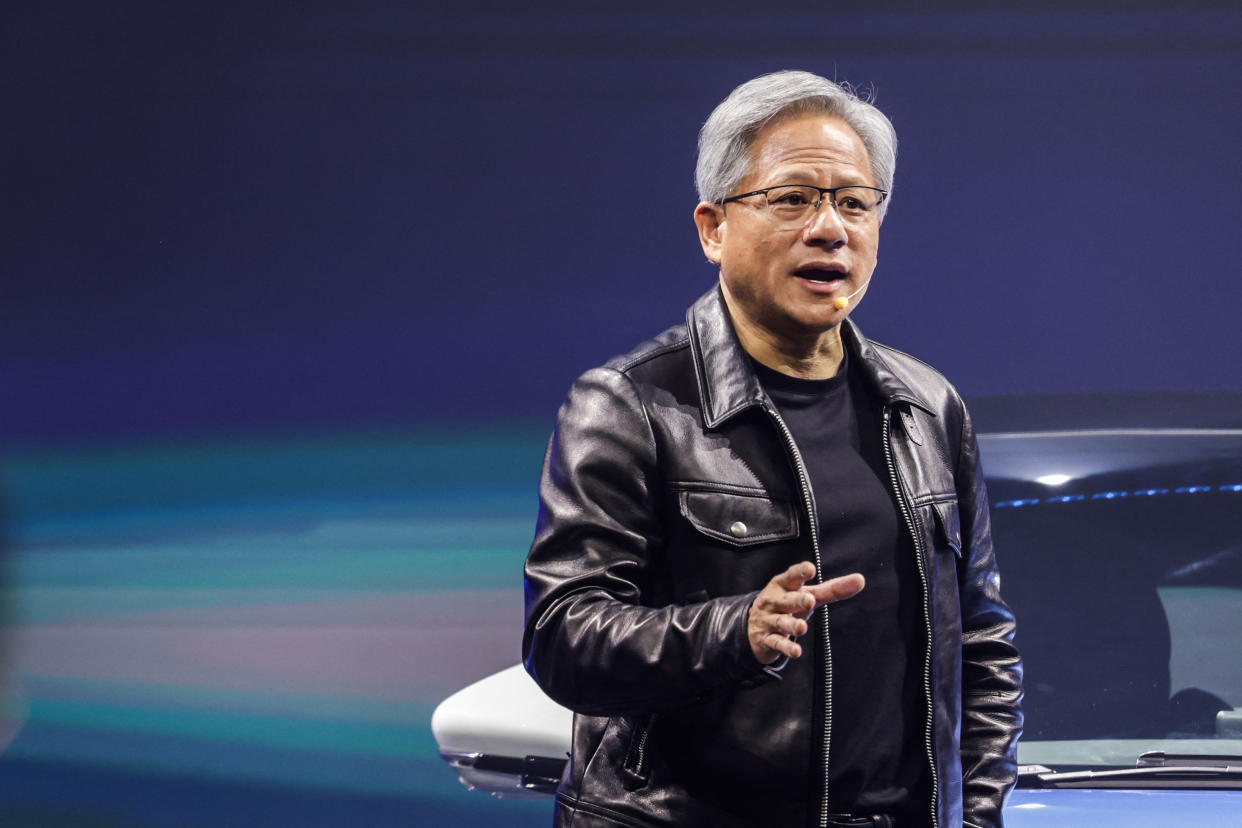

Nvidia (NVDA) is on top of the tech world. The graphics chip giant is leading the AI revolution thanks to prescient investments in AI processing years before anyone was talking about ChatGPT.

And that’s translated into some huge wins for the company and investors.

But Nvidia is just one company, and as the AI explosion continues to reverberate across the tech industry, major players ranging from Amazon (AMZN) to OpenAI and Microsoft (MSFT) to Meta (META) find themselves competing for all the chips Nvidia can pump out. And there are simply not enough.

Now a new race between tech’s biggest players is heating up, in which they’re building their own AI chips that will give them the ability to outwit each other without having to rely so heavily on Nvidia.

“No one wants to be completely beholden to one company,” TECHnalysis Research president and chief analyst Bob O’Donnell told Yahoo Finance. “Everybody wants to have a variety of different options to purchase from again. And oh, by the way, there can be advantages if you start to write your own software and design your own chips to run things specifically for you.”

On top of that, AMD (AMD) and Intel (INTC) are building chips and platforms to rival Nvidia’s and steal away customers and market share.

But Nvidia isn’t resting on its laurels. The company is already working on an upgraded version of its next-generation super-chip, the GH200, which it offers improved memory technology and will be available through manufacturing partners later next year. Nvidia's current most-advanced chip, the H100, sits in a 10.5-inch graphics card — which is then bundled together into a server rack alongside dozens of other H100 cards to create one massive computer.

The GH100, meanwhile, combines an H100 chip with an Arm CPU and more memory.

“Nvidia is synonymous with AI, just as much as if you ask for a tissue, what would you say? I want a Kleenex,” explained Glenn O’Donnell, VP and director at research firm Forrester.

The numbers tell the story. In its most recent quarter, Nvidia's revenue jumped 101% to $13.5 billion, with data center revenue, the segment that includes AI sales, up a stunning 171% versus the same period a year ago.

“It has become the brand immediately associated with that world. And Intel, AMD, and some others actually do have some good technology to compete. But overcoming that mindshare and breaking into that expensive ecosystem that Nvidia has isn't going to be an easy thing to do,” O’Donnell added.

And the company is increasingly creating the kind of foundational models that tech firms use to develop AI software, ensuring that its customers stick around well into the future.

Customers are creating competition

Still, with demand surging, and chips selling for tens of thousands of dollars, companies like Amazon, Google, Meta, Microsoft, Tesla, and others are increasingly leaning on their own specialized chips to power their AI ambitions called ASICs, or application-specific integrated circuits. Think of them as specialized chips for AI tasks.

ASICs, unlike GPUs, are designed for a specific task, such as AI processing. And while they’re expensive to develop, they can provide benefits in the long run by using less power, and giving companies greater control over the hardware they use to power their AI software.

According to The Information, Microsoft has been working on its own AI chip since 2019, and in May, Meta announced it was developing its own AI hardware. Google, in August, debuted its latest AI infrastructure, and Tesla, meanwhile, is building a supercomputer based on its own chips.

And while each of those companies will still need to get their hands on Nvidia chips for now, building their own hardware could cut into the graphics giant’s lead in the long run.

“If these companies are successful with these other homegrown silicones, Nvidia may see more competition than it has gotten used to and this will affect its margin,” explained Futurum Group CEO Daniel Newman. “The margin is the area I think is going to be most affected when competition really starts to settle in.”

Still, Newman is careful to point out that Nvidia isn’t in trouble, per se, rather, it won’t be able to necessarily rely on hyper-scalers like Microsoft and Amazon in the future.

“If you do the math, the conclusion that you will come to is that GPUs are really good from an ecosystem and performance standpoint, but chances are with AI ASICs you're going to be able to deliver better results faster at a fraction of the cost profile,” explained Chirag Dekate, VP and analyst for quantum technologies, AI infrastructures, and supercomputing at Gartner.

“All of these cloud providers have come to the conclusion that the AI workload is going to be so pervasive in the ecosystems that a GPU-only strategy might not be good enough, and you might need to have an AI ASIC strategy to deliver better cost value propositions to end users,” Dekate added.

Old rivals are stirring

Nvidia is also keeping an eye on its traditional competitors: AMD and Intel. Both companies are working to try to catch up with Nvidia in the AI space, rolling out their own chips and software designed to better combat the category leader.

According to Dekate, Intel and AMD are working out their AI strategies and, for now, could have a marginal impact on Nvidia’s market share. But as the companies further develop their hardware and, more importantly, software, they could pose a greater threat in the future.

That said, the AI chip race is still in its early stages, and while Nvidia is winning by a mile, it will need to keep innovating if it intends to hold on to its lead.

Daniel Howley is the tech editor at Yahoo Finance. He's been covering the tech industry since 2011. You can follow him on Twitter @DanielHowley.

Click here for the latest technology business news, reviews, and useful articles on tech and gadgets

Read the latest financial and business news from Yahoo Finance