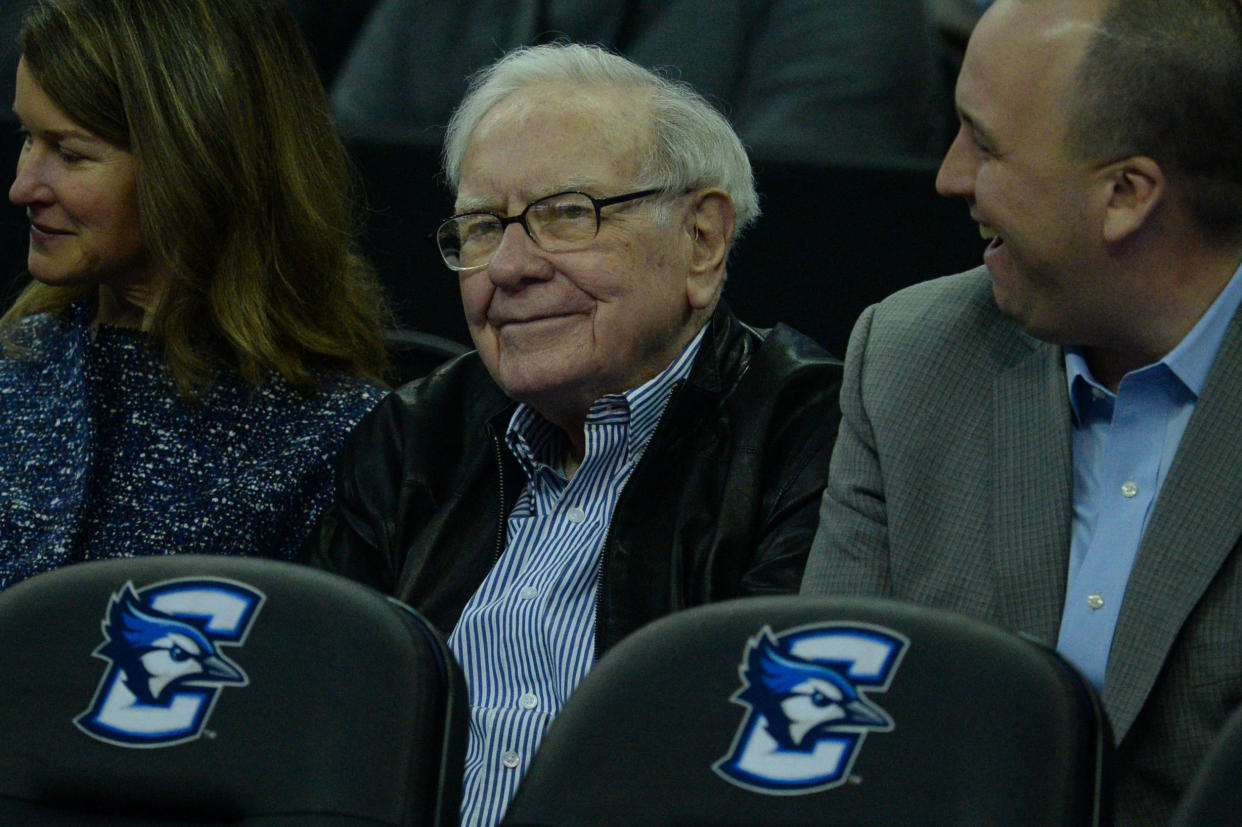

Why Warren Buffett has ‘never made a decision based on an economic prediction’

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Today's newsletter is by Sam Ro, the author of TKer.co. Follow him on Twitter at @SamRo.

You’d think that a big-time investor with exposure to lots of industries would pay close attention to what economists say.

Not billionaire investing legend Warren Buffett. At least that’s what he tells people.

“We think any company that has an economist has one employee too many,” Buffett said at Berkshire Hathaway’s (BRK-A, BRK-B) 2015 shareholders meeting.

One of the main reasons why he doesn’t bank on what economists say is that they’re just not that great at forecasting. And he’s right. In recent weeks, the Citi U.S. Economic Surprise Index has been telling us that economists have been underestimating the strength of the economy.

In recent years, Buffett has been pointing to the existence of trillions of dollars worth of bonds with negative interest rates as something almost no economist saw coming.

“So you don’t pay much attention to the ‘dismal scientists’ then?” Andy Serwer, editor-in-chief of Yahoo Finance, asked in a 2019 interview.

“Well, I pay none as a guideline to doing anything,” Buffett responded.

Here’s more of what Buffett said on the unreliability of economic forecasts:

Something different happens all the time. And that's one reason economic predictions just don't enter into our decisions. Charlie Munger – my partner – and I in 54 years now never made a decision based on an economic prediction. We make business predictions about what individual businesses will do over time, and we compare that to what we had to pay for them. But we have never said yes to something because we thought the economy was gonna do well in the next year or two years. And we have never said no to anything because we were right in the middle of a panic… There's so many variables. I mean, in the hard sciences, you know that if an apple falls from a tree, that it isn't gonna change over the centuries because of anything or political developments or 400 other variables that go in. But when you get into economics, there's so many variables, and the truth is, you've got to expect good times and bad times in business.

Buffett made a name for himself for being a great stock picker, and not a macro strategist. And so you’ll often hear him expounding the merits of seeking out great businesses with great managers.

Because, great businesses with great managers will be able to succeed during difficult times just as they would during good times.

Something that we all learned during the COVID-19 pandemic is that the onset of challenges doesn’t necessarily mean businesses are doomed to struggle. Rather, many companies proved to be remarkably adaptable in their efforts to keep business running.

As inflation concerns began surging a year ago, some warned that rising costs meant collapsing profit margins, which certainly would’ve made economic sense. However, many corporations went on to report robust profit margins in subsequent quarters.

When Buffett is looking for the next stock to buy, he doesn’t obsess over figuring out whether economic conditions will be good or bad in the near future. Rather, he’ll seek out well-priced businesses that he expects to perform over the long term no matter what the economy may throw at them in the short term.

“We're going to have good years, bad years, in-between years, and maybe a disastrous year some year,” he said. “We care a lot about the price. We do not care about the next 12 months.”

Buffett will be sharing his wisdom on Saturday at Berkshire Hathaway’s annual shareholders meeting.

What to watch today

Economy

8:30 a.m. ET: Employment Cost Index, 1Q (1.1% expected, 1.1% prior)

8:30 a.m. ET: Personal Income, month-over-month, March (0.4% expected, 0.5% during prior month)

8:30 a.m. ET: Personal Spending, month-over-month, March (0.6% expected, 0.2% during prior month)

8:30 a.m. ET: Real Personal Spending, month-over-month, March (0.1% expected, -0.4% during prior month)

8:30 a.m. ET: PCE deflator, month-over-month, March (0.9% expected, 0.6% during prior month)

8:30 a.m. ET: PCE deflator, year-over-year, March (6.7% expected, 6.4% during prior month)

8:30 a.m. ET: PCE core deflator, month-over-month, March (0.3% expected, 0.54% during prior month)

8:30 a.m. ET: PCE core deflator, year-over-year, March (5.3% expected, 5.4% during prior month)

9:45 a.m. ET: MNI Chicago PMI, April (62.0 expected, 62.9 during prior month)

10:00 a.m. ET: University of Michigan Consumer Sentiment, April final (65.7 expected, 65.7 prior)

Earnings

Pre-market

6:30 a.m. ET: Honeywell (HON) is expected to report adjusted earnings of $1.86 per share on revenue of $8.29 billion

6:45 a.m. ET: Chevron (CVX) is expected to report adjusted earnings of $3.44 per share on revenue of $50.26 billion

6:55 a.m. ET: Colgate-Palmolive Company (CL) is expected to report adjusted earnings of 75 cents per share on revenue of $4.40 billion

7:00 a.m. ET: Bristol-Myers Squibb Company (BMY) is expected to report adjusted earnings of $1.91 per share on revenue of $11.39 billion

7:00 a.m. ET: Bloomin’ Brands (BLMN) is expected to report adjusted earnings. of 74 cents per share on revenue of $1.13 billion

7:30 a.m. ET: Exxon Mobil (XOM) is expected to report adjusted earnings of $2.24 per share on revenue of $89.57 billion

7:45 a.m. ET: AbbVie (ABBV) is expected to report adjusted earnings of $3.14 per share on revenue of $2.03 billion

Post-market

No notable reports scheduled for release

—

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Instagram, YouTube, Facebook, Flipboard, and LinkedIn