Why recent layoff announcements signal the end of 'corporate stimulus'

Corporate America can't seem to lay off workers fast enough.

U.S. employers have already axed north of 100,000 jobs this year according to the latest figures from data firm Challenger, Gray & Christmas out last week. Yet the Labor Department's monthly jobs report Friday indicated hiring remains robust — with payrolls rising by more than half a million in January — leaving investors wondering what the real signal is.

But according to a new note from Savita Subramanian and the equity strategy team at Bank of America Global Research, the current moment marks, "The end of Fed, fiscal, and now corporate stimulus."

And this may offer the simplest explanation to investors for a seeming economic contradiction.

"The oft-forgotten third component of stimulus during COVID came from corporates, via employee assistance and firing freezes during COVID, which is firmly behind us," Subramanian and her team wrote in a note on Monday.

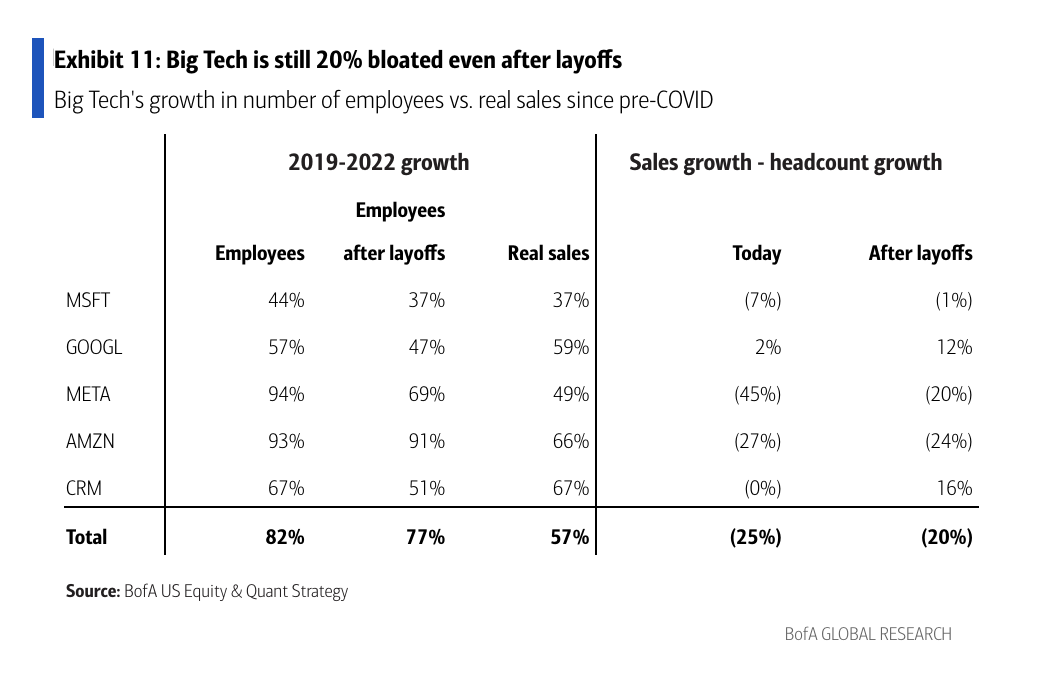

"Corporates are now in belt-tightening mode," the firm wrote. "Even after the spate of Tech layoff announcements, there is likely more to do given that tech saw 20% excess hiring over the past three years."

Subramanian's team points out that Big Tech’s hiring has largely outpaced sales growth, leaving many of the mega-cap giants that have trimmed their workforces in recent months still "bloated," even after reducing headcount.

Microsoft (MSFT), Amazon (AMZN), and Facebook parent Meta (META) have each laid off at least 10,000 workers since November, but the ratio of sales growth to headcount remains negative for each of these firms over the last three years, even after recent cuts.

Beyond the technology sector, other industries have employed new standards in order to cut the excesses associated with this period of corporate stimulus.

In the financial industry, for example, Goldman Sachs reinstated annual performance reviews paused during the pandemic, a strategy that had historically served to weed out laggard bankers. The firm later slowed hiring before eventually laying off 6% of its workforce last month.

Despite these moves, Goldman's latest quarterly filing still showed the company allotted more for expenses — specifically for compensation costs — indicating further cuts to its workforce may be necessary.

In a separate report out Monday, the economics team at Goldman Sachs indicated there are three characteristics shared by the big name companies that have recently announced large numbers of layoffs: many are in the technology sector, many hired aggressively during the pandemic — with headcount growing an average 41% — and many have seen more sizable declines in their stock prices, which have fallen an average 43% from their peaks.

"These characteristics suggest that the companies conducting layoffs are not representative of the broader economy and that many of the recent layoff announcements do not necessarily signal a weaker demand picture that might have wider implications," Goldman’s chief economist Jan Hiatzus and his team said in the note.

"Consistent with this, our more representative real-time estimate of the layoff rate has increased recently but only back to its pre-pandemic rate, which was low by historical standards."

—

Alexandra Semenova is a reporter for Yahoo Finance. Follow her on Twitter @alexandraandnyc

Click here for the latest trending stock tickers of the Yahoo Finance platform

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube