Why Pennies Still Exist and Other Money Trivia

The concept of money replaced primitive bartering around 3,000 years ago. Since then, the universal purchasing medium has often been shrouded in secrecy and surrounded with mystery. In America, many little-known facts, misconceptions, and rumors have emerged as we've gone from the first U.S.-minted coins to quarters highlighting influential American women. Here are some of the most noteworthy tidbits you should know about.

Related: Money-Saving Lessons From the Depression

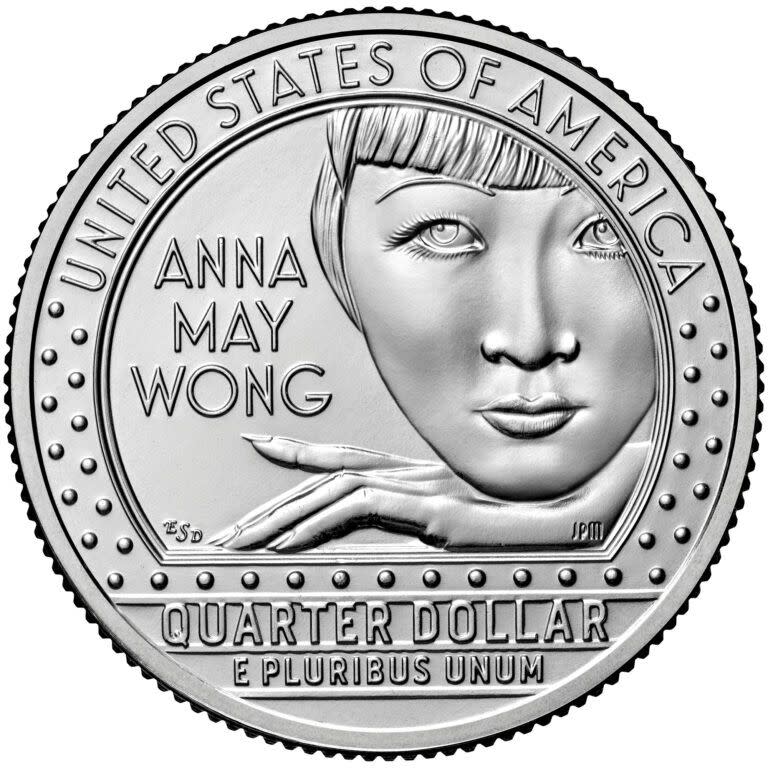

While the founding fathers and other prominent male figures from America's earlier history are on most coins in the country, newer variations have made steps toward a more diverse direction. The U.S. Mint rolled out an initiative to feature five women influential in American history on new quarters, with the first batch debuting this year. The last of the new quarters — which is being released on Oct. 24 — will feature Anna May Wong, who was not only the first Asian American movie star, but is now the first Asian American to be on U.S. currency. The program will continue through 2025, showcasing five different women each year. Quarters featuring poet Maya Angelou, astronaut Sally Ride, suffragist Nina Otero-Warren, and Wilma Mankiller, the first female principal chief of the Cherokee Nation, were released earlier this year.

Pennies have almost no purchasing power; it costs more to mint a penny than a penny is worth; and the U.S. Mint could cut its workload significantly just by ceasing production. But there's another side to that coin. According to penny-advocacy group Americans for Common Cents, the vast majority of Americans favor keeping the lowly penny, which the group says fuels charitable giving — and it's true that penny drives do produce significant donations from people who don't mind emptying their penny jars for a good cause. The group also says abolishing the penny wouldn't save the country money; it would likely raise government spending and would increase inflation.

It's almost certain that the cost of many goods would rise as businesses would likely round prices up to the nearest nickel, which would disproportionately hurt the poor since the less affluent make small purchases more frequently. As the first currency ever authorized by the United States in 1787, however, one thing is certain: The poor little penny is a rich part of American history.

Related: 20 Ways Companies Trick You Into Spending More Money

You know them as the stone-faced men and women with earpieces and automatic weapons under their jackets who protect the president and other high officeholders. But the Secret Service was originally founded in 1865 to combat a massive counterfeiting epidemic that sprung up at the close of the Civil War. More than 150 years later, the organization's primary responsibility is still to protect the integrity of the nation's currency.

Related: U.S. Secret Service: Scandals and Trivia

In 1861, two significant events took place: The first shots of the Civil War were fired, and the brand new Confederate States of America began issuing its own currency. Starved for metal during the war, the Confederacy never issued coins, but $1.7 billion in paper money was put into circulation. It was at first a powerful purchasing medium, but as it became more and more clear that victory was out of reach for the South, hyper-inflation rendered the Confederate dollar worthless.

Related: The 40 Best Places in America to Travel Back in Time

American money had been backed by gold and silver since 1789. Throughout the years, Congress adjusted ratios to make gold more valuable than silver, and by 1850, silver had such a limited buying power that silver coins had all but disappeared. After a brief pause during the Civil War when paper money could not be redeemed for metal, the true era of the "gold standard" began. During this time, which would last all the way until 1971, money and gold were not separate, but convertible versions of each other in which every dollar of U.S. currency was backed by gold.

Related: 18 Ways to Build Wealth During a Recession

Before the Civil War, the federal government was only authorized to mint coins, not paper money, which before then was printed by banks. That all changed when the Union government created the greenback. The greenback was actually a series of ornately decorated paper bills that funded the war, but it also created outrageous inflation.

For more fun trivia stories, please sign up for our free newsletters.

There is overwhelming scholarly evidence to support the idea that L. Frank Baum's "The Wonderful Wizard of Oz" was actually a clever allegory about money and the Populist movement that was born out of American financial insecurity. The Emerald City represented greenbacks. The Yellow-Brick Road represented the populist-preferred gold standard. Dorothy's famous ruby slippers were originally silver, which represented the anti-inflation free-silver movement. The scarecrow represented the Populist Midwestern farmer, perceived to be brainless by Northern bankers. The Tin Man represented dehumanized factory workers, whom populists saw as little more than humanoid machines who would benefit from joining their movement.

Williams Jennings Bryan, who populists didn't believe had the courage to buck the status quo and campaign against William McKinley on the gold standard, was the Cowardly Lion, while the Wizard represented McKinley. Dorothy was the average middle American, who had the power to kill an evil witch (the existing monetary system) as long as she believed in herself.

Related: 15 of the Most Expensive Clothing Items Ever Auctioned

Chances are, you received at least one of them as a birthday present when you were a kid, but chances are equally good that you've never actually spent one. It's the $2 bill — and it's the rarest small-denomination currency in circulation, representing about 1 percent of our money. It was first authorized in 1776 to help fund the Revolution. The general rarity of the $2 bill is compounded by the fact that many people hoard them. The $2 bill, however, might be making a comeback. Some 61 million were printed in 2005 alone.

Related: 31 Historic Places Across America That You Can Tour Virtually

From Susan B. Anthony to FDR to Sacajawea, dollar coins are nothing new. But in 2007, a program ordered by Congress was put into action and the government began minting a massive number of new dollar coins that would go on to feature every single American president. Congress believed the new money would engage Americans, get them to collect the new coins en masse, and perhaps even switch from paper dollars. It was an epic failure, and just four years into the program, more than $1 billion worth of the coins sat unused under heavy guard in giant vaults under the Federal Reserve Building.

Related: Not into Stocks and Bonds? Here are 12 Alternative Investments to Consider

Unless it's the bank that your Uncle Louis runs out of his basement poker room, any financial institution you do business with guarantees FDIC-insured deposits. But do you know why? The 1929 stock market crash decimated the global economic landscape, triggered massive runs on banks, signaled the start of the Great Depression, and eroded trust in American financial institutions. In 1933, Congress created the Federal Deposit Insurance Corporation to rebuild that trust and prevent future bank failures.

Related: 11 Money-Saving Tips From Grandma That Don't Work Anymore

Andrew Jackson was a slaveholder whose family counted among their vast property and possessions more than 300 human beings. Harriet Tubman was a leader on the Underground Railroad and is probably history's most famous abolitionist. It's hard to imagine the two having anything in common, but now they'll be sharing space on the $20 bill — or at least they might be.

A new version of America's most-circulated bill was originally scheduled to be released in 2020, with Tubman joining Jackson, who had always graced the bill. But in 2019, it was announced that the production of any new $20 design would be delayed at least until 2026, and it may not even feature Tubman. Former Treasury Secretary Steve Mnuchin asserted that this delay was due to technical and security issues rather than political leanings, though former President Donald Trump is an avid Andrew Jackson admirer who has opposed the idea of replacing Jackson since his presidential campaign. Last year, the Biden administration announced it was resuming efforts to put Tubman on the $20 bill and according to an exclusive statement from Treasury Secretary Janet Yellen to theGrio, the bill is heading down the pipeline toward a 2030 debut.

Related: 30 Beautiful Road Trips That Celebrate American History

The first credit cards were issued by banks and oil companies, which allowed preferred customers to use them to make purchases on credit — but only at their establishments. The first truly universal credit card, which could be used for purchases at a variety of places, was the Diners' Club card, which came out in 1950. The club had no competition for eight years, but then in 1958, the American Express Co. began issuing cards of its own.

Related: 17 Exclusive Credit Cards That Turn Heads

You might have read recently that investors are betting — and gaining — big on bitcoin, a new kind of currency that launched in 2009. But what is it? Defined as a "cryptocurrency," bitcoin is exchanged without a central authority like a bank or governmental agency. Instead, it's issued and controlled by bitcoin users around the world — and more and more of those users are joining the movement every day. In 2021, bitcoin hit $1 trillion in market value, became legal tender in El Salvador, and was even part of a Burger King promotion. Last year, the price of a single bitcoin rose from about $32,000 to more than $46,000, peaking at more than $67,000 in November. Alas, as interest rates soared, the bitcoin price plummeted and is now sitting at less than $20,000.

Related: 25 Emerging Businesses That Nobody Saw Coming

Like Cheapism's content? Be sure to follow us.