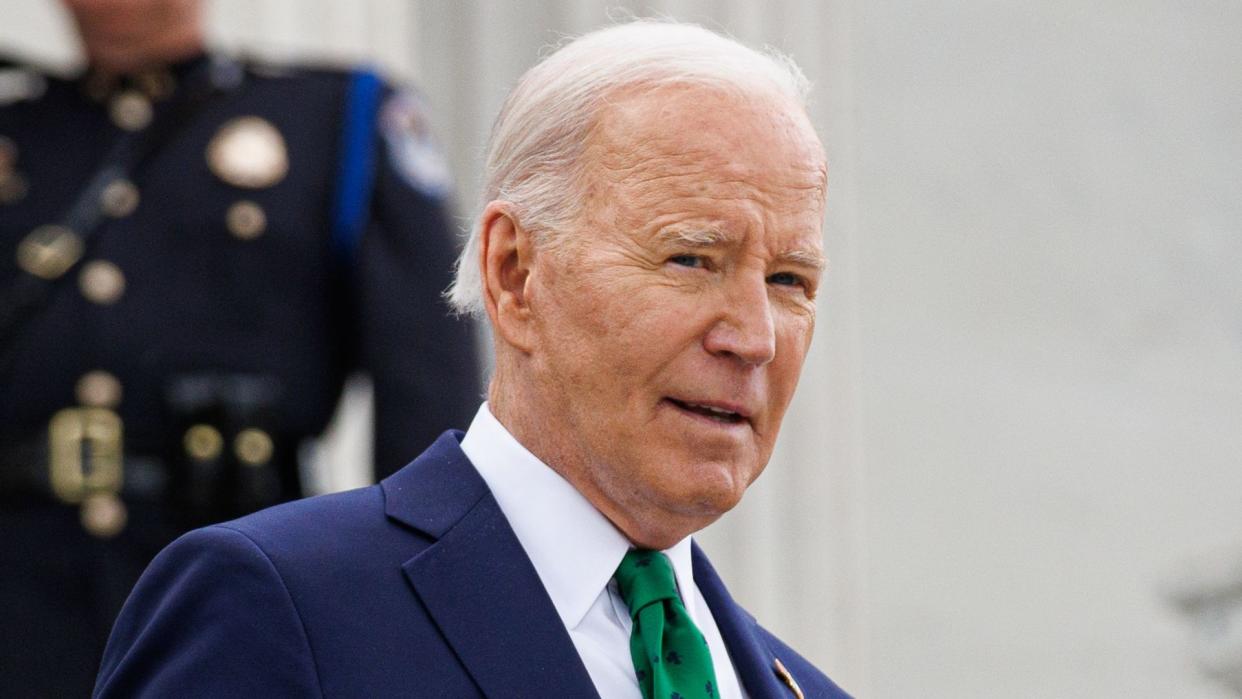

Why a Biden Re-election May Be Good News for Your Student Loans

The resumption of student loan payments — after a three-year hiatus and following the Supreme Court’s 6-3 decision to strike down President Joe Biden’s student loan relief program last June 30 — has affected millions of borrowers in several ways.

Read Next: Suze Orman: 3 Ways To Prepare for the Upcoming Financial Pandemic

Learn More: 7 Unusual Ways To Make Extra Money (That Actually Work)

The issue is at the center of President Joe Biden’s presidential campaign — and his re-election could be good news for borrowers.

On April 16, the Biden-Harris administration released its first set of draft rules proposing to provide debt relief for millions of borrowers, the Department of Education said in an announcement.

And under these new rules — part of the so-called “Plan B” — the total number of borrowers getting relief would reach more than 30 million. So far, the administration has approved cancellation for 4.3 million borrowers — representing $153 billion in debt forgiveness through various actions, the Department added.

The most recent action was on April 12, when the administration announced approving $7.4 billion in additional student loan debt relief for 277,000 borrowers. These cancelations were for borrowers who signed up for the new Saving on a Valuable Education (SAVE) Plan and were eligible for its shortened time-to-forgiveness benefit, the Department said in a statement.

“While a college degree still is a ticket to the middle class, that ticket is becoming much too expensive — much too expensive,” President Biden said on April 8, when presenting the plan at the Madison Area Technical College, in Madison, Wis. “Too many people feel the strain and stress, wondering if they’re going to get married, have their first child, start a family. Because even if they get by, they still have this crushing debt. It’s not just a drag on them, it’s a drag on our local economies,” he added, according to the transcript of his remarks on the White House website.

These new rules are now going through a 30-day comment period and have yet to be finalized.

As The Hill reported, the administration’s goal is to implement this new plan around the fall – weeks before election day.

More From GOBankingRates

The Best $20 You Can Spend at Dollar Tree, According to Superfans

This is One of the Best Ways to Boost Your Retirement Savings in 2024

This article originally appeared on GOBankingRates.com: Why a Biden Re-election May Be Good News for Your Student Loans