Where did the millions go? Pickleball Rocks CEO faces angry investors in bankruptcy call

What happened to all the money entrepreneur Rodney Grubbs borrowed from his creditors, including dozens of friends and associates he met in the fast-growing world of pickleball?

That was the $47 million question at a hearing Tuesday in Grubbs' bankruptcy case. And the answer remained a mystery at the conclusion of a virtual meeting of creditors.

During the meeting conducted online vai Zoom, Grubbs faced more than 100 people, many claiming he owes them thousands of dollars for unpaid personal loans and interest. The occasion was the first official meeting of creditors held in the search to track down Grubbs' assets as part of the bankruptcy case.

For roughly two hours, the Brookville man was peppered with questions by a federal-court appointed bankruptcy trustee, investors and their attorneys, a representative of the Indiana Office of the Attorney General, and an assistant United States Trustee for the U.S. Department of Justice.

Revisit Pickleball apparel CEO, dubbed sport's 'ultimate ambassador,' accused of Ponzi scheme

They inquired about the nature of Grubbs' business, All About Pickleball LLC.; his bookkeeping; and the roles his wife and adult sons played in the business that sold sports equipment and apparel.

Grubbs also was asked about more than $35,000 in checks he wrote to himself for cash; potential offshore accounts created when he traveled outside the country; the contents of a lock box; jewelry and bank accounts; his deceased brother; and his use of quick claim deeds in property transfers.

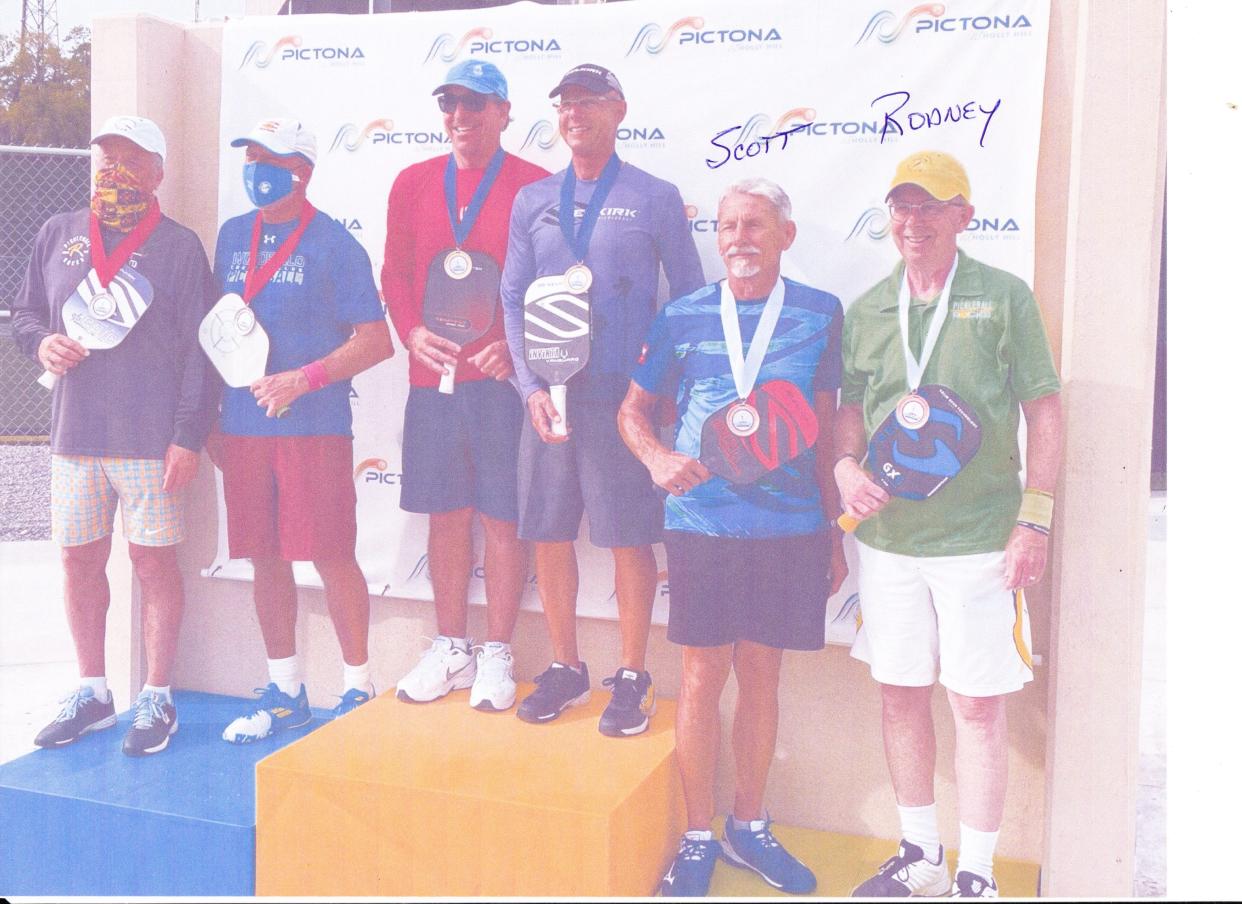

All of the questions were aimed at a common goal: Finding money to help repay his hundreds of investors across the country. Many were friends and acquaintances he made from traveling to pickleball tournaments.

"I know what question is on most peoples' minds — especially mine," said Joanne Friedmeyer, the bankruptcy trustee. "We see there's some inventory and all, but where's the money? Where did it go?"

In court documents filed earlier this year, Grubbs claimed to have roughly $1.6 million in assets, mostly real estate. Several banks accounts he controlled had small sums or were in the red. Grubbs said he’s not living extravagantly. He claimed the majority of the $47 million debt is accrued interest on loans going as far back as the early 2000s when he was heavily involved in real estate investment.

Grubbs said he lost his personal wealth during the Great Recession. “The real estate crash came and the secondary mortgage market went away," he said. "I got stuck with millions of dollars out there.”

Rodney Grubbs admits to poor bookkeeping practices

Grubbs was forced into bankruptcy earlier this year after investors claimed he defrauded them by offering high-interest, short-term promissory notes if they invested in All About Pickleball LLC, which conducted business as Pickleball Rocks.

The investments, which he pitched as exclusive opportunities, typically started at $25,000. He guaranteed 12% interest compounded monthly, with lump sum repayment after 18 months — and the interest rate grew to 18% if he defaulted. He often rolled over the loans.

The Indiana Secretary of State securities division issued a cease and desist order to Grubbs in January, accusing him of selling securities without a license. State officials and his creditors say Grubbs frequented pickleball tournaments across the country and used the events to meet and solicit investors for an alleged investment scheme. Grubbs allegedly told them the money would be used to help grow his business, but investors said he often defaulted on the promissory notes and failed to pay them back.

Grubbs admitted Tuesday he didn't keep good accounting records.

He collected the names of investors and promissory notes in a Microsoft Excel spreadsheet — that's how he calculated the $47 million owed to the more than 350 investors he reported to the federal court. He tracked sales for his pickleball company with Shopify and used ShippingEasy for online orders.

Grubbs said he tried to use QuickBooks, but the accounting was always off.

"I don't have a clean set of books," he said. "What I have is bank accounts. Your money went in and money went out. So at the end of every year, I would sit down and kind of look at what went in and what went out and report that to my taxes. That was pretty much it."

Friedmeyer also asked about an unexplained $70,000 transfer to an equity trust account — an IRA — Grubbs made on Dec. 4. He didn't have an answer, but speculated those funds were maybe a payment to an investor.

Friedmeyer, however, said she could not reconcile the transfer with the information Grubbs already provided to the court.

Creditor disputes Rodney Grubb's story about life insurance policies

The trustee had another question: Who is Robert Ruetz, the beneficiary of two Prudential Life insurance policies?

It was here that Grubbs detailed to the court how his debts go back to at least 2002, when he was focused on real estate investing. Grubbs said he was a hard-money lender who made loans to house flippers.

More: It's one of the fastest growing sports in the nation. Here's what to know about pickleball

The business was fine until 2008 and the Great Recession, an economic downturn that brought about the collapse of banks too big too fail. Americans strapped with bad mortgages lost their homes. Job vanished. Unemployment rose, and lines at food banks grew.

Ruetz, Grubbs said, is a long-term investor who's loaned money for both the real estate and pickleball ventures. "He's a good businessman," Grubbs said. "One of the things that he requested when he loaned me money many many years ago was that he would like to have a life insurance policy in case, you know, I got hit by a truck."

There was just one problem with that story. Ruetz was on the Zoom call, identified in the software as "wireless caller." He spoke up, asking to correct the record.

"I was never a real estate investor," he said. "My investments with Mr. Grubbs were solely for pickleball inventory and activities related to his pickleball businesses going back to I believe, late 2014."

Per their agreement, Grubbs was to provide to Ruetz an annual list of the rental properties he owned. Ruetz explained the properties would be liquidated once Grubbs turned 70. The money, he said, would be used to pay off investors.

"Well, the listing that I was given most recently, at the end of last year, showed 27 properties on an insurance report," Ruetz said. "He only claims 11 properties on his bankruptcy statements, but I'd like to know where the other 16 properties went that were on that insurance report."

Grubbs said he lost some properties in tax sales. In other cases, he said he just had an interest in some properties on the list so he couldn't report them in the bankruptcy.

Rodney Grubbs grilled about payment and debts to adult sons

Also on the Zoom call was Fort Wayne attorney James O'Connor of Barrett McNagny LLP. O'Connor represents Grubbs adult sons, Josh and Zach, and their wives. The four have joined the case against Grubbs as creditors.

In court documents, Grubbs claimed he jointly owed them more than a $1 million. His sons worked for All About Pickleball as 1099 employees who handled whatever needed to be done, Grubbs said. Josh earned $1,500 biweekly, mostly for inventory control, while Zach earned $1,800 for the same period of time to mostly handle shipping. They could earn extra for providing pickleball lessons.

Daughter-in-law Abby wrote a weekly newsletter, earning about $50 biweekly, Grubbs said. There are no timesheets. They were basically salaried and worked as many hours as needed.

O'Connor noted that checks written to Zach Grubbs between Jan.15, 2022, and Sept.12, 2023, have not been honored — a claim Grubbs did not dispute, acknowledging that he sometimes paid one son and not the other.

"In the case of Zack and and Amy, they had two incomes in their family," Grubb said. "So when it came down to paycheck time if I can afford to cash one, I cashed Josh's for them because they were a single-income family. Josh was pretty much the sole provider."

What's next in the bankruptcy case?

Motions have been filed with the court to hire realtors to sell Grubbs' rental homes in Ohio and Kentucky. Friedmeyer also has asked the court for permission to employ Christy’s of Indiana, Inc. to auction the remaining Pickleball Rocks apparel and equipment. If approved, the auction is scheduled to begin on at 9 a.m. May 20 and end at 5 p.m. May 27.

Contact IndyStar investigative reporter Alexandria Burris at aburris@gannett.com. Follow her on X, formerly Twitter, at @allyburris.

This article originally appeared on Indianapolis Star: Pickleball investors to Rodney 'Rocket' Grubbs: Where did the money go?