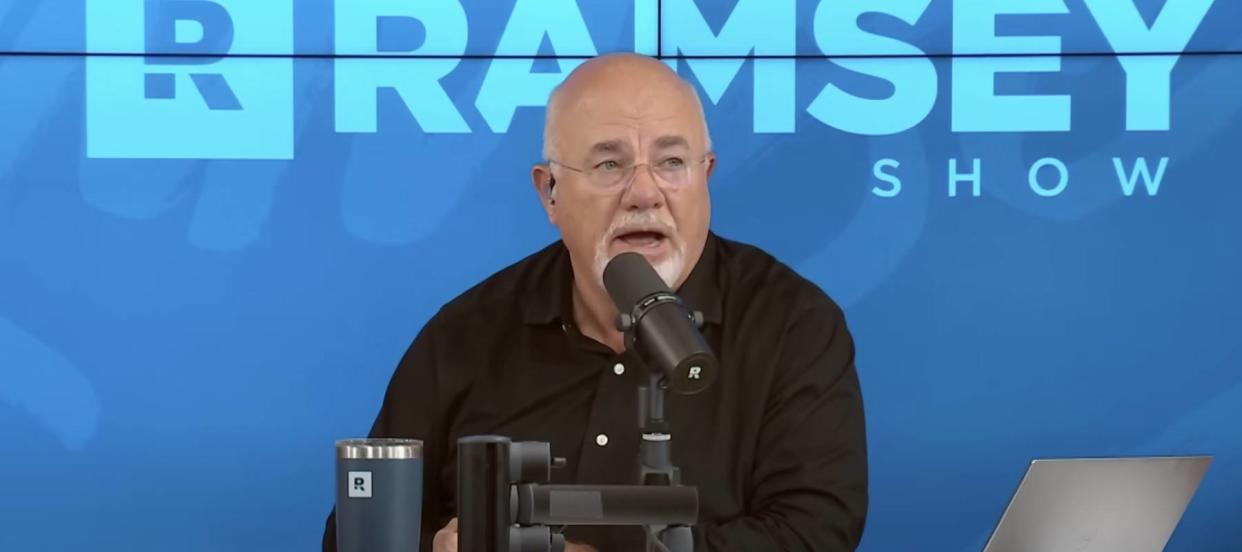

What's the threshold for a ‘good income’ in America? Dave Ramsey tells an Ohio woman that her $36K/year job doesn't qualify. Does yours?

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links.

What is a “good income”? It’s always been an important question but in the current economy it’s perhaps more pertinent. If prices are rising rapidly, are you earning enough money to support yourself or your family?

Recently, a guest on “The Ramsey Show” raised this question. Kelly, a 23-year-old from Ohio, believes she makes “good” money because she's able to save a reasonable amount every month. However, she was disappointed to hear Dave Ramsey describe her income as “low” in previous episodes with other guests.

Ramsey had a simple clarification — income is relative.

Don't miss

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here's how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

Cost-of-living in America is still out of control — use these 3 'real assets' to protect your wealth today, no matter what the US Fed does or says

These 5 magic money moves will boost you up America's net worth ladder in 2024 — and you can complete each step within minutes. Here's how

What’s a 'good' income?

Despite earning $36,000 annually after taxes from her position at a professional screen printing and embroidery shop, Kelly is diligently saving $1,100 each month for a down payment on her future home. Her hard work during her time at ministry school, juggling four jobs simultaneously, enabled her to avoid accruing any debt.

Kelly considers hers a “good income” but isn’t sure why Ramsey wouldn’t agree and is wondering if she needs to get another job.

“Good income is relative to the average household income in America, which is $78,000 right now.”

According to the U.S. Bureau of Labor Statistics, the median individual salary for full-time wage and salary workers is $1,145 per week, which is roughly $59,540 a year. By this measure, Kelly’s annual salary is 39.5% lower.

Even with a lower-than-average salary, Kelly could start building wealth by building some good financial habits.

One of the easiest habits to start is investing your spare change with Acorns, an automated savings and investment app.

When you make a purchase on your credit or debit card, Acorns automatically rounds up the price to the nearest dollar and places the excess into a smart investment portfolio.

Once you start socking away the change from small transactions, you may be surprised at how quickly your nest egg starts to grow.

Right now, when you sign up for Acorns, you can get a bonus $20 bonus investment.

Kelly could also benefit from speaking to a financial expert. Even if you’re not starting with a big pile of money to invest, a qualified financial professional can help you put together a plan to grow your wealth.

Advisor.com connects its users to highly-vetted financial professionals—with no minimum AUM required.

After answering some simple questions. Advisor.com will connect you with personalized matches that you can read up on and even have an obligation-free phone call with to determine if they’re the right fit for your financial goals.

Read more: 'Baby boomers bust': Robert Kiyosaki warns that older Americans will get crushed in the 'biggest bubble in history' — 3 shockproof assets for instant insurance now

Future destination

At 23, Kelly's $36,000 income suffices for now, but Ramsey advises planning for growth. Considering the steep rise in U.S. house prices—47.2% in a decade. If Kelly is aiming to buy a home one day, she must plan wisely.

According to Ramsey, she needs to look ahead and have a plan to boost that income. “What do you want the 33-year-old version of you to look like?” he asked. “Anything that’s not growing is dying.”

Homes are likely to be more expensive by the time Kelly is 33 years old, so she will need to make enough to afford one comfortably. If, like Kelly, you can’t afford to purchase a home in full right now, there are still other ways you can invest in real estate and build a passive stream of income.

With Arrived, you can invest in fractional shares of vacation and rental properties, freeing you from landlord duties. Back by world-class investors like Jeff Bezos, Arrived lets you explore properties vetted for their appreciation and income-earning potential.

With Arrived, you can choose how many shares you’d like to purchase and start investing with as little as $100.

Another way to earn from the real estate market is to invest in necessity-based commercial properties that are essential to the local community. First National Realty Partners (FNRP) allows individual investors access to highly vetted, grocery-backed real estate investments.

With FNRP, you can easily make an allocation and let their team handle the rest while you keep track of your investments with a personalized portal.

What to read next

Jeff Bezos and Oprah Winfrey invest in this asset to keep their wealth safe — you may want to do the same in 2024

'It's not taxed at all': Warren Buffett shares the 'best investment' you can make when battling rising costs — take advantage today

Car insurance premiums in America are through the roof — and only getting worse. But 5 minutes could have you paying as little as $29/month

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.