Weeks after election, Ginther, Council go big on tax abatement expansion for housing

Skyrocketing rents and construction costs are creating headwinds for residents and incentives for investors, and the Columbus City Council is taking aim.

The City Council as soon as Monday could approve a measure expanding its residential tax abatement program for new construction from older neighborhoods in need of redevelopment to the entire city limits, including its booming suburban-type areas.

The city is legally justifying that massive expansion with a state-required "housing survey" documenting the need for housing revitalization citywide. But, in fact, the survey prepared by Mayor Andrew J. Ginther's administration is just dozens of photos of houses in need of exterior repairs — including minor paint chipping, damaged fences and litter. And the majority of those example homes already fall within an existing designated tax-abatement area, The Dispatch has found.

While more property owners would be paying no taxes under the change — even those in areas of Columbus near New Albany, Dublin and Worthington — other major changes being contemplated by the council and Ginther's administration also would institute a series of new fees.

Officials could offer no information on what those potential fees could cost property owners annually, but have proposed levying them on all city rental units, all long-term vacant structures, and all units in foreclosure. Those owning large amounts of property would have their fees capped to lessen their bills, councilmembers revealed during public hearings.

Officials say the fees could generate millions of dollars for various city programs, including rental assistance. The vacant-unit fee would incentivize owners to put property to use, city officials said.

"We have not seen a written proposal to institute a fee for rental units," said Laura Swanson, executive director of the Columbus Apartment Association. "CAA opposes all fees that increase operational cost and adds pressure to increase rents," adding that the group was generally aware of the proposal.

City Council also is taking aim at an ever-growing amount of "wholesale" real estate purchases of residential property units in Columbus, which officials say often can be predatory in nature and run by out-of-state investors who are too often absentee landlords. The practice, which is swallowing up thousands of homes, is driving up the price of housing for everyone, they said.

While most of the changes are set for votes early next year, citywide tax abatements for developers could be approved as soon as Monday evening, according to City Council President Shannon Hardin's office, even though it hadn't yet appeared on any meeting agenda by Thursday afternoon and has had no required first reading.

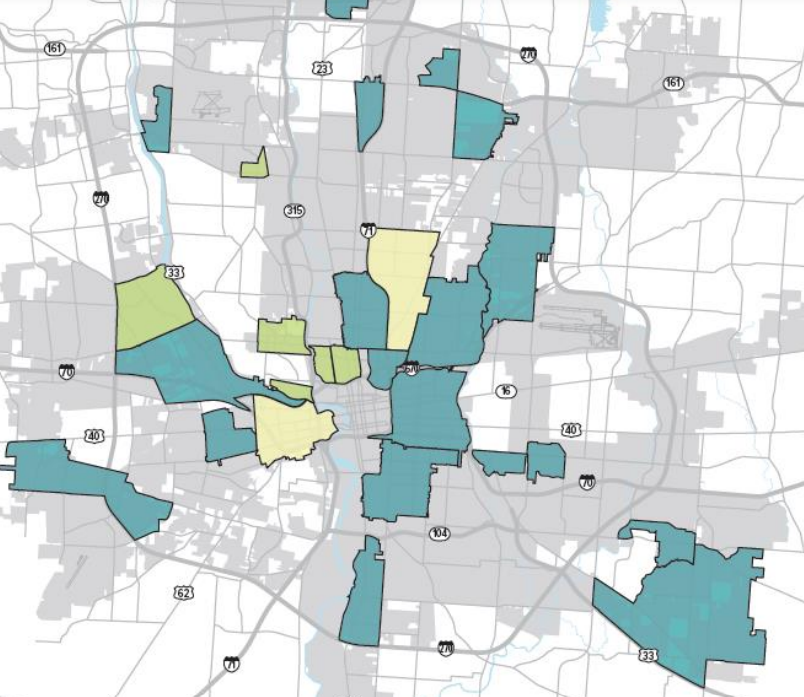

The measure would expand 15-year, 100% residential property tax abatements from being granted only in one of the existing "community reinvestment areas," or CRAs, which generally target older areas such as Linden, Franklinton, the South Side for incentives, to being granted anywhere in Ohio's largest city. The exceptions would be in some existing commercial CRAs and "Tax Increment Finance" zones in Polaris, Easton and other areas.

The CRA expansion idea was crafted by an "internal working group" led by Ginther's Department of Development, the department's director, Michael Stevens, told councilmembers at a hearing Nov. 20. The current 12 CRAs are "not expansive enough" and inequitable "because it focuses the development of housing supply and affordability only in historically disinvested neighborhoods," Stevens said.

However, Ohio law envisions CRAs being targeted to areas in need of reinvestment — not in high-priced residential areas already developing without tax breaks. The Ohio Revised Code defines a CRA as "one in which housing facilities or structures of historical significance are located and new housing construction and repair of existing facilities or structures are discouraged."

In other words, older neighborhoods in need of newer and improved housing options.

State oversight eliminated

Which areas qualified under that legal designation used to have to be approved by the state based on a "housing survey" commissioned by a municipality. But the Ohio Department of Development no longer has to sign off on that based on a new law signed by Gov. Mike DeWine last January. Now, all Columbus must do is "submit" a proposed CRA to the state, showing the area on a map.

Armed with this new freedom, Ginther has quickly moved to expand the amount of developer projects qualifying for city tax abatements — just weeks after winning reelection over an opponent whose main campaign issue was ending almost all property tax abatements.

"This idea is just one more developer-driven tool promoted by (developers) and their politically connected lobbyists, who whine about everything," Joe Motil, a Democrat whom Ginther defeated in the Nov. 7 general eelection, said at a City Council hearing last Monday. "And you foolishly listen to them time and time again.

"They have as much control over development policy in this city as the NRA has over (state) gun laws."

City officials counter that by using all tools to encourage new housing, rents will fall as supply increases. But they have offered no estimates on how long that plan may take.

"We know that, looking at nationwide data, for every $100 that rent increases in a region, that homelessness increases 9%," Erin Prosser, the city's assistant director of housing strategies, said at the Monday hearing. "It is a housing issue, and we need to have enough housing."

"No one loves every tool," Hardin said Monday. "But we have to use them if we're going to keep some affordability here."

In order to get tax abatements, the city typically requires developers to price 20% of units at below-market rent.

Columbus officials also note that Cleveland and Cincinnati already have citywide CRAs. However, unlike Columbus, those cities became effectively locked in by suburbs many decades ago, along with their aging housing stocks.

Columbus, on the other hand, is known for its recent growth and aggressive suburban annexation requirements in return for water and sewer services to developers, allowing its boundaries to stretch to the Franklin County line — and beyond in some places.

Housing survey in question

Asked to see the housing survey that Columbus is using to justify tax abatements in its sprawling suburban-type areas, the city Department of Development couldn't immediately provide it over two days. But Motil was able to provide it, having requested it earlier.

The document reveals that the survey consists of 84 pages of only photos of busted gutters, litter, dirty garage doors, fallen fences, and in some cases boarded-up homes. An example study on the state Development Department website includes no photos, but demographics, family income studies, housing characteristics, historic district locations, housing age and vacancy rates, conditions, values, zoning, and more.

Further, The Dispatch located each house in the city's study on a map, and found that of the total 49 properties listed, 34 of them — or 71% — were already located in an existing city CRA. Of the remaining 14 units, several are within blocks of an existing CRA, and two appear to have issues relating to house fires.

One 2,022-square-foot house in the 300 block of Hanton Way on the Far East Side had been valued at $249,100 by the Franklin County auditor when it caught fire on August 27, 2022, forcing a family of six to escape with their lives. The city study included that fire-ravaged home, constructed in 2010, to justify the need for more tax abatements citywide, along with another fire-damaged home near Downtown.

The city Department of Development didn't respond to a Dispatch inquiry on why a house fire or properties that already qualify for a tax abatements demonstrate the need to expand abatements across the entire city, including newer, suburban-like areas.

wbush@dispatch.com

@ReporterBush

This article originally appeared on The Columbus Dispatch: Columbus Council seeks citywide tax abatements for housing