This week in Bidenomics: Unloved

Inflation is coming down. Workers are surprisingly upbeat. The Federal Reserve may actually pull off a “soft landing” by raising interest rates without choking off employment. There’s even progress on the debt-ceiling standoff between Republicans and Democrats in Washington, D.C.

Yet President Biden remains deeply unloved. A new Washington Post-ABC News poll pegs Biden’s approval rating at a measly 36%, the lowest of his presidency in that survey. That’s remarkably terrible for an economy with a 3.4% unemployment rate, the lowest since 1969.

Other polls rate Biden slightly higher. His FiveThirtyEight aggregate approval rating is 42%. But that’s still pretty sad given how many things are going right.

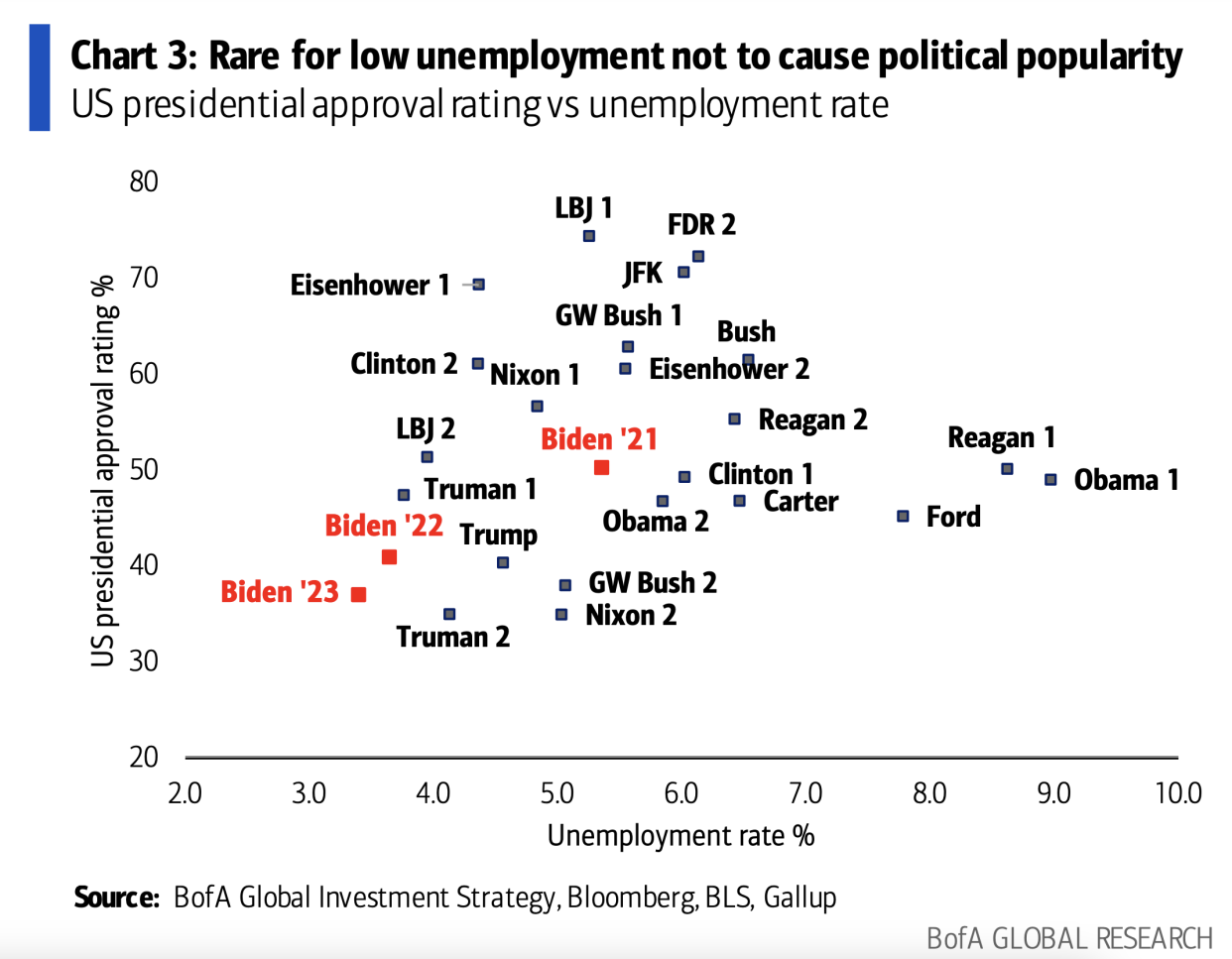

Bank of America charted the unemployment rate against presidential approval and found that only Harry Truman, in the early 1950s, scored worse than Biden with the unemployment rate below 4%. And that was amid the Korean War, labor strife with disgruntled steelworkers, McCarthyism, and charges of corruption in Truman’s administration.

What do voters have against the affable Biden? Bank of America thinks it’s straightforward: “Inflation [is the] sole macro reason for disapproval,” the bank’s strategists declared in a May 11 analysis.

The latest consumer price data shows that the annual inflation rate dropped from a peak of 9% last June to 4.9% now. The Federal Reserve wants inflation at 2% but would probably settle for 3%. It seems to be heading there. Gasoline prices, directly wired into consumer psyches, are a manageable $3.50 per gallon, 30% below peak prices last June. Inflation for goods is now a mere 2.1%, suggesting the COVID-related shop-o-mania is over. Shouldn’t voters be feeling a little more sanguine?

To understand why they’re not, Yahoo Finance recently analyzed inflation on a 2-year and 4-year basis. That captures all of the inflation that has occurred since COVID hit in 2020 and sent the US economy topsy-turvy. And it clarifies how painful inflation really is and why it depresses people.

Inflation during the last 12 months was 4.9%—not so bad, in itself. But inflation during the 12 months prior to that was 8.3%. So overall, prices are up nearly 14% over two years. Inflation is cumulative, and consumers bear all prices hikes over time, combined. A slower rate of inflation today does nothing to alleviate prior inflation.

[Drop Rick Newman a note, follow him on Twitter, or sign up for his newsletter.]

If incomes were rising by more than inflation, it would take the sting out of rising prices. But for the last two years, incomes have been rising by about 1.5 percentage points less than inflation. Before COVID, incomes were rising just a little bit more than inflation. So before Biden’s presidency, the typical American was getting slightly ahead. During Biden’s presidency, the typical American is falling slightly behind. That’s the essence of Biden’s popularity problem.

Since he’s running for president, Biden obviously needs to turn this around—and simply getting the inflation rate down may not be good enough. If the year-over-year inflation rate fell to 0 next month, it would still not erase the 14% inflation consumers have dealt with for most of Biden’s presidency. That money is spent. What no or low inflation would do is allow consumers to start clawing their way back and rebuilding some purchasing power. A real improvement that would make people start to feel better would be wage growth that overtakes inflation on a sustained basis and stretches the typical paycheck further.

Inflation is not going to 0, and it’s unlikely wages are going to grow by more than inflation any time soon. Wage growth actually contributes to inflation, since producers pass higher labor costs onto consumers through higher prices. So Biden’s in a pickle.

Normal metrics suggest Biden’s reelection odds are good. As Bidenomics regulars know, early election models based on economic factors forecast a victory for the incumbent party—Biden and his fellow Democrats—in 2024, due largely to a strong labor market. There’s also the likelihood of lousy competition, in the form of Republican front-runner Donald Trump, the former president who’s a chronic liar and may soon be a chronic criminal defendant.

But a president’s approval rating hints at re-electability, and Biden is in danger if he stays in the low 40s. At a minimum, he wants to be at around 45%, and ideally higher. He also wants the trend to be improving, not worsening. Biden doesn’t need voters to love him, but during the next 18 months his job is to persuade gloomy Americans they they shouldn’t loathe him, either.

Rick Newman is a senior columnist for Yahoo Finance. Follow him on Twitter at @rickjnewman

Click here for politics news related to business and money

Read the latest financial and business news from Yahoo Finance