This week in Bidenomics: 'Recession canceled'

The Biden recession may never materialize. His opponents will be disappointed. President Biden will say, I told you so. Voters may finally start to feel a little more economically secure under Biden and boost his reelection odds for 2024.

This is the latest shift in tone among experts following the economy and the 2024 election, which is already underway.

Assessing the latest economic news, Bernard Baumohl of the Economic Outlook Group sent a research note on June 29 declaring, “Ladies and Gentlemen, the recession has been cancelled!”

On June 30, The Hill newspaper declared, “US economy defies recession fears.”

Citi Research noted on the same day that “markets continue to struggle with the possible unwinding of the US recession trade,” meaning that traders betting on the economic consequences of a downturn are getting smoked.

Several surprises account for the undead economy. The government raised its estimate for first quarter GDP growth from 1.3% to 2%, an unusually large revision. Consumer spending and exports turned out to be stronger than measured in prior estimates.

Spending on major purchases known as durable goods shot up by the most in more than two years. The pandemic boom in spending on stuff was supposed to be over, as people free to move about the world again shifted to travel and other services. But the desire for stuff turns out to be unquenchable.

Services spending rose as well, by twice the pace of the last quarter of 2022. Americans want it all.

Economists keep predicting a slowdown in the super-hot labor market, but it keeps not happening. Jobless claims for the most recent week dropped by 26,000, the largest decline in five months.

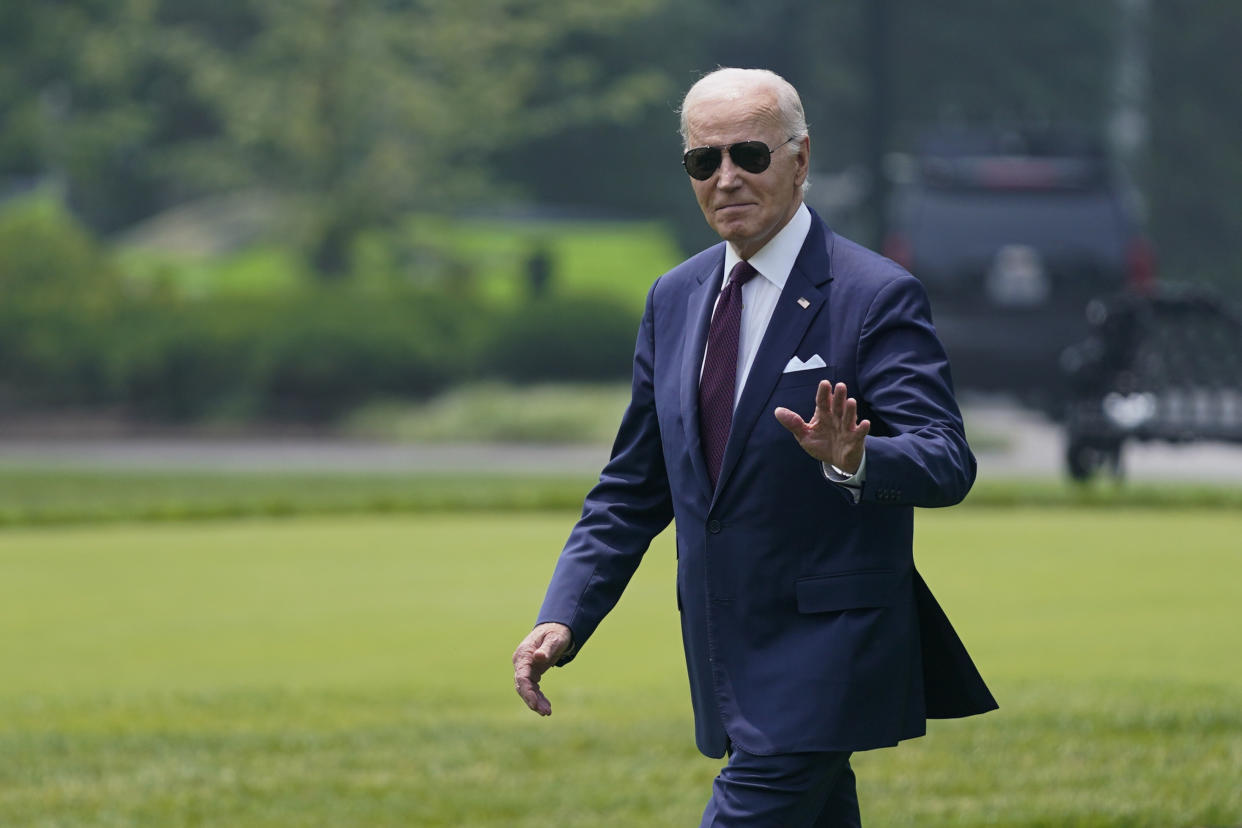

Biden has begun campaigning for reelection in earnest, and he’s currently on an “Investing in America” tour talking up the economy.

So far, voters aren’t buying it. Consumer confidence was on the upswing when Biden took office in 2021, as Covid vaccines were rolling out and the pandemic was receding. But confidence plunged to recessionary levels as inflation took root and hit a peak of 9% one year ago. Inflation has since dropped to 4%, but confidence levels are still depressed.

[Drop Rick Newman a note, follow him on Twitter, or sign up for his newsletter.]

Biden’s approval rating reflects that. He started with a solid approval rating of 55%. It fell below 50% during the summer of 2021, around the time of the chaotic withdrawal of US troops from Afghanistan. He’s never been close to 50% since. Biden’s current approval rating is around 40%, near the lowest of his presidency. There’s been no movement upward during the last year, even as inflation has come down.

Economists and consumers alike have been awaiting a recession because that’s what normally happens when inflation gets out of control and the Federal Reserve has to hike interest rates aggressively to slow the economy. That’s the playbook for taming inflation: Hike rates, make borrowing more expensive, restrain spending and investment, and soften demand.

The Fed is certainly doing its part, hiking rates by 5 percentage points during the last 15 months. But the expected slowdown in investing, spending and hiring hasn’t followed, at least not yet.

Baumohl argues that this time, it’s different. “The rapid pace of technological innovation, growth in working from home, the recalibration of supply chains have in part fundamentally changed the DNA of the US economy,” he wrote in the June 29 analysis.

This means it’s possible to have a vigorous economy and declining inflation at the same time. If he’s right, the Fed can stop trying to slow growth, focus on inflation alone, and stop overthinking it.

Not everybody has abandoned their recession predictions. Oxford Economics said on June 30 that it’s revising its forecast, shifting the start of a recession from the third quarter of 2023 to the fourth quarter. It expects a modest downturn, with GDP dropping 1.3% and the unemployment rate rising from 3.7% now to 5.3%.

That would be a gloomy scenario for the sunny Biden, since voters would feel the pain of a recession heading straight into an election year.

Biden seems unworried, saying in a June 28 speech in Chicago, “Bidenomics is working … I’m not here to declare victory on the economy. I’m here to say we have a plan that’s turning things around incredibly quickly.”

If the recession forecasters continue to be wrong, voters might slowly start to believe it.

Rick Newman is a senior columnist for Yahoo Finance. Follow him on Twitter at @rickjnewman

Click here for politics news related to business and money

Read the latest financial and business news from Yahoo Finance