Warren Buffett's Berkshire Dials Back Liberty Global Stake

- By James Li

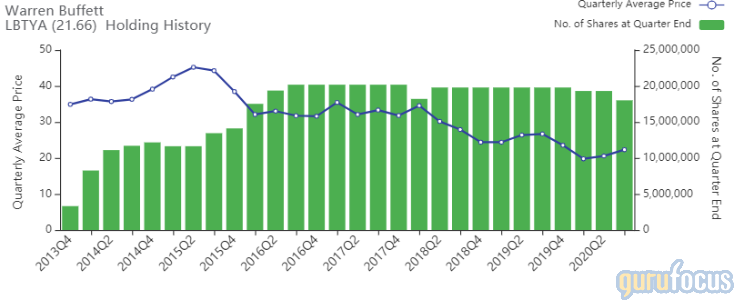

Berkshire Hathaway Inc. (NYSE:BRK.A)(NYSE:BRK.B), the $520-billion insurance conglomerate headed by Warren Buffett (Trades, Portfolio), announced this week that it reduced its holding in Liberty Global PLC (NASDAQ:LBTYA) according to GuruFocus Real-Time Picks, a Premium feature.

The insurance conglomerate sold 1.3 million shares of the UK-based cable company on Sept. 4, reducing the position 6.73%. Shares traded around $22.31 at the time. Berkshire has an estimated loss of 33.13% on the stock since initially buying shares during the fourth quarter of 2013.

Company background

Liberty Global operates cable networks in a wide range of European markets, including the UK, Switzerland, Belgium, the Netherlands, Ireland, Poland and Slovakia. The company serves over 9 million Internet access customers across its consolidated footprint.

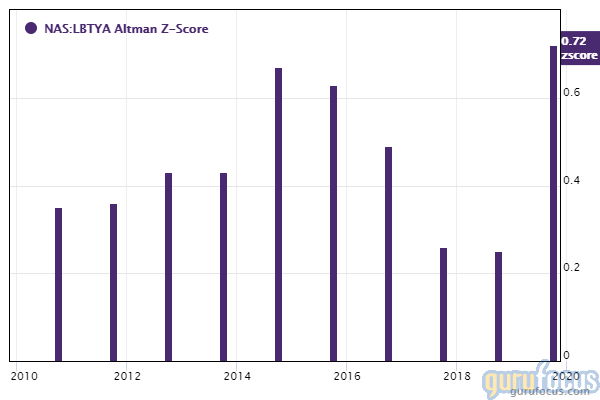

GuruFocus ranks Liberty Global's financial strength 4 out of 10: Although the company has a high Piotroski F-score of 7, Liberty Global has a weak Altman Z-score of 0.85 and a debt-to-equity ratio that underperforms 76.32% of global competitors.

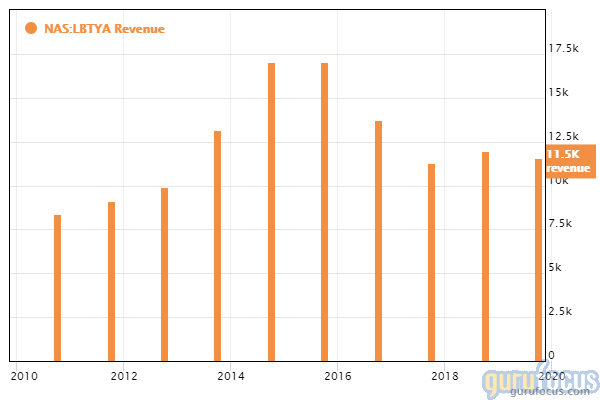

Liberty Global's profitability ranks 5 out of 10 as three-year revenue and earnings growth rates that underperform over 60% of global competitors offset strong net profit margins and returns on equity.

See also

Buffett trimmed his conglomerate's holding in Wells Fargo & Co. (NYSE:WFC) and increased Berkshire's stake in Bank of America Corp. (NYSE:BAC) over the past few weeks, according to the list of GuruFocus Real-Time Picks. The guru also announced on Aug. 31 that his conglomerate took stakes in five Japanese conglomerates.

Disclosure: No positions.

Read more here:

5 Tech Stocks With High Gross Margins Over the Past 5 Years

Simon and Brookfield Partners Set to Rescue J.C. Penney

Tesla Veers Off Course on S&P 500 Index Snub

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.