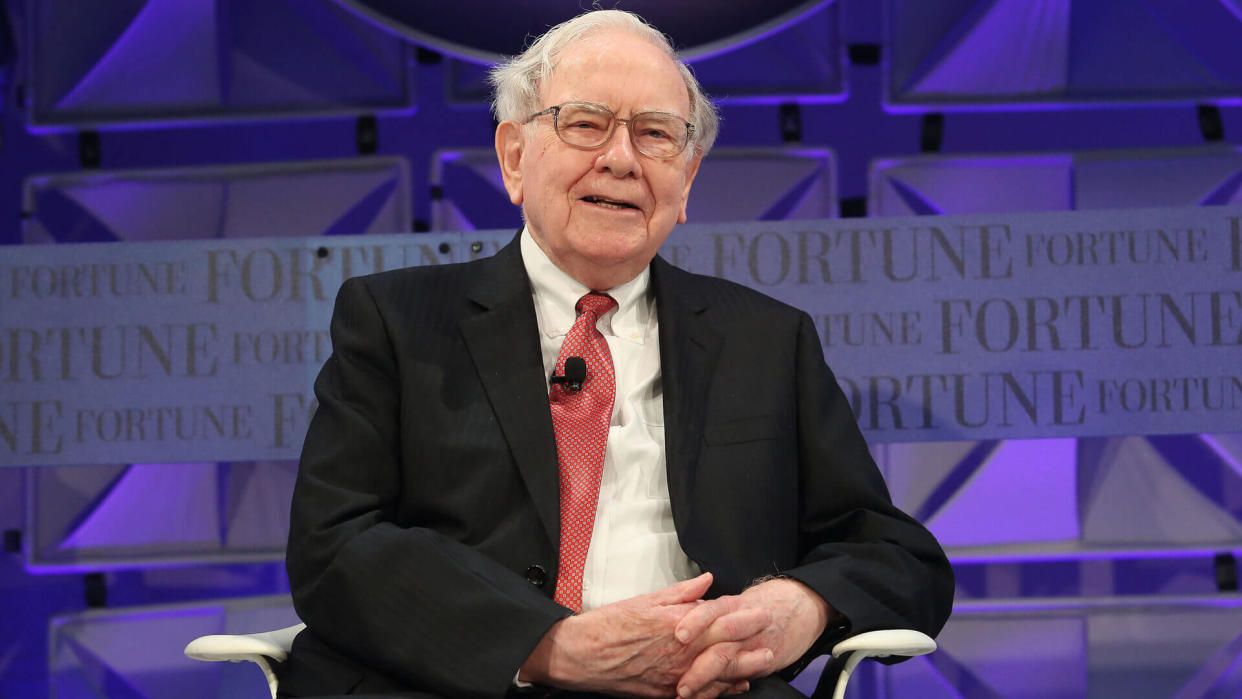

Warren Buffett’s ETF Picks: Unveiling His Top 2 Choices For Savvy Investors

There are a few tenets central to Warren Buffett’s investing philosophy. Chief among them is holding on to stock for the long-term, letting them grow wealth through compound interest. He has said, “When we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever.”

Discover Next: I’m a Self-Made Millionaire: 5 Stocks You Shouldn’t Sell

Try This: 4 Genius Things All Wealthy People Do With Their Money

Such is his influence that CNBC keeps a Berkshire Hathaway Portfolio Tracker, or a “Buffett Watch,” on its site that it updates regularly. And why not? As one of the most successful investors in history, Buffett believers keep a close eye on everything the “Oracle of Omaha” says and does.

Although the 93-year-old co-founder, chairman and CEO of Berkshire built his wealth through investing in strong brands with excellent financials, like Coca-Cola and American Express, it doesn’t mean he doesn’t appreciate other investments like exchange-traded funds (ETFs).

Berkshire’s portfolio contains two ETFs: SPDR S&P 500 ETF Trust (NYSE ticker symbol: SPY) and Vanguard S&P 500 ETF (VOO). Though they makeup a very small percentage of Berkshire’s investment basket, Buffett recognizes these important diversifications. “In my view, for most people, the best thing to do is own the S&P 500 index fund,” Buffett said at Berkshire’s 2020 annual meeting.

Also here’s how much you’d have now if you invested $1,000 in Berkshire Hathaway 10 years ago.

Buffett’s ETF Investment Picks

Buffett’s right, “for most people,” ETFs make sense. We all can’t invest billions of dollars into mega-corps. But we can invest in low-cost, low-maintenance index fund investments that can be foundational holdings for long-term, buy-and-hold portfolios. Investing in S&P 500 ETFs are a safe way to own shares of the 500 largest U.S. companies across multiple sectors.

Be Aware: 7 Best Stocks To Buy Under $1

SPDR S&P 500 ETF Trust

Although it makes up a negligible percentage of Berkshire’s portfolio, Buffett is a fan of the most heavily traded of State Street Global Advisors’ S&P 500 ETF, the SPDR S&P 500 ETF Trust. While it’s not the cheapest — there’s an annual management fee of $9.45 for every $10,000 invested — it’s very competitive and the most well-established ETF on the market.

Vanguard S&P 500 ETF

Berkshire owns a little more of the Vanguard ETF than SPDR and mentioned in a 2013 letter to Berkshire Hathaway shareholders that if you’re choosing between the two, “I suggest Vanguard’s,” according to the Motley Fool. While both ETFs own many of the same funds, VOO has an expense ration cheaper than SPDR, charging 0.03% compared to 0.095%. As CNBC Make It reported, this doesn’t seem like a big deal, but it can save and make you more over the long haul and that’s something that’s right up Buffett’s alley.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Warren Buffett’s ETF Picks: Unveiling His Top 2 Choices For Savvy Investors