Want to get your taxes done for free? There Rhode Islanders are here to help.

PROVIDENCE − A few years ago, a flyer for free tax preparation hanging in Sop & Shop caught the eye of Len Reynolds.

He was certainly interested - the year before, he went to a large tax preparation company and lost most of his sizeable refund to exorbitant fees.

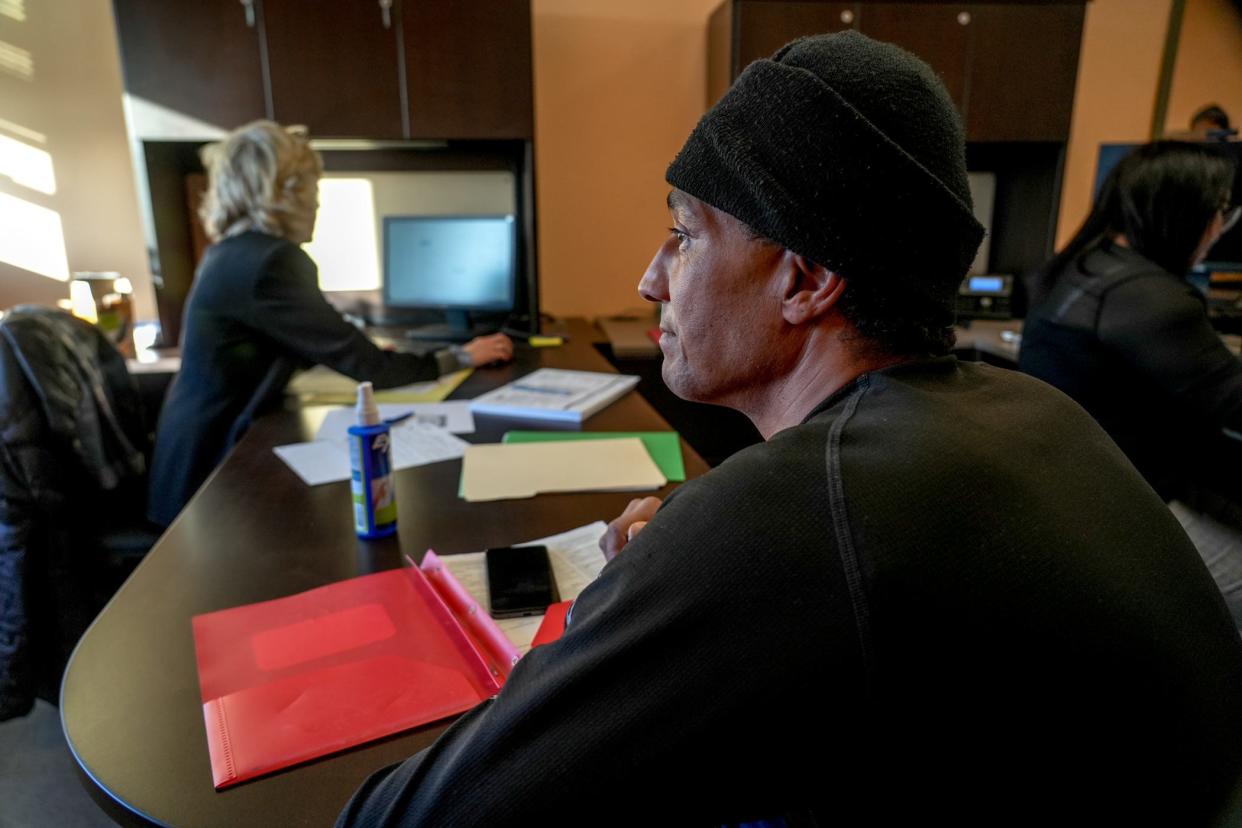

"I called the number, they answered, and here I am," he said, while at the Genesis Center in Providence, as volunteer preparer Irene Ziegler looked over the last entries on Reynolds' tax return and highlighted the key points he needed to check.

Reynolds was, last year, one of the 10,086 single or family filers in the state who had their taxes done, for free, by volunteer preparers using software provided to them by the IRS, part of the federal Volunteer Income Tax Assistance, or VITA, program.

What is it like to prepare free tax returns?

Ziegler, an accountant by trade, volunteers once a week at the Genesis center, one of 11 volunteer tax preparation sites in Providence. In all, there are 24 in the state.

The do-it-yourself option: The how-to guide on filing your RI and federal taxes for free in 2024

Last year the volunteer program, organized here by the United Way of Rhode Island, processed 19,608 tax returns, resulting in $21 million in tax refunds, an average of $1,072 per return.

Ziegler learned about the program over five years ago, when she first started volunteering. She theorized she must have heard about it from a friend.

Sitting across from Ziegler on most days is Niurka Lopez, who started as a volunteer and is now a paid staff member at the Genesis Center. Every day she does tax prep, she estimated she gets through 10 to 15 people. In all last year, they prepared returns for 323 people.

Most of it time it's fun, as the software provided by the IRS is easy to use and they are the bearers of good news, the facilitator of tax refund checks. But not always.

"Sometimes it's difficult because some people don't have all their documents or they don't understand it's the government's rules, not ours," Ziegler said.

One major point of contention is usually Form 1095-A, the one that states if a person was covered by health insurance in the previous year. Under state law, there is a tax penalty for most people who do not have health insurance.

Other problems arise when workers find out their employer has classified them as independent contractors, who receive a 1099-NEC, instead of the normal W-2 form. The state Department of Labor and Training calls the misclassification of workers as contractors a "serious problem" in the state.

Who is eligible for free tax prep?

While the free tax prep program is often marketed as being for "low income" people, the maximum amount someone can make is around $64,000 a year. For context, the area median income (AMI) for the majority of the state is $74,200 for a single person.

The tax preparers are usually ready to even do more complex taxes than the usual combination of income from a regular job and maybe a few extras thrown in, like interest income.

While Reynolds' taxes were quick to prepare, it is gig workers who often have the most time consuming, if not complex, taxes, Ziegler said.

Setting up workers for future tax success

Much of the time spent during the tax preparation sessions, especially with new clients, is spent educating them on what happened to their taxes, why, and how to prepare for the next year.

For many gig workers, that means Ziegler explains to them why they need to keep a contemporaneous mileage log documenting their odometer readings, to get their proper mileage deductions, as well as logs or spreadsheets of the rest of their expenses.

Some drivers luck out, as the companies track their mileage and send it to them with their tax documents, but others, like DoorDash, do no such tracking.

The other complex cases are those who run their own businesses, which means a whole round of calculating deductible expenses, and sometimes telling clients what can't be deducted, like trips to the salon or restaurants.

For Lopez, much of the education centers around combating misinformation her clients are receiving, often on social media.

Help in other languages is available

At the Genesis Center, volunteers and paid staff processed 350 tax returns last year, with an average federal return of $2,000. Of the people who came through, 35% identified themselves as having limited English proficiency.

As Ziegler and Lopez recounted doing the taxes for a family that emigrated from Afghanistan, Ziegler dug through her bag, holding up an envelope where she had written the name and number of the man who helped interpret for the family the previous year.

Tax preparation is also done in languages other than English, including Spanish, Portuguese, Vietnamese, Arabic, French, Korean, Mandarin and Russian.

Interested in filing your taxes for free yourself this year?

If you're interested in filing your own taxes for free this year, read our guide on what options are available to Rhode Islanders through the IRS's Free File program.

Six companies offer free preparation of federal and Rhode Island tax returns for Rhode Island residents.

Our guide runs through the income limitations, the pros and the cons of each option available for both state and federal returns.

If you need help with a tax issue, not related to this year's return, the IRS runs two Taxpayer Assistance Centers in Rhode Island, one in Providence and one in Warwick.

The Providence location has extended its hours on Tuesdays and Thursdays, through tax season. Read about what the tax centers can help with here.

See all of the state's Volunteer Income Tax Assistance locations

Bristol

Bristol EBCAP/Benjamin Church, (401) 435-7876 x1137

Central Falls

Progreso Latino, (401) 753-4854

Cranston

Comprehensive Community Action, (401) 467-7013

East Providence

East Bay/East Providence Senior Center, (401) 435-7876 x1137

Johnston/North Providence

Tri-County Community Action Agency, (401) 519-1915

Pawtucket

BVCAP Woodlawn Community Center, (401) 475-5051

Providence

Amos House, (401) 272-0220

Capitol City Community Center/Lillian Feinstein Senior Center, (401) 207-0223

CAPP Hartford Ave., (401) 273-2000

Center for Southeast Asians, (401) 274-8811

Federal Hill House, (401) 421-4722

Indigenous Empowerment VITA, (401) 255-6238

OpenDoors, (401) 214-1807

Providence Spanish SDA Church, (401) 270-9996

The Genesis Center, (401) 781-6110 x13

Mount Hope Community Center, (401) 521-8830 x 102

Johnson and Wales University, (401) 568-4789

Wakefield

Tri-County Community Action South, (401) 515-2490

JonnyCake Center of Peace Dale, (401) 789-1559 x10

Warwick

Westbay Community Action, Inc., (401) 384-7779

Westerly

WARM - Westerly Area Rest and Meals, (401) 596-9276 x113

Westerly Education Center, walk-in site

Woonsocket

Community Care Alliance, (401) 235-7187

Connecting for Children and Families, (401) 766-3384

What to bring to a Volunteer Income Tax Assistance appointment

Valid picture ID

All received tax forms (W-2, 1099, 1095-A)

Last year's federal tax return

Tax identification numbers for dependents (Social Security number)

Tax identification numbers for child care providers, if claiming a child tax credit

Proof of health insurance

Thanks to our subscribers, who help make this coverage possible. If you are not a subscriber, please consider supporting quality local journalism with a Providence Journal subscription. Here's our latest offer.

Reach reporter Wheeler Cowperthwaite at wcowperthwaite@providencejournal.com or follow him on Twitter @WheelerReporter.

This article originally appeared on The Providence Journal: These volunteers are helping people file their taxes for free in RI. Here's how.