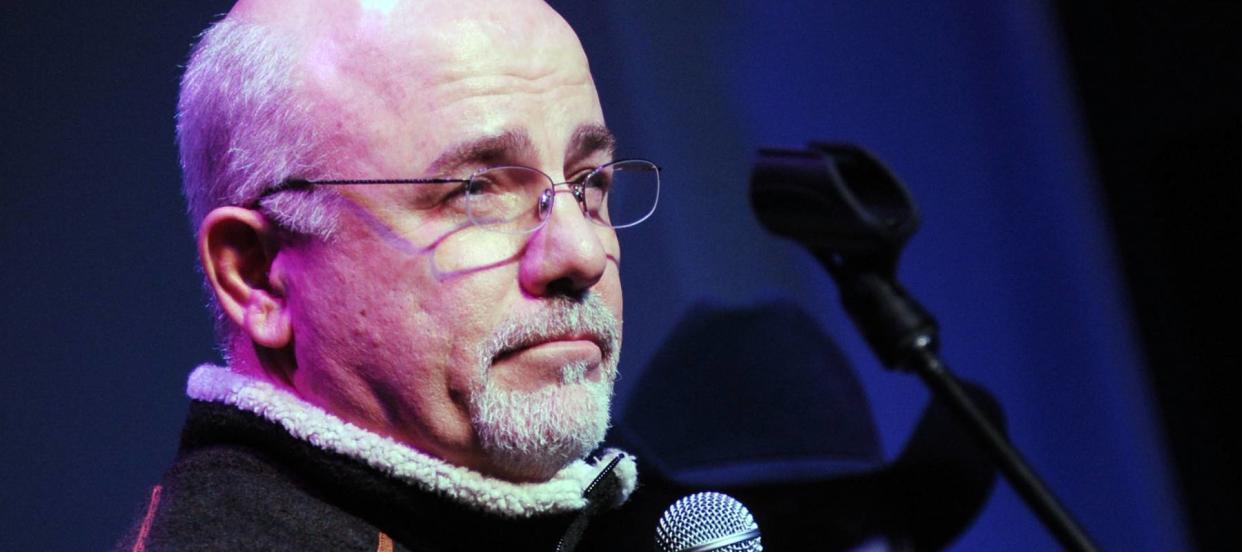

Want to retire in America with at least $1M? Dave Ramsey shares 1 breakthrough tip to turbocharge your savings

Some people simply aren’t putting enough money aside for their retirement, while others are relying on their Social Security benefits. But if you plan to spend 20-plus years in retirement, you’ll want to enjoy those golden years — not struggle to get by each month.

An assessment from Fidelity Investments found that American savers only have 78% of the income they’ll need to retire — and about one-third (34%) will likely need to make “significant adjustments” in order to cover their retirement expenses.

Don't miss

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here's how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

Cost-of-living in America is still out of control — use these 3 'real assets' to protect your wealth today, no matter what the US Fed does or says

These 5 magic money moves will boost you up America's net worth ladder in 2024 — and you can complete each step within minutes. Here's how

Preparing for retirement means making a commitment to save. But if you want to turbocharge your savings — and retire as a millionaire — personal financial expert Dave Ramsey warns against get-rich-quick investments. Rather, he recommends that you “get rich slow.”

How to get rich slow

Ramsey does not hide his disgust when it comes to get-rich-quick schemes.

“The only people getting rich quick on get-rich-quick schemes are the jokers selling you the stuff to do it.” Ramsey said in a Facebook video clip posted in January 2022.

In his experience, “the way you build wealth is slow and steady, time and consistency.”

Sure, it’s possible to get rich quick. Ramsey did so himself when he started buying real estate in his 20s and made his first million dollars. But his fortune was built on debt, and eventually his house of cards came crashing down and sent him into bankruptcy.

That’s why he’s vocal about money trends like cryptocurrency, NFTs and even single stocks, where people think they can make a quick buck by buying low and selling high.

“You could lose your shirt (and pants) messing around with crypto. Steer clear, Big Tuna. Head for open waters. Crypto is risky business,” as his website, Ramsey Solutions, has advised.

Read more: Generating 'passive income' through real estate is the biggest myth in investing — here’s how you can do it in as little as 5 minutes

Get-rich-slow plans, on the other hand, can be “really boring,” according to Ramsey Solutions, but offer a more steady path to reach your financial goals.

“It’s not flashy or wild. It’s not a rollercoaster. Building wealth takes time — especially when you’re investing the right way.”

In a survey of 10,000 millionaires conducted by Ramsey Solutions from November 2017 to January 2018, around 80% of respondents said they built much of their wealth through their employer-sponsored retirement plan. Around 75% also attributed their success to regular, consistent investing over a long period of time. In other words, they got rich slowly.

So how slow is slow?

Ramsey became a millionaire once again after the bankruptcy. But the second time around, he did it differently: he paid off his debts and started saving his money.

When it comes to get rich slow, Ramsey has made a name for himself by coming up with 7 baby steps that can help people build wealth over time. It starts with getting out of debt (except for your house) and setting up an emergency fund. From there, you can focus on investing and building wealth.

Ramsey Solutions recommends investing 15% of your income into tax-advantaged investment accounts, using the formula “Match beats Roth beats Traditional.” When investing outside of your company plan, it’s suggested you spread your risk across four types of mutual funds: growth, growth and income, aggressive growth, and international.

Next, adopt a buy-and-hold strategy, keeping a long-term perspective rather than chasing returns because that’s how “you wake up one day with an empty nest egg and a ton of regret.”

It can help to work with a financial adviser, Ramsey Solutions says, but you shouldn’t invest in anything “until you understand how it works.”

Striking gold in a get-rich-quick scheme is a rarity — not the norm. Building real wealth, according to Ramsey Solutions, means you have to “stop being in such a hurry to get rich” because “slow and steady wins the race every time.”

What to read next

Rich young Americans have lost confidence in the stock market — and are betting on these 3 assets instead. Get in now for strong long-term tailwinds

Car insurance rates have spiked in the US to a stunning $2,150/year — but you can be smarter than that. Here's how you can save yourself as much as $820 annually in minutes (it's 100% free)

Thanks to Jeff Bezos, you can now use $100 to cash in on prime real estate — without the headache of being a landlord. Here's how

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.