Want to buy a home in Washington? Here’s how much you need to earn per year, Zillow says

Looking to enter the homeowners’ club in Washington?

According to a new report from Zillow, you’ll need to earn an annual income of over $106,000 to afford a home in the United States comfortably.

That’s 80% more than the income buyers needed to purchase a home in January 2020, the real estate marketplace company said in the Feb. 29 report.

As a result, hopeful homebuyers are “more often partnering with friends and family or ‘house hacking’ their way to homeownership,” Zillow said.

Here’s how housing costs have soared in the past four years:

Average home cost in the U.S.

The average monthly mortgage payment for a single-family home in the U.S. has almost doubled since January 2020, Zillow says.

With a 10% down payment, a typical monthly payment is around $2,188. That’s 96.4% more than what homebuyers would have paid four years ago.

According to data collected by Zillow, U.S. home prices have increased about 42% since 2020, with the typical home averaging $343,000.

While mortgage rates averaged 3.5% in early 2020, they are currently around 6.6%, according to Zillow’s Feb. 29 report.

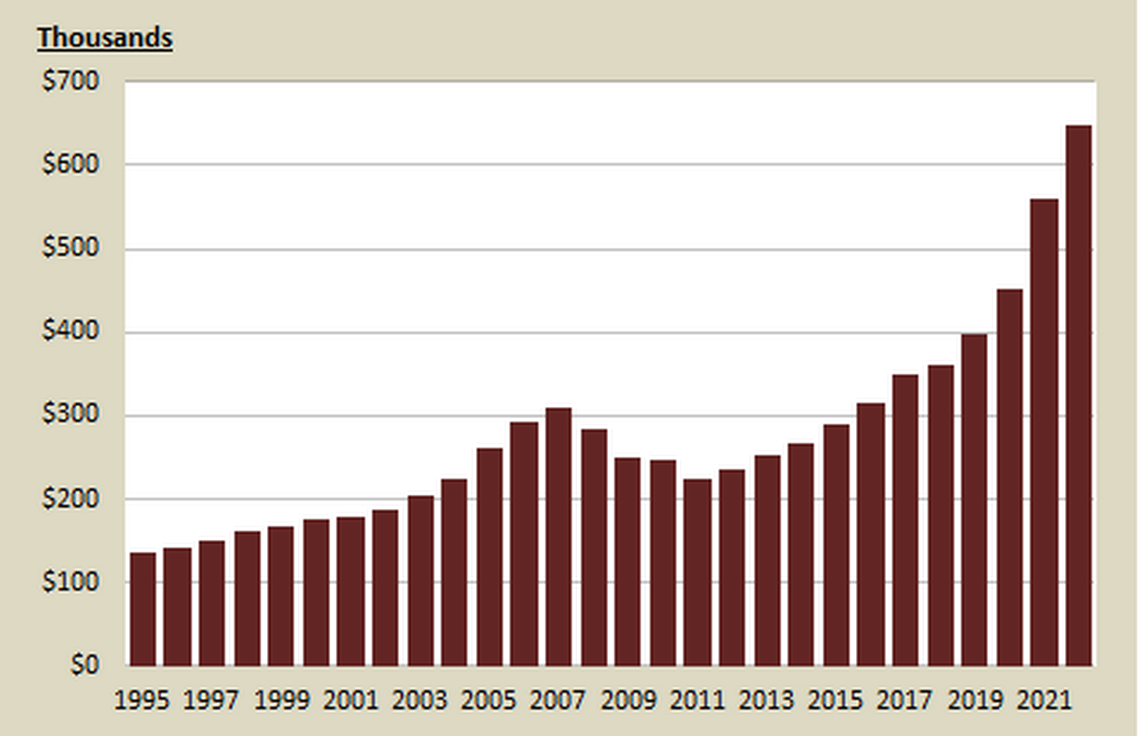

Average Washington home price

The Washington State Office of Financial Management shows that the price of homes in the state has risen steadily since 2011. The latest data available is from 2022, when the median home price was $647,900, compared to $223,900 ten years prior. This is a much more significant increase than previous increments.

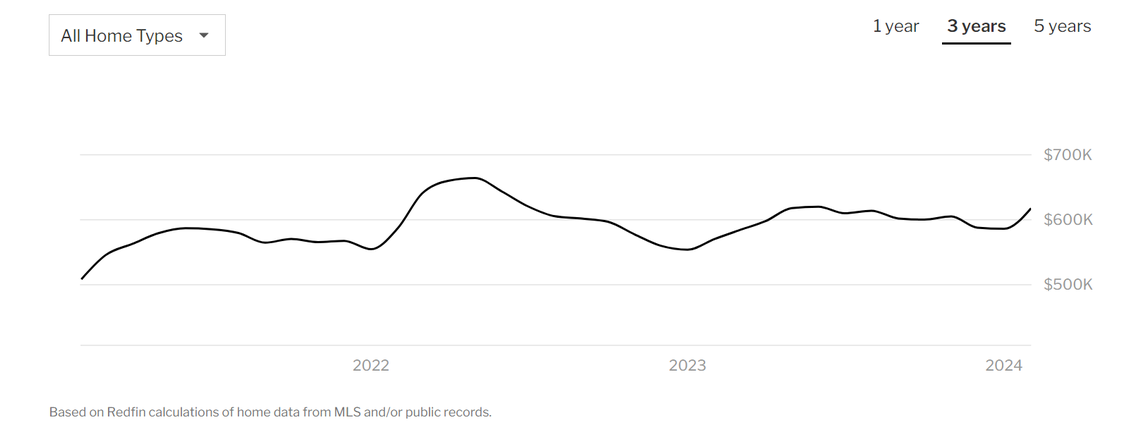

Redfin says the average home price in Washington for February 2024 is $617,000, up 8.3% from the year prior.

The recommended annual income for a home around that price is $133,200.

Zillow also analyzes the value of homes in Washington. Home value is often not synonymous with sale price. Data through February 2024 shows the typical value of a house in Washington is $575,894, a 2.6% increase from a year before.

According to MoneyGeek, Washington state has the fourth-most expensive average monthly mortgage payment, at $1,459, about $300 above the national average.

Difficulty in achieving homeownership

In 2020, a household with an annual income of $59,000 could comfortably afford the monthly mortgage on an average U.S. home by spending no more than 30% of its income with a 10% down payment, Zillow says.

At the time, that figure was below the U.S. median income of around $66,000, meaning more than half of American households could afford to own a home then.

New homebuyers now need to make more than $106,000 to comfortably afford a 30-year home mortgage with a 10% down payment, Zillow said.

However, according to Zillow, a typical U.S. household earns about $81,000 per year, making homeownership a distant dream for many.

Places with the most affordable homes

Here’s where Zillow says buyers can comfortably afford a home in the U.S. and how much income they need to earn each year:

Birmingham, Alabama - $74,338

New Orleans, Louisiana - $74,048

Cleveland, Ohio - $70,810

Memphis, Tennessee - $69,976

Pittsburgh, Pennsylvania - $58,232

Places with the least affordable homes

Zillow says seven metropolitan areas in the U.S. require homebuyers to have an annual income of $200,000 or more to comfortably afford a home.

Here’s where and the annual income needed to comfortably afford a home:

San Jose, California - $454,296

San Francisco, California - $339,864

Los Angeles, California - $279,250

San Diego, California - $273,613

Seattle, Washington - $213,984

New York, New York- $213,615

Boston, Massachusetts - $205,253