How To Verify a Cashier’s Check: 3 Precautions To Take

Unlike a personal check, a cashier’s check is a direct obligation of the bank. As a result, there is virtually no risk that a cashier’s check will bounce or otherwise be invalid.

See: How To Guard Your Wealth From a Potential Banking Crisis With Gold

Unfortunately, fraudsters can create phony cashier’s checks and use them for check scams. Learn how to verify a cashier’s check so you can avoid being a victim of check fraud.

How To Verify a Cashier’s Check

You can take precautions to ensure that a cashier’s check is legitimate. To avoid being a fraud victim, follow these steps to verify a cashier’s check:

Don’t accept it if there are signs of a scam.

Look for a watermark, microprint or a red flag: typos.

Visit or call the issuing bank and ask for verification.

Here’s a closer look at the steps you should take to avoid scams involving cashier’s checks.

1. Don’t Accept a Cashier’s Check If There Are Signs of a Scam

One common cashier’s check scam involves someone overpaying for an online purchase — so if you sell something and receive a cashier’s check for more than the purchase price, don’t accept it.

For example, a buyer based outside the U.S. sends a cashier’s check seemingly from a U.S.-based bank and asks you to refund the overage separately. Federal law requires that funds from a deposited cashier’s check be made available in one business day. By the time the fraudulent check is discovered days or weeks later, the buyer is nowhere to be found. Because you made the deposit, the bank can hold you liable for the funds.

2. Examine the Cashier’s Check

Cashier’s checks often include a distinct feature specific to the bank and often tell you what to look for. If the check states there is a watermark or microprint, look for that on the check. If it’s missing, the check might not be valid.

Typos are another giveaway that a check is phony, as fake cashier’s checks sometimes come from senders overseas.

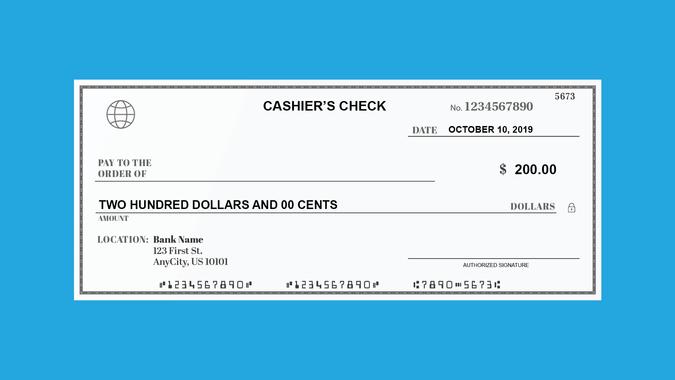

Here’s how a cashier’s check typically looks:

3. Visit or Call the Bank

Only the bank that issued a cashier’s check can truly verify it. Keep in mind that you can’t verify a cashier’s check online, but other options are available.

If the check is issued from a bank that has a branch near you, there’s no better approach than to take the check into the bank and ask for verification. At a larger bank, cashier’s check verification would follow a set process. There’s no charge to verify a cashier’s check.

If you can’t visit in person to trace a cashier’s check, independently confirm the phone number of the bank as listed on the check, then call the bank and ask to verify the check. All banks require these pieces of information to verify a cashier’s check:

Check number

Issuance date

Payment amount

How To Cash a Cashier’s Check

You can cash or deposit a cashier’s check at the bank that issued it, but you might have to pay a fee if you’re not a customer there. If the issuing bank is not near you, you can cash the check at another bank where you have an account. You’ll need to present ID verifying that you are the payee the check is made out to. Some banks might require more than one form of ID.

Because of the prevalence of fraud involving cashier’s checks, a bank that did not issue the check might not allow you to cash or deposit the check if it has reason to believe you might not be entitled to the payment. Or you might be subject to a longer wait period for the funds to become available. Discuss this issue with the bank prior to the transaction.

If you’re wondering whether cashier’s checks clear immediately, be aware that there is typically a waiting period. Certain check-cashing businesses, as well as many Walmart stores, can cash a cashier’s check for you, but they will likely charge a fee. Walmart, however, promises the cash immediately.

Common Cashier’s Check Scams To Watch Out For

In addition to the overpayment scam described above, other common scams to watch out for include the following:

You Recieve a Letter Announcing You’ve Won a Lottery or Inherited Money

This cashier’s check scam involves receiving a letter informing you that you’ve won or inherited a significant sum of money. However, before you can receive the funds, the letter states you’ll have to pay a processing fee or transfer tax. The letter further explains that you’ll be sent a cashier’s check to cover the fees or taxes. All you have to do is deposit the check into your account and then wire the fees to a third party who is most likely in a foreign country. Unfortunately, if you follow through, you’ll eventually be notified by your bank that the cashier’s check is fraudulent and you’ll be on the hook for the money you wired.

A Buyer Uses a Cashier’s Check To Buy Something You’re Selling

A buyer sends you a cashier’s check for the agreed-upon price of some items you are selling online. After you receive the check, you ship the items and deposit the check. Later, you find out the check is fake, and you’ve given your items to a scammer instead of receiving the money you’re owed.

You Receive a Letter Stating You’ve Been Chosen as a Mystery Shopper

While mystery shopping can be a legitimate way to make some extra cash, you sign up with the mystery shopping companies — they don’t contact you. Mystery shopping companies also do not send you a cashier’s check, which is what qualifies this as a scam. You’ll be instructed in the letter to deposit the cashier’s check into your bank account, buy some items with the funds during your “mystery shopping assignment” and then wire some of the funds to a third party. By the time you’re a victim of cashier’s check fraud, you’ll be on the hook for the funds you sent to the third party.

What To Do If You’re a Victim of Cashier’s Check Fraud

If you’re a victim of cashier’s check fraud, it’s essential to report it immediately. Talk to your bank about how to resolve the issue. You should also report it to:

The Federal Trade Commission

Your state’s attorney general

If the cashier’s check was sent by mail, you should also report it to the United States Postal Inspection Service.

FAQ

Here are the answers to some of the most frequently asked questions regarding cashier's checks.

Can you call a bank to verify a cashier's check?

You'll need to call the issuing bank and ask if it will verify the cashier's check over the phone. The bank might require you to take the check to a local branch instead.

How do I certify a cashier's check?

You cannot certify a cashier's check. Instead, you can obtain a certified check, which requires the bank to verify the customer's signature and verify the funds are in the customer's account by adding a signature, stamp or other identifying mark to the check.

Can cashier's checks be fake?

Unfortunately, cashier's checks can be fake. It's important to take steps to verify the check, which begins with contacting the issuing bank.

How long does it take for a bank to verify a cashier's check?

The issuing bank should be able to verify a cashier's check within several hours. However, this time frame can vary depending on the bank.

More on Checking Accounts

Compare Checking Accounts

Cynthia Measom contributed to the reporting for this article.

This article has been updated with additional reporting since its original publication.

This article originally appeared on GOBankingRates.com: How To Verify a Cashier’s Check: 3 Precautions To Take