Will University of Iowa risk management major help grow Des Moines' slowing insurance sector?

Part of a series.

Jim Lewis wants kids these days to know that insurance is exciting.

A former marketing executive, Lewis became the director of the University of Iowa’s Vaughan Institute of Risk Management and Insurance last fall. His arrival comes as insurance leaders around Des Moines hope the state's universities and colleges can pump out more talent.

Executives of the Des Moines metro's insurance industry, centered in a slow-growth state, know that competition for each crop of graduating students is fierce. They want more candidates. And that means they want more students to think about insurance early in their college careers.

More: Life insurance statistics and industry trends 2024

Lewis admits his task is tough. Business majors usually dream about making money in other fields.

They watch “Wall Street” and imagine a career in Manhattan. Or “Silicon Valley” and dream of California. Or the more subtly named “Industry,” the British drama about the investment banking industry.

Showrunners aren’t pitching many prestige dramas about the lives of underwriters and actuaries.

“We’ve got to do something pretty dynamic and aggressive as an industry to fill the pipeline,” Lewis said.

It may not seem too dynamic, but Lewis added that his first approach is important: In mid-January, as the spring semester in Iowa City began, he visited the early finance courses. He explained why students need to consider the risk management and insurance major, a program the university rebooted 40 years after a cost-cutting dean axed it.

Lewis said the major returned last fall because insurance executives have lobbied for more young employees. The initiative comes as other Iowa universities are trying to bulk up their insurance programs. The Iowa Economic Development Authority has also partnered with colleges and companies to create an insurance internship program aimed at freshmen and sophomores.

Des Moines finance industry slowdown underscores need for new talent

The schools are responding to a problem with the state’s labor force.

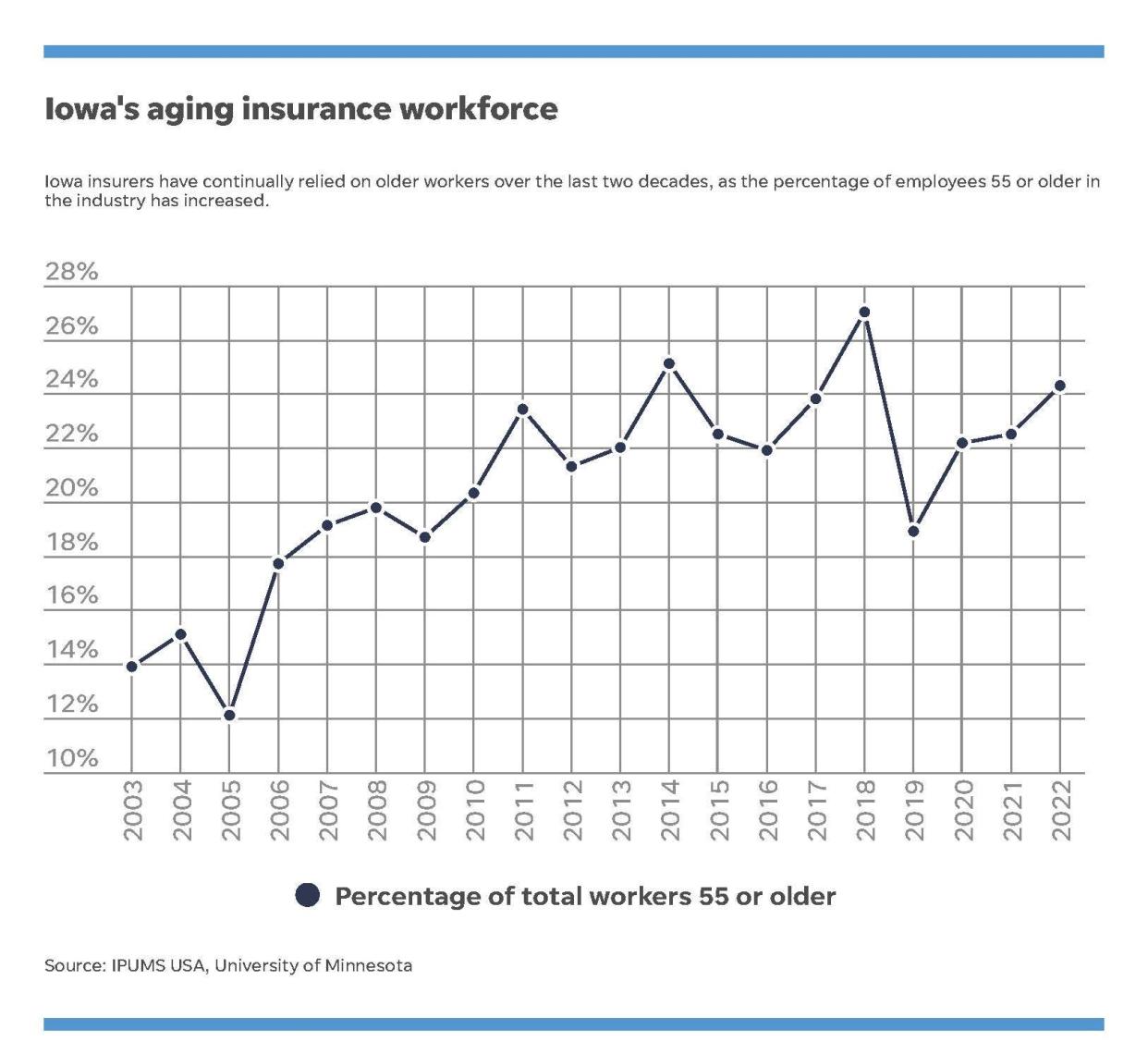

After decades of employment growth far exceeding the national average, the Des Moines metro has shed about 4% of its financial activities jobs since July 2017. That comes as the country overall has increased financial activities jobs by 9%.

While much of Des Moines’ job loss occurred because Wells Fargo & Co. has scaled back its mortgage division, the metro’s insurance industry is not growing as fast as it once was. Rather than leading the country, Des Moines has been adding insurance jobs over the last six years at about the same pace as the country overall.

Des Moines has fallen well behind insurance job growth in faster-growing cities like Phoenix, Atlanta and Orlando.

More: High car insurance prices are worrying Americans. See who's paying the most and least in the US.

The problem has led to a debate among local corporate leaders. Does Des Moines need to recruit more companies that can grow jobs? Or does the state need to prepare more employees whose availability can encourage companies to expand here?

Lewis believes the latter is the right answer.

“That’s what the industry is asking us to do,” he said. “Bring them more talent.”

With risk management skills, 'You're a much more attractive employee'

As an academic offering, risk management is about learning how to evaluate a company’s vulnerabilities. Professors teach students how to identify the areas where companies are at risk, what risks are most dramatic and what managers can do in response.

The major can help students prepare for any industry, Lewis said. But it is particularly helpful in insurance, where employees must put a price on a contract years before they know what that contract will cost them.

Typically, professors told the Des Moines Register, insurance companies do not need college graduates who studied their industry. Instead, companies look for students who studied business management, human resources, marketing, accounting, law, software development, data analytics or actuarial science.

More: Iowa, ISU and Northern Iowa are increasing tuition this fall. What it means for students:

But they said courses in risk management could better prepare students for life in the industry. Lewis said many of the 167 students majoring in risk management at the University of Iowa also are pursuing other majors.

“You’re a much more attractive employee,” Kevin Croft, the director of the Kelley Center for Insurance Innovation at Drake University, said of the University of Iowa’s program. “I don’t think I have to train you up as much.”

The birth, death and rebirth of a University of Iowa major

Risk management has a long history at the University of Iowa, spearheaded by Emmett Vaughan, an early pioneer in the field who began teaching at the school in 1963. His textbooks were used around the world, and the United Nations tapped Vaughan to assess the value of damages in Kuwait after the Gulf War.

Former Gov. Terry Branstad credited Vaughan’s teachings for giving the state some of the best regulators in the country, building Iowa’s reputation as an insurance hub.

“He was an incredible teacher,” said his daughter, Terri Vaughan, a former Iowa insurance commissioner. “He took complicated concepts; he made them simple. And he made them entertaining to learn. He had lots of stories and lots of examples that would embed lots of concepts in your brain. People loved going to his classes.”

But in 1983, the university ended the risk management major, moving Vaughan to an associate dean role. Branstad said the state's universities were cutting majors to save costs as the budget shrank during the farm crisis.

The business school’s dean at the time, George Daly, told the Des Moines Register he couldn’t recall Iowa having an insurance major. But he wasn’t surprised to hear that he would have cut it.

“You kind of get these specialized majors, and then often they have enrollment problems,” he said. “And so streamlining the curriculum, as it would be stated, would be a quite reasonable objective.”

At Drake, Croft said the university also cut its risk management major in the early 1990s, due to “an interest-of-students issue.”

Des Moines insurance agency head advocates for revived program

Not everyone saw the cuts the same way.

“It was an egregious act,” said Dana Ramundt, a 1974 risk management graduate.

Ramundt, who founded The Dana Company, a Des Moines insurance agency, said Iowa has lost ground to other states in recruiting insurance talent because it lost the risk management major. He said he got nine job offers out of college, which he attributed to Vaughan’s status as “an icon.”

Ramundt remained close to Vaughan after graduation and advocated for the university to bring the major back for years. Finally, in 2005, a year after Vaughan’s death, the school launched the Vaughan Institute.

Ramundt said university administrators declined to restart the major, though. He said other deans and professors may have objected to spending more money on new staff and classes. Instead, the program offered a certificate for students who took five courses.

But Ramundt said he and other executives continued to advocate for a major. Amy Kristof-Brown, who became the Tippie College of Business’ dean in 2020, pushed their request through the Board of Regents two years ago.

“It’s just been one of the most rewarding experiences I’ve ever had, seeing this thing come back to life,” Ramundt said.

Drake, Iowa State bulking up on insurance offerings

Other schools around the state are also trying to improve the talent pipeline.

At Drake, Croft said the school hosts “disruption days,” when students listen to guest speakers share how they are trying to change the insurance industry. Croft hopes the talks excite students who might view insurance as a staid industry.

Drake also hosts an “innovation lab” where executives from EMC Insurance Cos., Principal Financial Group and Holmes Murphy & Associates share problems they are trying to solve.

More: Drake University business school named for former Principal CEO and wife, who are among top donors

Holmes Murphy CEO Dan Keough said the company received feedback from students last summer about launching a managing general agent line of business and how a startup could lower risks for car wash companies.

In Ames, Iowa State University added an actuarial science major in 2019. Professor Rahul Parsa, who joined the faculty from Drake, said Principal CEO Dan Houston and other Des Moines executives told him the state needed more actuaries.

He said local companies have struggled to land graduating students, particularly from a school like Drake, where many students hail from Chicago.

More: How John Pappajohn Entrepreneurial Centers started 25 years ago with a $1 million check

“The young kids, they want to go somewhere fun,” he said. “They don’t think Des Moines is fun. It’s boring. There’s nothing to do here.”

He added that many Iowa State students come from rural parts of the state. He believes they are more likely to stay in the area after school.

About 35 students are majoring in actuarial science. Parsa hopes to bump the number up to 50.

“For them, Des Moines is big,” he said. “They’re happy. That’s why the businesses like our program.”

All the schools are participating in Insure Your Future, the internship program that the IEDA launched last year. The program pairs freshmen and sophomores with companies, giving them paid internships in hopes that they will become interested in the insurance field.

Terri Vaughan said that the program is the brainchild of Michael Gould, the state’s insurance economic development director. (The IEDA did not return the Register’s interview request.)

Lewis said about 70 students at schools around the state interned with about 25 companies last summer, the first cohort of Insure Your Future.

The insurance industry's struggle with sex appeal

Fidelity & Guarantee Life CEO Christopher Blunt said he understands why more young students aren’t gravitating toward the industry.

“It doesn’t jump to the top of anyone’s mind of sexy industries,” he said.

Blunt himself wasn’t interested in insurance when he studied at the Wharton School at the University of Pennsylvania. He began as an asset manager.

He said the industry could reach more students if it marketed itself better. He said executives need to explain the impact they can have, that the contracts they sell will pay for rebuilt homes after storms or help families if a breadwinner dies unexpectedly

He said too many insurance leaders are “math nerds” who talk about the mechanics of their insurance contracts.

“We have to talk more about what we do, the outcomes, the mission,” he said.

In Iowa City, Lewis said he also believes the industry can achieve that goal. In particular, he thinks students need to know that they can earn a solid living without spending long hours in a hypercompetitive atmosphere.

He said current finance majors are gearing up for a “hard path” on Wall Street.

“A lot of them hit that reality when they come out of (those jobs),” he said. “’What have I done to myself?’ It’s a really tough survival.”

Tyler Jett is an investigative reporter for the Des Moines Register. Reach him at tjett@registermedia.com, 515-284-8215, or on Twitter at @LetsJett. He also accepts encrypted messages at tjett@proton.me.

This article originally appeared on Des Moines Register: Can Iowa universities help make insurance industry a sexy career choice?