This Washington couple took their 'unconstitutional' $15K IRS bill to the Supreme Court — and it could cost the US a jaw-dropping $340B if they win, pundits say. Here's why

A dispute over $15,000 could reshape the American tax code and potentially halt $340 billion in government revenue.

On Dec. 5, the Supreme Court heard oral arguments in Moore v. United States, a case that centers on the mandatory repatriation tax (MRT) included in 2017’s Tax Cuts and Jobs Act. The thought of a $14,729 tax bill might fill some taxpayers with horror, but advocates say the outcome of this hearing could have a far more costly impact on both tax rules already in place and those being considered by President Joe Biden’s administration.

Don’t miss

Commercial real estate has outperformed the S&P 500 over 25 years. Here's how to diversify your portfolio without the headache of being a landlord

Find out how to save up to $820 annually on car insurance and get the best rates possible

Finish 2023 stronger than you started: 5 money moves you should make before the end of the year

Here’s why this case is so pivotal.

Reshaping the tax code

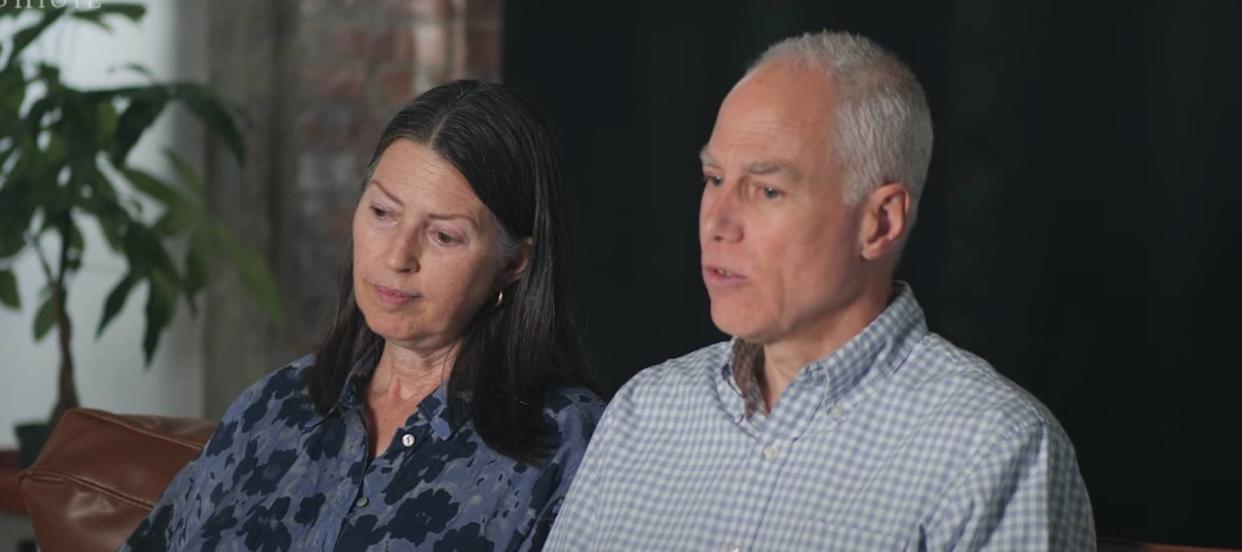

Charles and Kathleen Moore of Redmond, Washington State, are the plaintiffs in this case. In 2005, the couple invested $40,000 to buy a 13% stake in KisanKraft, a manufacturing business based in India. However, when Congress passed President Donald Trump’s signature Tax Cuts and Jobs Act (TCJA), it placed a levy on U.S. taxpayers who owned more than 10% of a foreign company.

The government expected the rule to generate nearly $340 billion in tax revenue over 10 years.

Based on this new rule, the Moores paid $14,729 in taxes, despite telling American Enterprise Institute, a center-right thinktank, that they hadn't received a penny from the business at that point. They’re now seeking a refund, arguing that the tax is “unconstitutional” and “an unapportioned direct tax in violation of the Constitution’s apportionment requirements.” In simple terms, the couple believes the government has no right to tax unrealized gains.

A “gain is not income unless and until it has been realized by the taxpayer,” lawyer Andrew Grossman reportedly told the Supreme Court justices during the hearing.

If the Supreme Court rules in their favor, it could open the door to reshaping the country’s tax code. Stan Veuger, Alex Brill and Kyle Pomerleau, senior fellows at the American Enterprise Institute (AEI), worry that if the Moores win, it “risks upending key elements of the current federal income tax and wreaking havoc on parts of the U.S. economy.”

One of their top concerns is that a requirement that income be realized before it can be taxed could lead to increased “economic distortions, create policy uncertainty and reduce federal revenue.” Calling it “economically incoherent,” the AEI fellows add a decision in favor of the Moores could lead to the reintroduction of problems previous legislation sought to address, and thus increased wealth disparity as the wealthy hold on to assets strategically and look to find opportunities to purchases or sales that allow them to avoid paying tax altogether.

Other experts also worry about the impact on government revenue. Tax Policy Center Institute Fellow Eric Toder estimates that the federal government could lose $87 billion in revenue for 2024 and $125 billion by 2028 if the court rules in the couple’s favor. To cover the shortfall, Congress might have to implement new rules. If the shortfall isn’t covered, it could further expand the government’s budget deficit.

Meanwhile, Democrats are worried the case could impact their ability to implement a wealth tax.

Read more: Owning real estate for passive income is one of the biggest myths in investing — but here's how you can actually make it work

Undermining the wealth tax

In late November, lawmakers introduced the Billionaires Income Tax Act — a new rule they say could close loopholes and force wealthy individuals to "pay their fair share" in taxes.

The bill would tax any individual with more than $1 billion in assets — or $100 million in income for three consecutive years — at a 20% rate. This would apply to both realized income and unrealized gains. The proposed legislation is co-sponsored by 15 Democratic Senators and over 100 supporting organizations.

Democrat Sen. Ron Wyden, who is championing the Billionaires Income Tax Act, argues that the bill could be stymied if the Moores win their case. This would put a key element of the Biden administration’s tax agenda at risk.

Based on their comments, it appears that some Supreme Court justices are leaning towards a narrow ruling to avoid far-reaching impacts across the tax code and economy. However, a decision is not expected until 2024.

What to read next

You can cash in on prime real estate for as little as $20. Here’s how.

Millions of Americans are in massive debt in the face of rising rates. Here's how to get your head above water ASAP

Rising prices are throwing off Americans' retirement plans — here’s how to get your savings back on track

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.