UAW members at Detroit Three didn't see return to pensions but saw something else

Demands during the UAW contract negotiations in 2023 at the Detroit Three reflected the retirement angst many face today and called for bringing back traditional pensions for those autoworkers who were hired after the fall of 2007 and not covered by pensions.

Pensions did not return, as most experts predicted, but the new contracts quietly opened the door for a unique way for autoworkers to opt to set aside a chunk of their 401(k) savings into a lower cost annuity for a more predictable stream of income in retirement. It's a new type of idea that has been discussed in retirement circles but not well known among everyday savers.

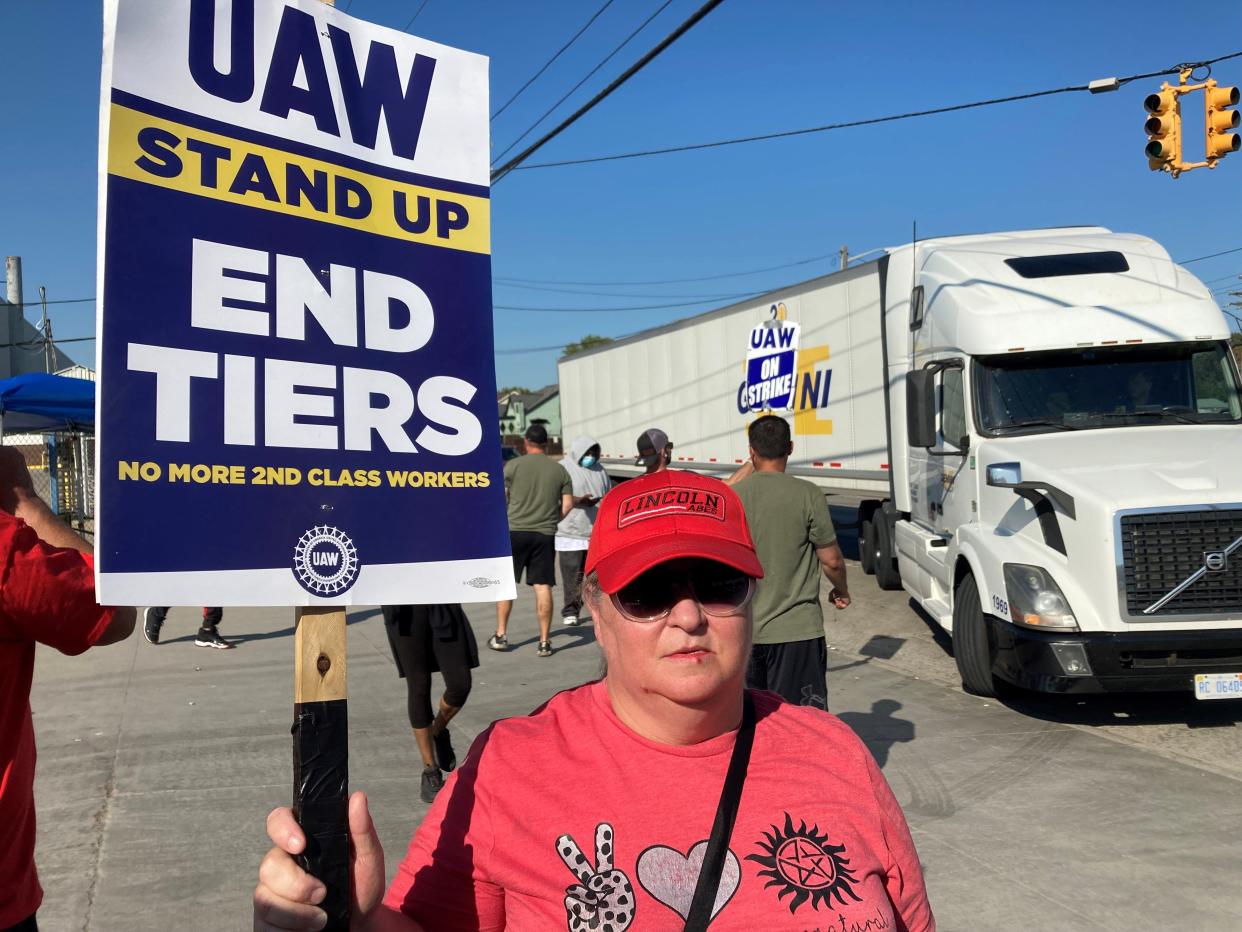

Annuities don't turn up the heat on social media, like big wage demands. I didn't talk with a single UAW member on strike last fall who even mentioned annuities. Many, though, did express fear that they wouldn't have enough money to retire.

The UAW contracts with the Detroit Three, ratified in November after a 46-day strike, received more attention for other gains, including a total pay increase of 25% over the course of a 4½ year contract, the resumption of cost of living adjustments and a pretax, $5,000 ratification bonus for all employees, including temporary workers.

The UAW contracts at the three automakers all included a significant boost in the automatic employer contribution to 401(k) plans — with no required employee contribution — for eligible UAW members who are not covered by pensions. The Detroit Three employers will contribute 10% of base pay for these eligible hourly workers. That's up from 6.4% for those hired after the fall of 2007.

How annuities popped up in UAW contract negotiations

But the annuity part of the package shouldn't be ignored. Many UAW-represented autoworkers will consider whether to retire in 2024 and future years, thanks to big incentives that are part of the contract. Some will want to study how to essentially create a "personal pension" check of sorts out of 401(k) money.

Kelli Hueler is CEO and founder of Income Solutions, the annuity purchase program of Hueler Investment Services based in Edina, Minnesota, outside of Minneapolis. The online platform allows plan participants to browse annuity products, compare payouts offered by select insurance providers and research how an annuity might fit their needs.

Hueler was brought to the table by General Motors during contract negotiations to help address alternative options for the UAW's pension demands, she said. The goal was to provide a solution acceptable to all parties regarding access to lifetime income annuities.

"This was a real sticking point that needed a resolution," Hueler told the Free Press in a phone interview. "It was important to see that there is a program that all parties could get around."

Income Solutions had worked with GM for several years offering services to salaried employees. Hueler noted it also has relationships at Boeing, IBM and other big employers. Income Solutions doesn't manage money or sell annuities.

Instead, Income Solutions is an independent lifetime income marketplace with tools that allow individuals to examine how they can use their 401(k) or other savings to create steady income in the future. The site enables plan participants to compare low-cost, competitively bid lifetime income annuities from multiple insurance companies and choose the income stream best suited to their needs.

More: Social Security COLA increase in 2024 will be 3.2%. Some say it won't cover much.

More: Lower income workers face a big challenge for retirement. What's keeping them from saving

What's happening at Stellantis

In September, Income Solutions announced that Stellantis would offer its U.S. salaried employees and retirees access to Hueler’s "Think Income" program, which allows participants to transfer a lump sum into an annuity to create a stream of income.

Stellantis added the voluntary benefit for all UAW members as part of the 2023 contract. The UAW contract highlights online stated: "In-progression members will be given the opportunity to purchase an annuity at a discounted rate with funds from their 401(k)." In addition, Stellantis noted that all eligible individuals can use other money, including awards or bonuses, to purchase an income stream at a discount.

Income Solutions is available to all current and former employees, retirees and alumni, who participate in an FCA-sponsored benefit plan, according to Jodi Tinson, a spokesperson for Stellantis.

What retirement savers need to know

It's not a one-size-fits-all or all-or-nothing approach. Some money can stay in the 401(k) and some can be put in an annuity, based on what the employee wants.

Even so, putting $100,000 or $150,000 or more into an annuity to get a set amount of money each month might not be a strategy that some embrace. After all, many who play the lottery and win huge prizes, such as a Mega Millions jackpot, opt for the lump sum, not a 30-year payout even though they might face less risk taking smaller amounts of cash over time.

Yet, a 401(k) plan isn't a lottery jackpot. It's savings that has built up over years. You don't want to spend it all in a few years when you could need to cover expenses over 25 years or more of retirement. MetLife research indicated that one of three retirees who took a lump sum from their defined contribution or pension plan had depleted it in an average of five years.

Overall U.S. annuity sales hit a record of nearly $313 billion in 2022, fueled by anxiety about the stock market and U.S. economy, according to an estimate by LIMRA, an insurance industry group. The group forecasts total annuity sales of more than $350 billion in 2023. Investors have tried to lock in favorable payouts at a time of higher interest rates.

Hueler noted that people who have a balance in a 401(k) plan over time know how to save but they're often worried about outliving their retirement savings. Many worry about what happens to their money — and their standard of living in retirement — when the stock market tumbles.

"People don't even know they want an annuity because they're worried about their current salary and benefits," she said.

But when someone is nearing retirement and preparing for living without their regular paycheck, she said, the concept of outliving your resources becomes a greater concern.

How Income Solutions works

Hueler said the Income Solutions platform gives savers an "apples to apples" comparison of real-time quotes for annuity products offered by various insurance companies. Savers can set aside as little as $10,000 into an annuity product, so unlike a lottery payout, they don't have to make an "all-or-nothing" decision about their nest egg.

The application process includes reviewing how much money is suitable for an individual to set aside in an annuity, given the amount of their retirement savings and other assets. If someone has $50,000 in available liquid assets, for example, she said, the most they would typically be allowed to put into an annuity is 50% or $25,000.

Savers can choose to annuitize any portion of their retirement savings or other assets.

Annuity options can cover a single lifetime to help protect against the risk of outliving your savings. Or you can select other options, such as one that provides monthly payments to cover a single lifetime but, in case of death, also provide monthly payments to a designated beneficiary over a fixed period. Annuities can be structured to provide continued income or a survivor death benefit.

The site offers definitions and explanations of the types of annuities offered. Insurance companies participating are Nationwide, Mutual of Omaha, Lincoln Financial Group, Symetra, Integrity Companies, and Securian Financial.

Hueler's team gave me a glimpse of how the site works, showing how one can use a toolbar to determine what kind of monthly payouts several insurers might offer for converting $100,000 in retirement savings into an annuity. The tool lets you play around with different examples based on age and dollar amounts you'd like to convert. Income Solutions also provides a staff, not sales representatives, to answer questions.

Employers also provide some information in advance about the program.

The amount of income that a retiree would see each month would vary, based on several factors including age, how much savings is used to buy the annuity, the insurance company, and the interest rates at the time the annuity was bought.

Setting $100,000 aside in a single income annuity at age 65, for example, could generate more than $650 a month in income based on the examples via the Income Solutions tool that I saw in early January.

In many cases, the monthly payment will stay the same and not adjust for inflation. Some insurers offer an option in which payments increase by a set percentage, such as 1%, each year, for a set time.

Annuities offered through the Income Solutions platform associated with employers and fee-only advisers carry a one-time, upfront 1% transaction fee. The one-time fee is 2% when consumers buy annuities directly at the Hueler public site. All fees are disclosed. By contrast, many annuities offered elsewhere could have commissions of 3% to 5% and contain other fees or charges as well.

Hueler said many people who are nearing retirement could want to evaluate how much their personal savings might cover over their lifetime.

Annuities are part of the retirement conversation

Spencer Look, associate director of retirement studies at the Morningstar Center for Retirement & Policy Studies in Chicago, said he's not surprised that the latest UAW contract with the Detroit Three addresses how annuities could be offered to hourly autoworkers to address retirement concerns.

"Annuities within 401(k) plans, defined confined contribution plans, have long been touted as a substitute for pensions that have been declining in popularity and availability for many years now," Look said.

Fewer people can depend on a steady retirement check each month. And many worry that they're going to run through their traditional 401(k) money, as they try to pay their bills and cover the taxes owed on those withdrawals. They collect Social Security benefits but that won't cover most expenses in retirement for many families.

Having an employer select an annuity option or even a tool outside of a plan can be a "pretty big benefit for plan participants" Look said. The participant then doesn't have to face an overwhelming number and different types of annuity options in the retail market.

Many 401(k) plans aren't jumping on board to provide an annuity inside the plan but the interest is building, particularly among large companies.

Fidelity Investments just started offering an in-plan annuity option in late 2023.

"We are offering this due to the demand for the product expressed by plan sponsors and participants, who are looking for more guarantees for their income in retirement," said Kristen Andrews, a spokesperson for Fidelity.

Two years ago, the SECURE Act — or the Setting Every Community Up for Retirement Enhancement — made it possible for more workers to see their 401(k) plans add annuity options as part of the investment mix in their 401(k) plans.

The law, signed by then-President Donald Trump in December 2019, included providing a safe harbor for 401(k) plan sponsors to add an annuity option to the plan. The provision lessens the liability of a plan fiduciary when selecting an insurance company to provide an annuity in a 401(k) plan. A number of steps must still be followed to vet the insurance company and the annuity option.

What's happening at GM, Ford

At GM, the Income Solutions annuity platform will be available to UAW-represented workers no later than Feb. 1, according to Jack Crawley, a spokesperson for GM.

UAW-represented employees at GM would have the option to invest in an annuity through Income Solutions. "Through this benefit, employees will receive a 50% discount on fees associated with the annuity options," Crawley said.

Crawley said the annuity benefit will be available for all permanent employees, including those covered by a pension plan. He noted nonrepresented GM employees already have this identical benefit available.

He declined to provide any details around the bargaining process involving annuities.

"GM’s goal in negotiations was to reach an agreement that rewards our employees and allows us to be successful into the future. We are pleased to offer additional savings benefits for our employees," he said.

"We feel this gives employees a more holistic set of options to consider for retirement savings," Crawley said.

"Our employees told us one of the things they value is income security in retirement, and we developed a creative solution by offering a suite of annuity options, which are insurance products that each individual can tailor to his or her specific needs," he added.

More: UAW wants pensions restored as members worry if 401(k) will be enough to retire

More: UAW strike hits at wrong time for many pocketbooks, driving some to take out strike loans

As part of the UAW agreement at Ford, the UAW highlighter notes that negotiators "bargained an option that allows the conversion of your TESPHE (401k) account to an annuity upon retirement."

The UAW noted: "Annuities are contracts made with an insurance company that provide a fixed income stream used for retirement. It can also provide tax deferral and protection against market volatility that can be beneficial in retirement. Implementation will happen as soon as administratively feasible."

Ford workers represented by the UAW would be able to convert part or all of their account balance to an annuity when they begin taking distributions from the plan.

Kevin Legel, Ford vice president of U.S. labor affairs, noted in a letter as part of the agreement that "the range of options to provide annuities is a complex and developing area. The parties agree that providing such an option for employees could be beneficial under the right circumstances."

More research would follow. He stated that an annuity option that is mutually agreed upon would be implemented "as soon as administratively feasible."

A Ford spokesperson said in late December that the review is ongoing, and no details are available yet.

Some UAW members also will be looking at $50,000 buyouts

Deciding when to retire is always a key part of the puzzle. Eligible UAW-represented autoworkers will be tempted to grab a $50,000 pretax lump sum payment as a retirement incentive offered in 2024 and in other years at some companies.

Stellantis has a $50,000 retirement incentive for eligible production and skilled trade UAW members who retire in 2024 and will offer the incentive again to eligible employees who retire in 2026.

Ford has agreed to a special retirement incentive of $50,000 for eligible production and skilled trade UAW members who retire in 2024.

The UAW-General Motors agreement includes the promise of three "Special Attrition Programs" from January through the life of the agreement. A $50,000 lump-sum, pretax retirement incentive will be offered to "traditional employees who meet the normal or early retirement eligibility requirements," according to the UAW highlights of the GM agreement. GM and the UAW "will agree on timing, size, and scope of the offering."

This year is likely to be a crucial for many when it comes to making big retirement decisions. Running the math and reviewing possible options will need to be part of the process.

It's one thing to work hard for decades to try to build a decent retirement nest egg by saving money, investing it wisely, and fighting the urge to give up entirely when the stock market goes against you.

Once you stop getting a paycheck, though, it's quite another challenge to develop a plan to pay your bills over potentially decades in retirement.

Contact personal finance columnist Susan Tompor: stompor@freepress.com. Follow her on X (Twitter) @tompor.

This article originally appeared on Detroit Free Press: Detroit Three's UAW members facing buyouts could hear about annuities