U.S. student loan system will lead to 'inevitable cancellation,' expert argues

Income-based repayment (IBR) plans are sometimes touted as the best alternative to student loan forgiveness, potentially helping reduce the debt burdens held by millions of American student borrowers.

Read more: Options for repaying student loans

A recent paper from the National Bureau of Economic Research (NBER) suggested that expanding existing IBR plans and making them more generous could be more effective at providing relief than forgiveness, particularly for middle- and lower-income borrowers.

But IBR plans, which are tied to borrowers’ incomes, “underestimate the crisis of non-repayment,” Marshall Steinbaum of the Jain Family Institute wrote in a recent report. Optimism that IBR plans will fix the student debt crisis, Steinbaum argued, rests “on the false assumption that entrance into the labor market allows borrowers to achieve solvency.”

At the end of the day, according to Steinbaum, there will have to be “inevitable cancellation because the debt won’t be paid back.”

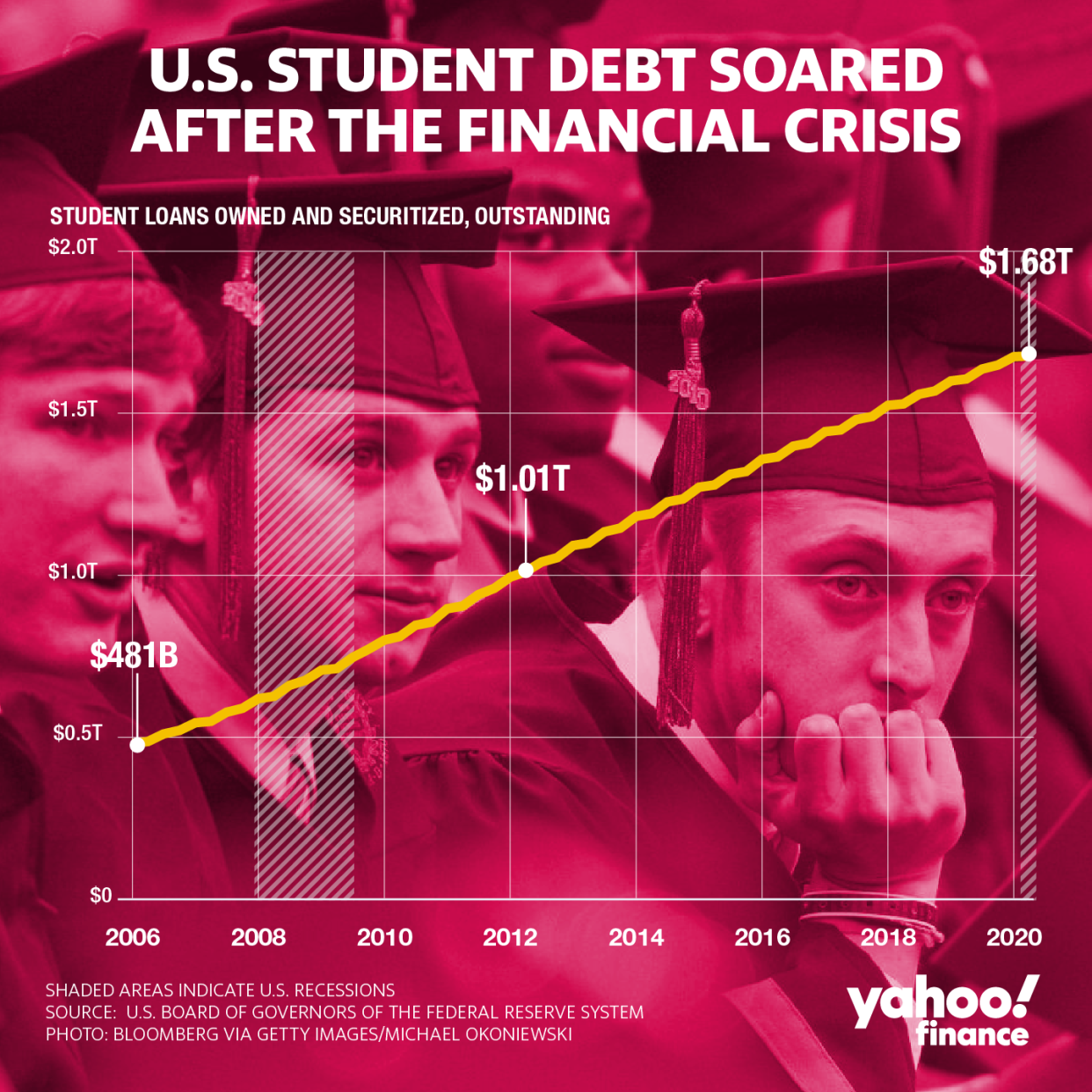

A recent Wall Street Journal article corroborates that argument: The Education Department expected an eye-popping $435 billion loss on the $1.37 trillion in government-held student loans as of January 2020, according to a government analysis obtained by the Wall Street Journal.

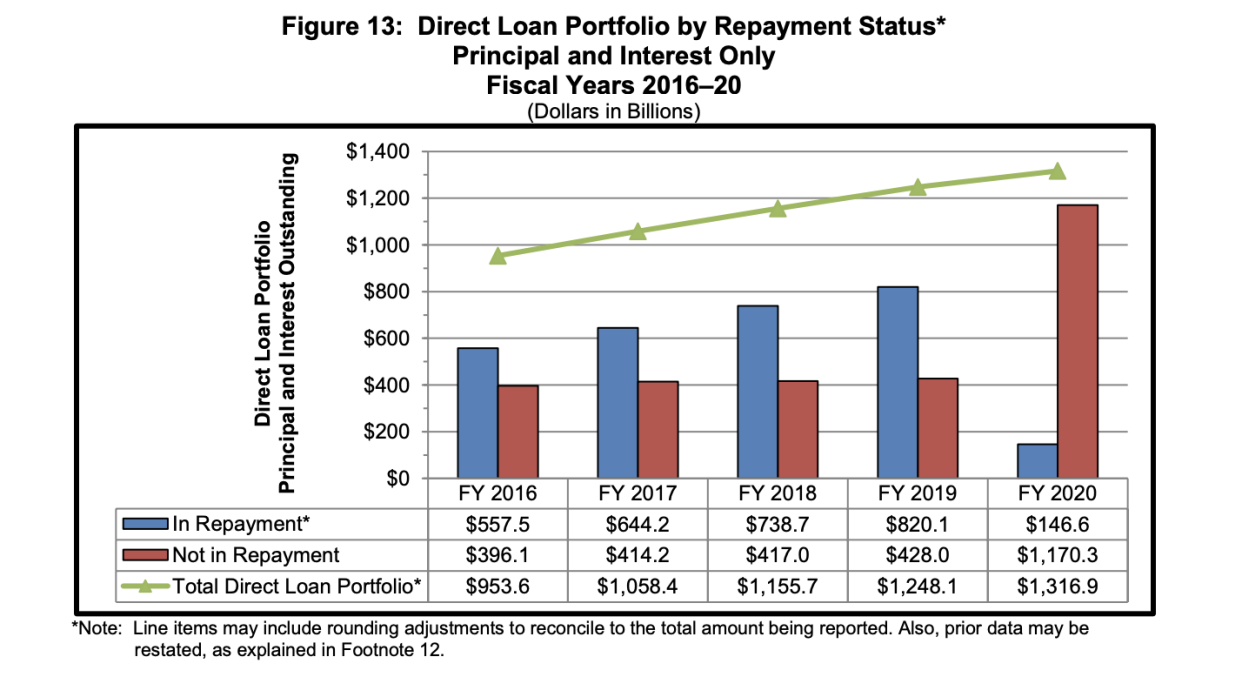

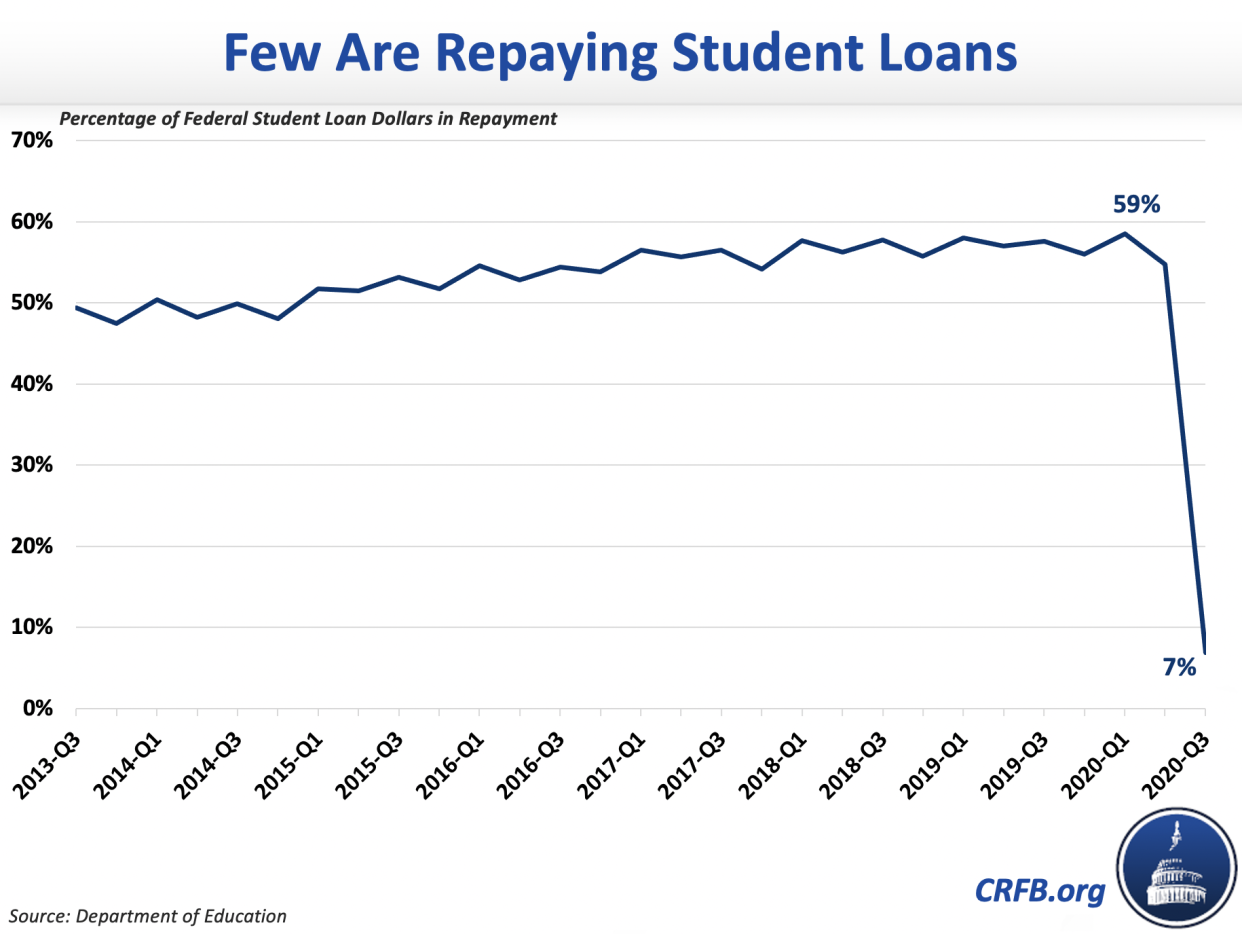

And according to the latest annual report from Federal Student Aid, which handles the trillion-dollar student loan portfolio, the balance of loans in repayment status had been growing between 2016 and 2019 before the coronavirus pandemic in 2020 led to a pause on federally-backed loans.

The pause, which began in March and was recently extended, means that borrowers haven’t been seeing interest on their loans accrue — and they haven’t been required to pay back any debt.

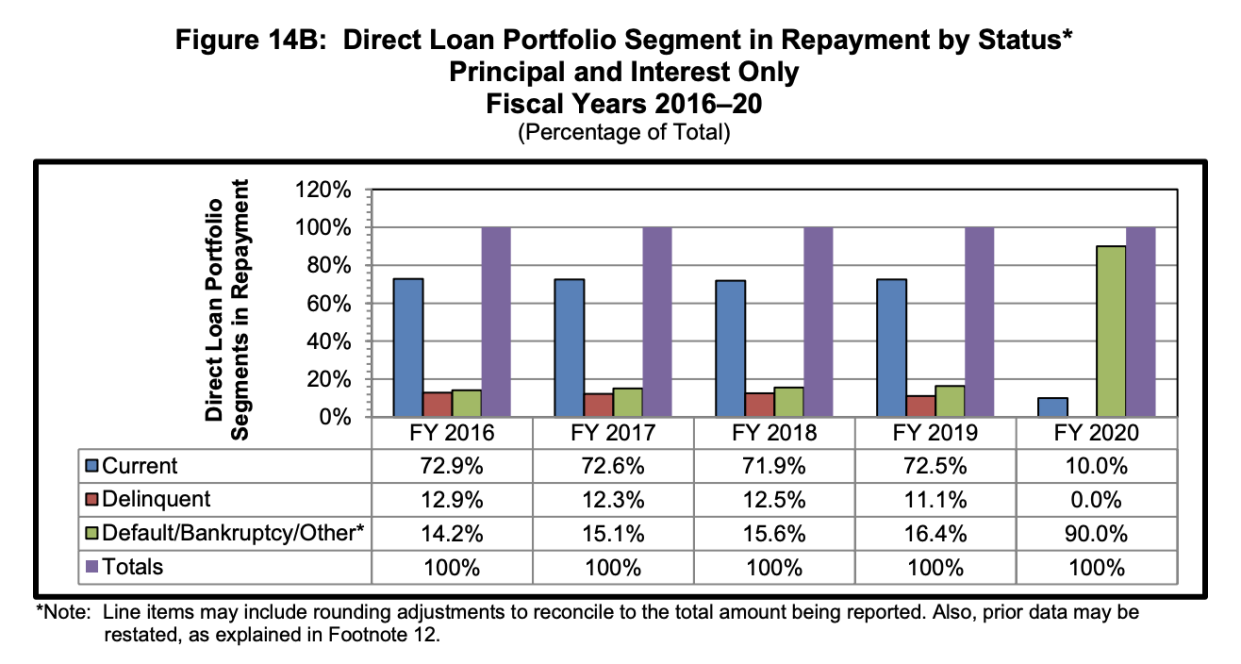

Digging even deeper into the data, the vast majority of student loans — roughly 90% or $1.18 trillion — are currently in “default/bankruptcy/other status” amid the federal pause.

And it’s unclear how FSA will get these borrowers back on track for repayment when the payment pause expires on January 31, 2021.

Already, lawmakers have called for a further extension of that relief.

“There are hard months ahead, and I’ll keep fighting to give student loan borrowers the peace of mind they need to breathe easier,” Senator Patty Murray (D-WA) said in a statement last week.

Who is on income-driven a repayment plans?

The IBR program, also known as income-driven repayment, were created under the Bush administration, to help borrowers repay their student loan debt. The Obama administration expanded the program.

Payments were capped at 10-15% of borrowers’ income per month. After making regular payments for 20 to 25 years, the program promised, a borrowers’ debt would be discharged.

Roughly 7 million borrowers are taking advantage of these programs to pay off about half of the $989 billion in outstanding federal student loans, the Government Accountability Office (GAO) reported in March 2020.

An earlier report from the Congressional Budget Office (CBO) also noted that based on a breakdown of 2017 stats, roughly three-fifths of the debt being repaid on IBR programs were incurred by graduate students (who generally hold more debt).

And while income-based repayment plans have been proposed as a way to help borrowers out of their student debt, two experts said that the plan is not likely to work unless big reform was forthcoming.

IBR plans were “designed to address a liquidity crunch: Since students are graduating with more debt, they may not earn enough immediately upon entering the workforce to pay it down,” Steinbaum explained, adding that the government wanted to ease those with high levels of student loan debt into repayment.

Steinbaum acknowledged that these programs had in the beginning prevented delinquency and default. But they “will never be successful as a solution to the student debt crisis,” he stressed, “because they’re designed to address a liquidity problem rather than the real problem — solvency.”

The underlying problem, according to Steinbaum, is the cost of higher education and income inequality.

The Trump-era Education Department (ED), meanwhile, has asserted that the IBR program was working well.

“We've recognized that there is an increased reliance on income driven repayment, income driven repayment is there to help borrowers manage their repayment obligation,” Diane Jones, principal deputy undersecretary at the U.S. Department of Education, said recently.

However, indicating some inefficiencies in the program, Jones noted that “it turns out that the department was not confirming the income or family size” so “there were borrowers in income driven repayment that perhaps shouldn't have been there or that perhaps we're paying a lower payment than their salary would have otherwise required them to pay.”

‘Isn’t being repaid and isn’t going to be repaid’

Another issue related to IBR programs is that the income-contingent payments often don’t keep up with the exorbitant interest rates on student loans, Steinbaum’s data revealed.

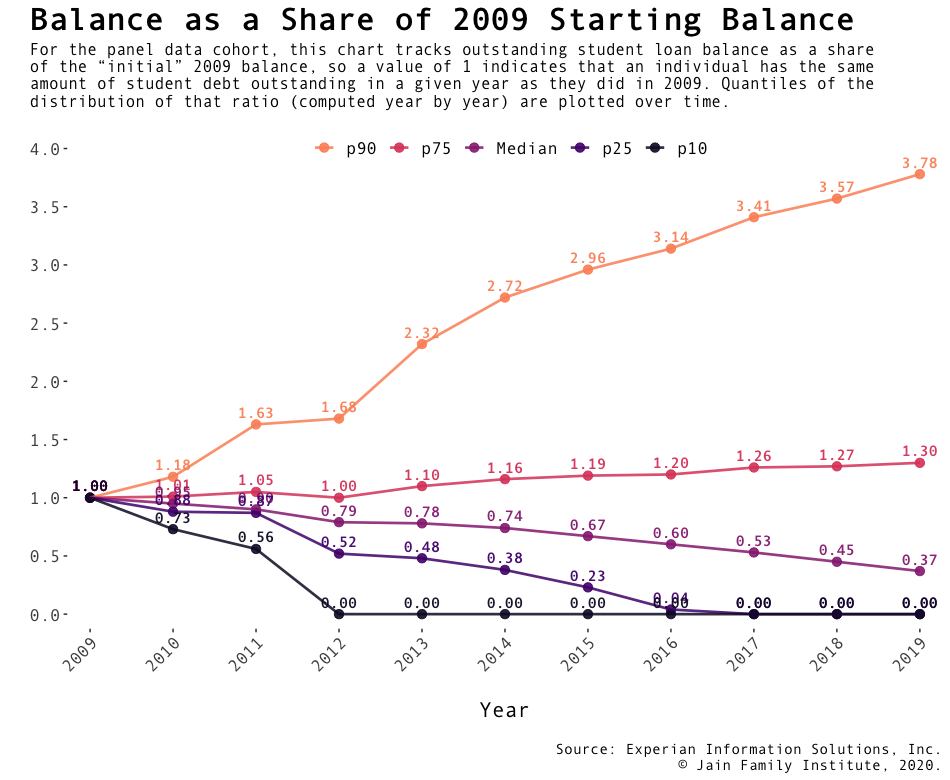

Using demographic and economic data from the American Community Survey, Steinbaum found that even after a decade of repaying their student loans, the median student loan borrower had only paid off 63% of their loan balance (purple line).

“That means that over 50% of the borrowers with outstanding debt in 2009 hadn’t fully paid back their student loans 10 years later,” Steinbaum explained.

The WSJ report found that consultants employed by ED realized that IBR plans were a key source of the estimated $435 billion loss that the government would eventually eat: “Borrowers in income-driven repayment will repay, on average, 51% of their balances, while borrowers in other plans will repay 80%, the Education Department’s analysis shows.”

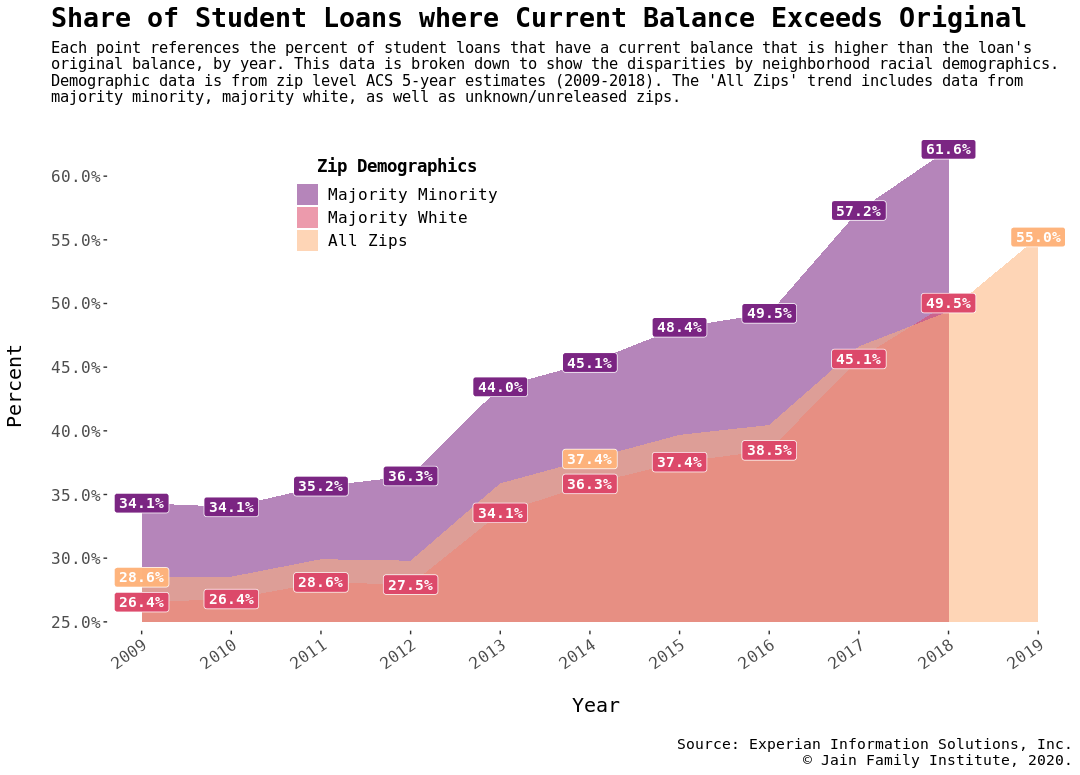

Looking deeper into zip codes, Steinbaum found a major disparity between races: While more neighborhoods which host mostly minorities have had access to higher education because of student loans, their share of debt has been steadily rising.

The racial disparity in the student loan system has been documented previously. A September 2019 report that followed college students starting college in 1995-1996 found that 20 years later, the median white student had managed to pay off 94% of their debt while their Black counterpart still had 95% of their debt.

Ultimately, the data point to the fact that “we already have a great deal of student debt outstanding that isn’t being repaid and isn’t going to be repaid,” Steinbaum wrote in his recent report.

—

Aarthi is a reporter for Yahoo Finance. She can be reached at aarthi@yahoofinance.com. Follow her on Twitter @aarthiswami.

Read more:

Student loan forgiveness 'doesn't solve the crisis long term,' expert explains

Election 2020 'has enormous implications for student loan debt'

Student debt cancellation already in focus amid President-elect Biden transition

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.