Twitter 'has never been more relevant,' chairman says amid Musk drama

Twitter Chairman Bret Taylor thinks the company's deal with Elon Musk will get done, in part because of the platform's relevancy — in addition to the binding agreement Musk signed.

"Twitter, as a platform, has never been more relevant," Taylor, who is also Salesforce's co-CEO, recently said on Yahoo Finance Presents (video above). "And it's a privilege to be a part of such an important platform. And as you said, it's a very unusual situation. I can't say much beyond what we said in the proxy, but we're obviously committed to closing the transaction."

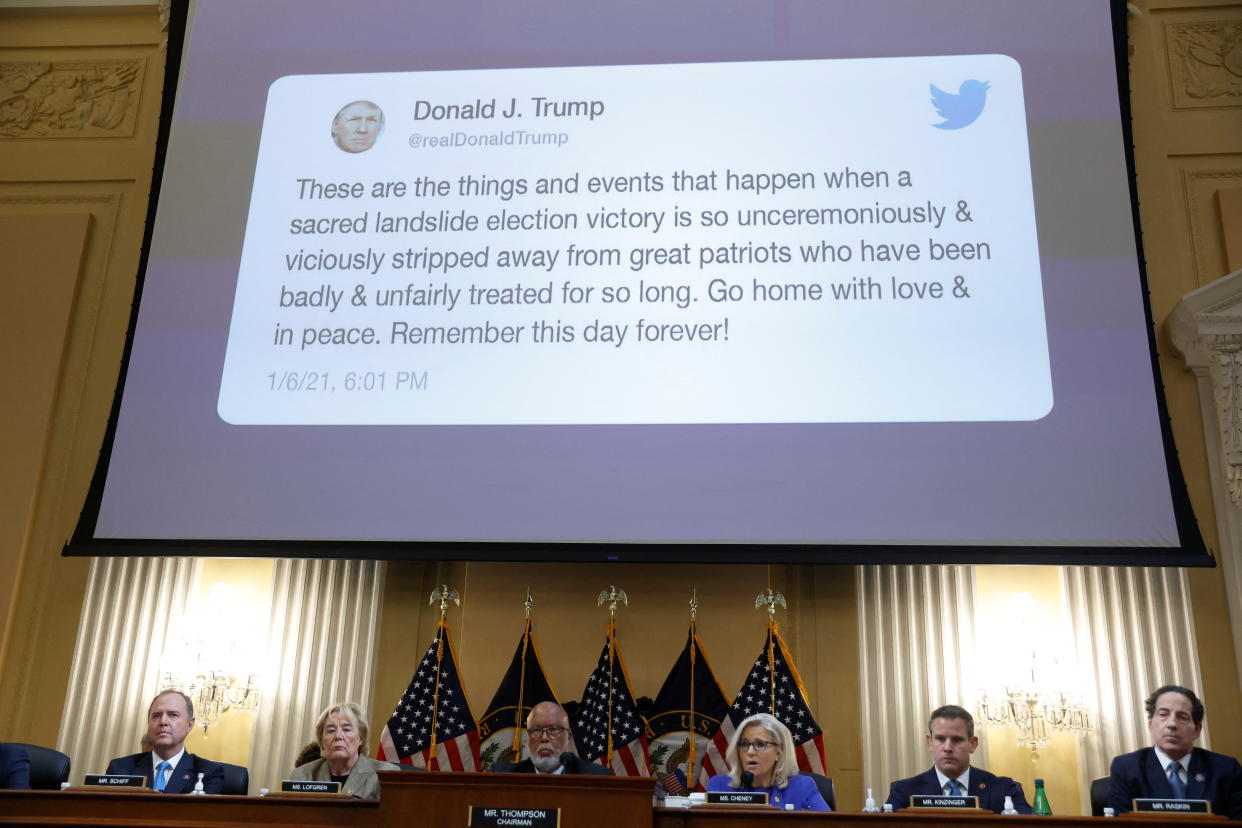

The social media veteran also said that he "just watched my Golden State Warriors win the NBA championship — Twitter was my second screen throughout the entire championship. You look at what's going on in politics, the United States right now, and how much of it's happening on the platform."

Since revealing his stake in Twitter several months ago, Musk has behaved in typically erratic fashion. The world's richest person first disclosed himself as a passive investor before pivoting to become an active one. He initially agreed to be on the board but changed his mind on that front, too.

And after signing a binding agreement to buy Twitter for $44 billion or $54.20 a share on April 25, the CEO has repeatedly shown signs he's having second thoughts. Twitter, meanwhile, recently stated in a SEC filing that its board of directors advised its shareholders to approve Musk's $44 billion deal. No date for the shareholder vote has been set.

Musk has repeatedly pushed Twitter to disclose the number or fake accounts on the platform. Twitter provided Musk with a "fire-hose" of data to help understand the fake account issue, but Musk's team reportedly were unable to verify the data.

Twitter shares currently trade at $38.79 as of Thursday's close — well below Musk's offer price. Musk would be forced to pay a $1 billion fee should be walk away from the transaction.

"With a $54.20 bid looming and Twitter's stock currently at ~$39, the stock and Street are clearly highly skeptical of a deal happening at the current bid," Wedbush analyst Dan Ives wrote in a note to clients this week. "We believe the chances of a deal ultimately happening are currently at ~60% with a renegotiated bid at a lower price likely in the $42-$45 range due to the fake account issue. There is still a ~35% chance Musk decides to walk away from the deal, try to pay the $1 billion breakup fee, and likely end up in a nasty court battle with Twitter's Board for the coming months."

Brian Sozzi is an editor-at-large and anchor at Yahoo Finance. Follow Sozzi on Twitter @BrianSozzi and on LinkedIn.

Click here for the latest trending stock tickers of the Yahoo Finance platform

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube