'Trash' stocks are up. They might end up in the dumpster: Morning Brief

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Thursday, February 23, 2023

Today's newsletter is by Julie Hyman, anchor and correspondent at Yahoo Finance. Follow Julie on Twitter @juleshyman. Read this and more market news on the go with the Yahoo Finance App.

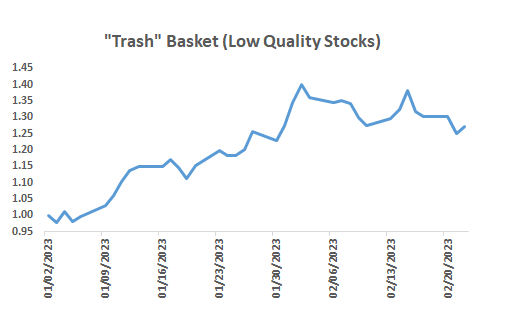

It's been a roller coaster ride for the meme-stock darlings. Or as some might say, the "trash" trade.

Last year's interest rate hawkishness sent AMC stock and other risky assets plunging, until hopes for a dovish Federal Reserve buoyed it and other risk assets in 2023.

Even after shifting sentiment more recently spurred bets that the Fed will raise rates more than expected, AMC kept going. The shares have risen nearly 40% in the past week alone, compared with a 3% drop in the S&P 500. (They also held gains after Wednesday’s Fed minutes release, which seemed to confirm the view that the Fed could raise rates through July).

AMC isn’t alone. One of the other dogs of 2022, Carvana, has more than doubled this year. Coinbase has bounced by about 70%. Ditto Peloton. A Goldman Sachs index of retail favorites has risen by a more-muted 11% year-to-date, but that trounces the S&P 500’s 4% return.

“Trash” stock gains have been fueled by a number of factors this year, RBC’s Amy Wu Silverman told Yahoo Finance Live, including:

Investors who sold stocks for so-called “tax-loss harvesting” (i.e. selling at a loss for tax purposes), and then repurchased them this year;

Momentum shifted;

Retail call option buying picked up in some of the pandemic favorite names.

What are “trash,” or low-quality stocks, in RBC’s view? The main criteria:

free cash flow negative now and over the past year

have net losses

carry net debt.

The firm’s basket includes names like QuantumScape, Rivian, C3.ai, Spirit Aerosystems and Draftkings.

“All these names that I think everyone became quite familiar with in 2020, when stimulus checks went out, those were the losers of 2022, but they have really rallied sharply in 2023,” Wu Silverman said. “But you know the fundamentals haven’t changed. These are still low-quality names facing what is a pretty abrasive environment.”

That “abrasive” environment is one in which rates are rising and the economy may be slowing, which tends to disadvantage growth names.

The resurrection of meme stocks has coincided with retail investor money pouring into the market. According to Vanda Research, average daily inflows into U.S. stocks from retail investors reached a record $1.5 trillion a day in January.

Vanda defines retail investors “as all the investors that use the classic major retail brokerage accounts to execute their investments,” the firm said in a tweet.

Of course, meme stocks didn’t account for all, or even most, of these moves. As my colleague Jared Blikre wrote yesterday, large-cap growth names have been leading the way higher this year – perhaps another negative portent for the rally.

What to Watch Today

Economy

8:30 a.m. ET: Chicago Fed National Activity Index, January (-0.49 during prior month)

8:30 a.m. ET: GDP Annualized, quarter-over-quarter, 4Q Second Estimate (2.9% expected, 2.9% prior)

8:30 a.m. ET: Personal Consumption, quarter-over-quarter, 4Q Second Estimate (2.0% expected, 2.1% prior)

8:30 a.m. ET: GDP Price Index, quarter-over-quarter, 4Q Second Estimate (3.5% expected, 3.5% prior)

8:30 a.m. ET: Core PCE, quarter-over-quarter, 4Q Second Estimate (3.9% expected, 3.9% prior)

8:30 a.m. ET: Initial Jobless Claims, week ended Feb. 18 (220,000 expected, 194,000 during prior week)

8:30 a.m. ET: Continuing Claims, week ended Feb. 11 (1.696 million during prior week)

11:00 a.m. ET: Kansas City Fed Manufacturing Activity, February (-2 expected, -1 during the prior month)

Earnings

Alibaba Group Holding (BABA), Autodesk (ADSK), Beyond Meat (BYND), Block (SQ), Booking Holdings (BKNG), Cars.com (CARS), Carvana (CVNA), CubeSmart (CUBE), Dillard's (DDS), DISH Network (DISH), Domino's Pizza (DPZ), Farfetch (FTCH), Intuit (INTU), Keurig Dr Pepper (KDP), Live Nation (LYV), Moderna (MRNA), Nikola (NKLA), Papa John's (PZZA), PG&E (PCG), Planet Fitness (PLNT), Steven Madden (SHOO), Warner Bros. Discovery (WBD), Wayfair (W), YETI Holdings (YETI)

—

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube