Too many people are still quitting their jobs for the Fed's liking: Morning Brief

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Wednesday, August 31, 2022

Today's newsletter is by Myles Udland, senior markets editor at Yahoo Finance. Follow him on Twitter @MylesUdland and on LinkedIn.

Back in 2013, current Treasury Secretary Janet Yellen, then Vice Chair on the Federal Reserve's Board of Governors, flagged a relatively new and still-overlooked job market indicator: quits.

Speaking before the NABE conference in Washington, D.C., Yellen said (emphasis ours):

In addition, I am likely to supplement the data on employment and unemployment with measures of gross job flows, such as job loss and hiring, which describe the underlying dynamics of the labor market. For instance, layoffs and discharges as a share of total employment have already returned to their pre-recession level, while the hiring rate remains depressed. Therefore, going forward, I would look for an increase in the rate of hiring. Similarly, a pickup in the quit rate, which also remains at a low level, would signal that workers perceive that their chances to be rehired are good — in other words, that labor demand has strengthened.

At the time, Yellen's comments were closely followed as investors scoured the ranks of Fed officials and other economics luminaries in search of Ben Bernanke's replacement as Federal Reserve Chair.

When Yellen emerged as the favorite to replace Bernanke in late summer 2013, that speech became the calling card for what has now been a nearly decade-long focus from investors on the monthly Job Openings and Labor Turnover Survey (JOLTS). In October, Yellen was nominated for the role by President Obama and confirmed by the Senate the next year.

The JOLTS report is a relative newcomer on the economic data scene, tracking data back to December 2000. And because of the focus Yellen and other policymakers have brought to this report, JOLTS data has become a key part of tracking the labor market's health in real time.

On Tuesday, the JOLTS report for July showed an unexpected uptick in the number of open jobs in the economy, pointing to continued resiliency in the U.S. labor market as demand for workers remains steady.

As Richmond Fed President Thomas Barkin told Yahoo Finance in an interview on Tuesday, this data shows why the current economic conversation is no longer as focused on recession as it was earlier this summer.

"The job market is still very tight," Barkin said.

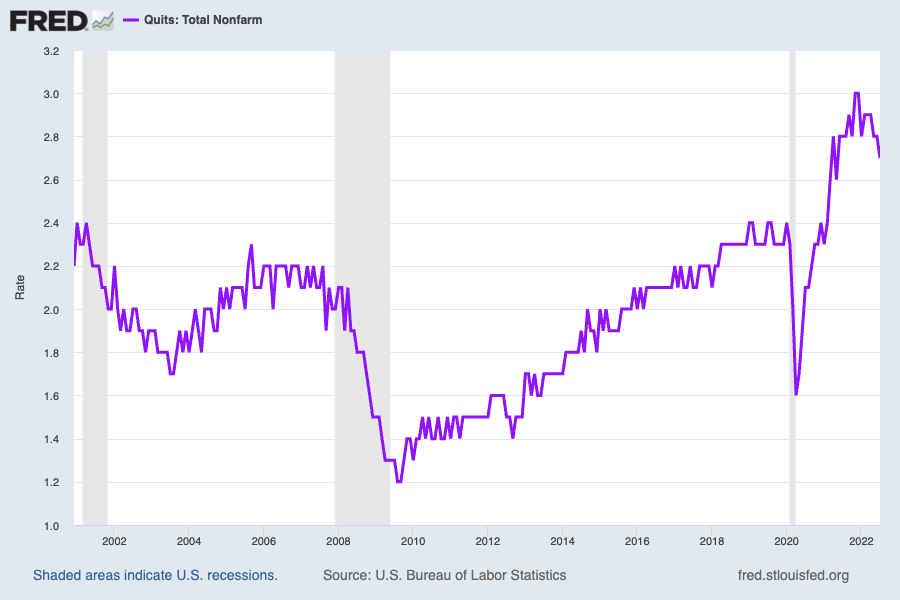

The latest JOLTS data did show, however, a moderation in the amount of quitting American workers have been doing in recent months. While trend stories continue to pop up about the semi-mythical trend of "quiet quitting," data shows actual quits are leveling out.

In July, some 2.7% of the U.S. workforce quit their job, down from 2.8% in June and a record 3% seen in November and December 2021.

"The quit rate fell to a 14-month low, which should help restrain wage pressures as businesses feel less threat that current employees will depart," economists at Wells Fargo led by Sarah House wrote in a note on Tuesday, "but is unlikely to completely quell the inflationary pressures stemming from the labor market."

Overall, quits remain near record highs.

In early 2016, a pop in the quits rate to 2.4% in December 2015 served as occasion for the business media to write about how many workers were fleeing their jobs.

And while the conversation in markets and the economy is almost always about the rate of change and not the absolute level of any data series, the current labor market is still historically dynamic.

"Today's report confirms it will take time and a weaker economy to bring labor demand and supply into better balance — a necessary step to take the heat off wage inflation," Oxford Economics Lead U.S. Economist Lydia Boussour wrote, adding that Tuesday's JOLTS data showed there are currently 2 open jobs for every 1 unemployed worker in the U.S. economy.

As Fed Chair Jerome Powell said last week: "The labor market is particularly strong, but it is clearly out of balance, with demand for workers substantially exceeding the supply of available workers."

That statement was corroborated by Tuesday's data, serving as another reminder that the Fed's resolve to continue raising rates to slow inflation and ease pressure on the economy likely won't be fully tested in the months ahead.

At least so long as this many people continue to up and leave their jobs for something better.

What to Watch Today

Economic calendar

7:00 a.m. ET: MBA Mortgage Applications, week ended August 26 (-1.2% during prior week)

8:15 a.m. ET: ADP Employment Change, August (300,000 expected)

9:45 a.m. ET: MNI Chicago PMI, August (52.5 expected, 52.1 during prior month)

Earnings

Anaplan (PLAN), Cooper (COO), DesignerBrands (DBI), Donaldson (DCI), FiveBelow (FIVE), MongoDB (MDB), Okta (OKTA), PureStorage (PSTG), Semtech (SMTC), VeevaSystems (VEEV), Vera Bradley (VRA)

Yahoo Finance Highlights

—

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube