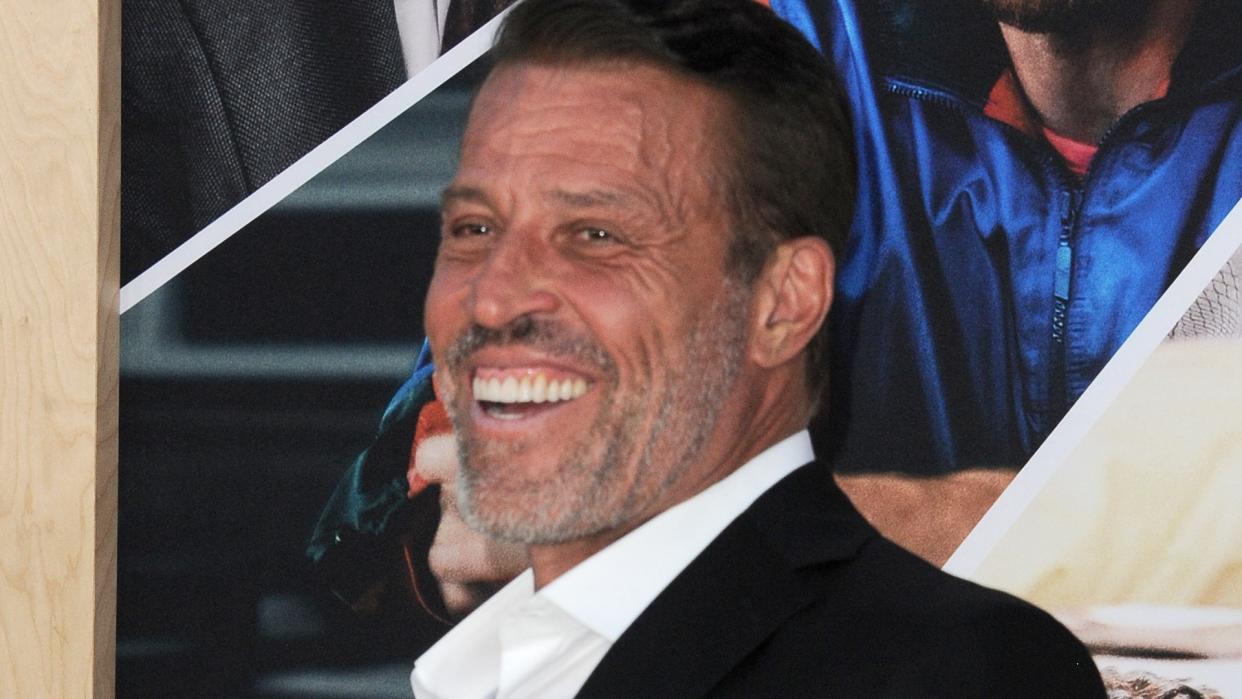

Tony Robbins: 5 Retirement Planning Tips He Swears By

Life coach and business strategist Tony Robbins is known for his high-energy self-development seminars and for helping countless people reach their personal and career goals. He started making just $40 a week as a janitor in Los Angeles, where he learned an important lesson about the value of freedom.

Check Out: Suze Orman: 5 Social Security Facts Every Soon-To-Be Retiree Must Know

Read Next: 5 Genius Things All Wealthy People Do With Their Money

“I think if you can find a place where you can do something that gives you freedom and gives you a chance to really take control of your own time, it leads toward the idea of maybe owning your own business,” Robbins told CNBC.

Today, Robbins is worth $600 million and also helps get people on track for retirement and achieve financial freedom. Here are five retirement tips he recommends.

1. Be Careful of Hidden 401(k) Fees

While many people rely on 401(k) accounts for retirement, Robbins cautions about the existence of hidden fees that can significantly impact your savings. Understanding these fees is crucial for your financial empowerment.

In a blog post on his site, he wrote, “Eight out of ten Americans don’t know the cost of their plan — and 67% believe they’re not paying anything. Nothing could be further from the truth!”

He added, “The 401(k) industry did not have to reveal how much it was charging consumers. Now that they do, thanks to new legislature around disclosure, they’ve simply created 50-page documents that are so opaque it would take a Ph.D (and a boatload of patience) to understand. Within these ‘disclosure’ agreements, there are as many as 17 different additional charges that are not outright called ‘fees.'”

2. Understand Taxes in Retirement

It’s a common misconception that social security and retirement accounts are not taxable. Many people are surprised to learn that a large portion of their nest egg can go to taxes if not planned carefully.

“While millions of Americans have a retirement account in place, the scary truth is, they have not considered the impact of taxes in retirement,” Robbins stated in a blog post. “And taxes are vital — they determine how much of your money you will actually keep.”

He added, “Your retirement tax planning must go beyond maximizing your 401(k) or IRA contributions. You need to learn about the different types of retirement savings accounts and the pros and cons of each. Don’t get to retirement only to find out that a huge chunk of your life savings will go to taxes.”

3. Accurately Calculate How Much You Need for Retirement

How much to save for retirement is one of the most common questions people have. There are so many things to consider, such as lifestyle, healthcare costs, everyday expenses, housing, long-term care and more.

“This number isn’t what you earn, it’s what you spend on a normal basis,” Robbins explained on his site. If you spend more than you make, use that number — but you need to figure out how to reverse that practice! For example, if you make $80,000 a year but live off $70,000, your number would be $70,000.”

According to Robbins, you then multiply that number by 20. “This is a rough idea of how much you’ll need to maintain your current lifestyle through retirement.”

4. Pay Down Debt Before Investing

Before investing for retirement, Robbins recommends paying down debt first.

“Are you realistic about your current financial situation?” he asked in a blog post. “Anyone can invest a percentage of their paycheck in a 401K or IRA. But if you’re wondering how to invest money to make money quickly or thinking about a higher-risk area, make sure you first pay down debt and have a good idea of your cash flow and budget.”

5. Pay Yourself First

Learn More: Here’s Exactly How Much Savings You Need To Retire in Your State

Another financial tip Robbins swears by is setting aside a small amount of your paycheck. “Track how much you earn and spend in a month, and pick a percentage of your income to set aside, ideally no less than 10%, but as high as you can go,” he wrote on his site. “Save as much as you can because that number will increase as your income grows. This amount is off the top and doesn’t factor into other spending. Other expenses, such as housing costs, utility bills and restaurant meals, come next.”

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Tony Robbins: 5 Retirement Planning Tips He Swears By