How Termina selected and ranked the 2024 Seed 100 and Seed 40 lists of the top early-stage venture capitalists

Business Insider's Seed 100 and Seed 40 lists are created based on data from Termina.

Termina began with data on over 1,800 investors, analyzing 25 success attributes, such as exits.

The analysis identifies skilled investors with a high likelihood of continued success.

The Seed 100 and Seed 40 lists are derived from a statistical analysis of investor track records. We've been working with Business Insider to publish these lists for the past four years, but this is the first year we're doing so under the Termina brand. Incubated by Tribe Capital, Termina is an AI-software platform that powers quantitative due diligence for leading investors around the world.

Our methodology is the same as it was in past years. It analyzes each investor's performance in 25 areas using Crunchbase and PitchBook data. Since one of our goals is to analyze investor's potential success rather than focus solely on past achievements, we only assess investors who have made a minimum of five investments between 2009 and 2024. Our list includes solo venture capitalists and angel investors who are assessed based on their investments in US companies.

To be named to the list, seed investors must have:

Investments that performed well, including successful IPOs or acquisitions (exits that were meaningfully above "liquidation preference" or showed increased company value rather than simply raising capital).

Show intermediate signs of future success with seed investments that consistently receive follow-on investment.

Be active in the seed-investing ecosystem, with moderate-to-high levels of activity over the past two years.

Though each criterion is weighted equally, exits (IPOs or acquisitions) statistically have the most influence in differentiating investors.

Over 1,800 investors met the above criteria, an 18% increase from last year. The seed-investor ecosystem grows every year, making the list more competitive. We're also delighted that there were 187 female candidates with sufficient data, a significant increase that allowed us to release an expanded Seed 40 list this year. Ten percent of all seed investors in scope were women, up from 8% when the first Seed 100 was released in 2021.

The final rankings had 35 new investors, 21 who improved their rank, and 39 with the same or lower rank as last year.

AI is storming seed investing and beyond

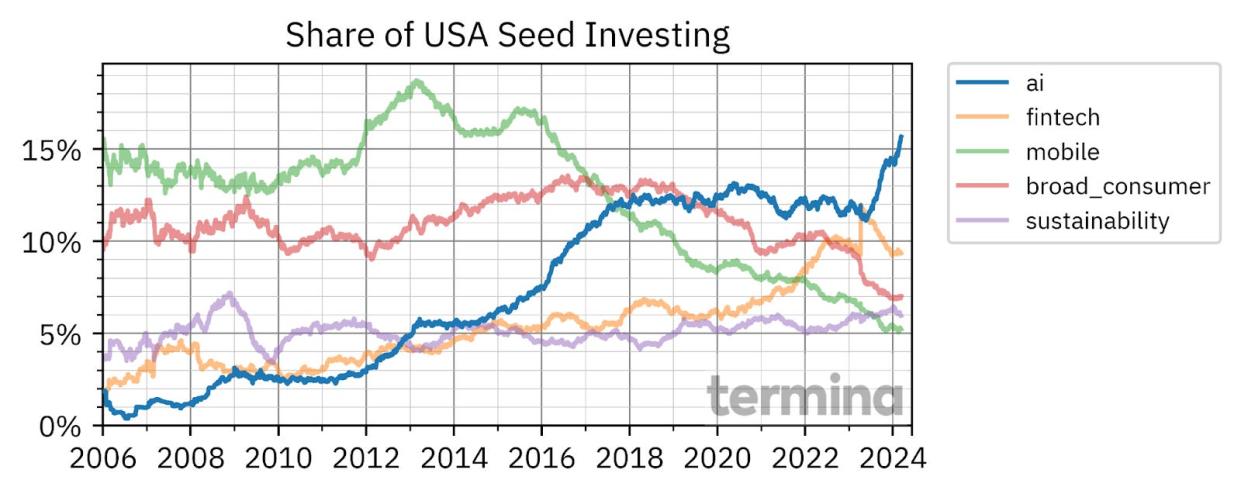

One reason we look at seed-stage investments is because they tend to be leading indicators of innovation in the coming years. OpenAI released their GPT-4 model just over a year ago. The model reached an inflection point of capability that has ignited the imagination of entrepreneurs and investors worldwide. The result in just one year is the largest-ever rebalancing of how investors allocate seed capital across sectors. In our analysis, AI tech receives over 16% of all seed-investing capital, with a significant jump in the 12 months following GPT-4's release.

In the chart below, we show five seed-investment categories to contextualize the growth of AI investment. This is not an exhaustive view of seed-investment sectors. In this view, though there has been a steady expansion of AI investing at the seed stage, the jump last year clearly stands out.

We believe AI will allow more seed-stage companies to bring products to market with less capital, similar to how cloud computing accelerated processes and reduced the capital required to launch products. If true, this will make seed-stage investing even more critical as AI begins to form the infrastructure that launches new tech products and services.

Jake Ellowitz is the chief technology officer and cofounder of Termina.

Read the original article on Business Insider