It's tax time: Here's how lower-income Worcester residents can get help

WORCESTER — With tax season here, the Worcester Free Tax Service Coalition is launching its 21st year of working to make tax credits and preparation more accessible to low-income residents.

The coalition helps guide residents through the Volunteer Income Tax Assistance (VITA) grant program, where IRS-trained volunteers prepare tax returns for households that earn less than $64,000 annually, or that qualify for the Earned Income Tax Credit.

The Worcester Community Action's Council's VITA program is open Tuesday through the April 15 tax deadline. Residents can book appointments on the Worcester Community Action's Council's website.

This year, the coalition is looking for more volunteers than ever before.

According to the coalition, it has helped return $44.5 million through its four locations through 29,000 returns filed over 21 years.

Residents can get connected with the VITA program at four locations in Worcester: The Worcester Community Action Council, 18 Chestnut St., Worcester State University, Plumley Village, 16 Laurel St. and Main South Community Development Corporation, 875 Main St.

The Worcester Community Action Council will also expand to events in Webster, Southbridge and Leicester.

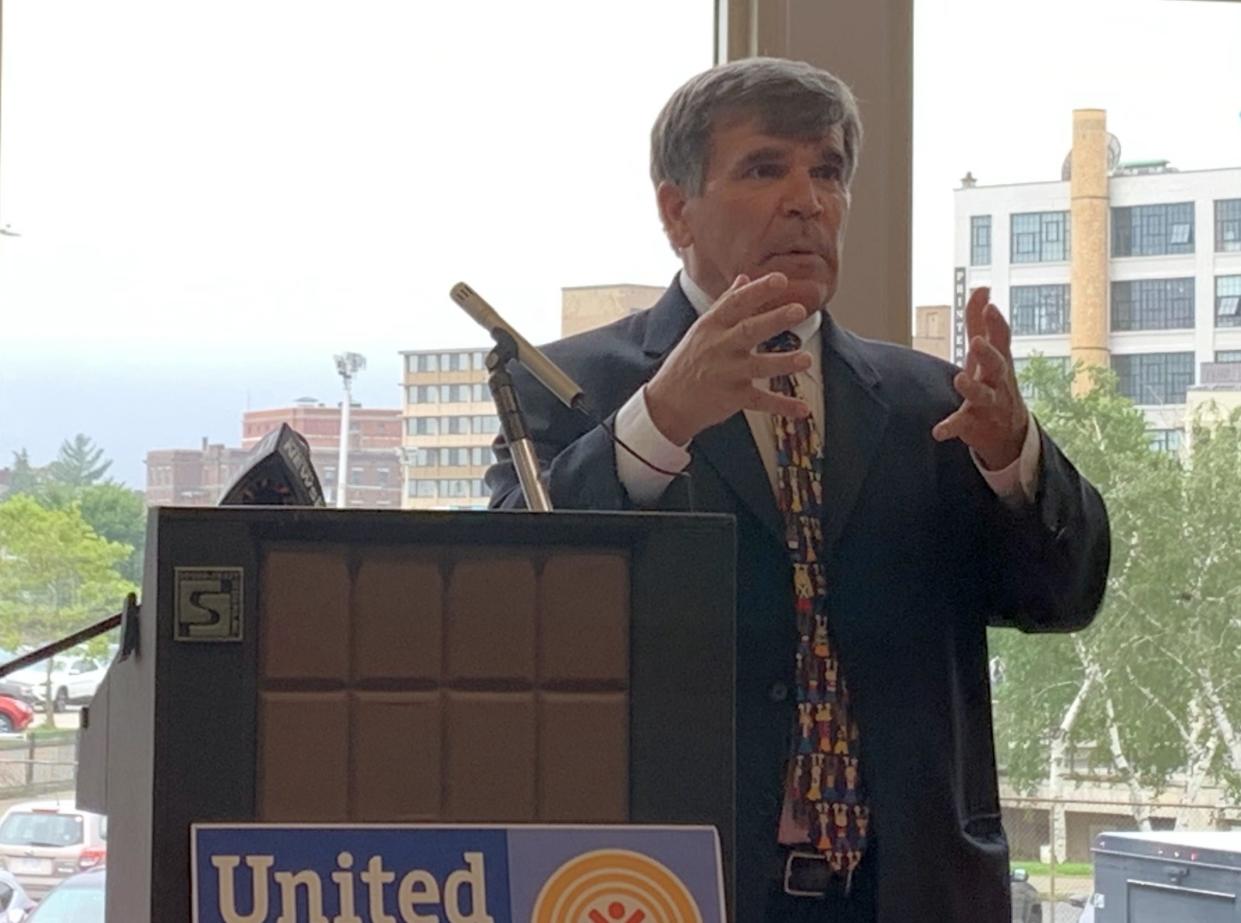

At an event at the Worcester Community Action Council, coalition members discussed the benefits of the VITA program and Earned Income Tax Credit and how they can support funding for these programs in Washington, D.C.

"It is a builder of a more quality life," said Tim Garvin, president and CEO of the United Way of Central Massachusetts.

Tania Medina, a mortgage specialist at UniBank, is a VITA volunteer. She said UniBank sees the value in helping residents with VITA and the returns can mean a lot to cash-strapped families.

"This refund will be used to help maybe pay off some debt, or maybe make a purchase they've been waiting for, an important purchase, or maybe just simply it's a way to help families to give them a little bit of breathing room on their very tight budgets," Medina said.

Garvin said coalition members can help U.S. Rep. James P. McGovern, D-Worcester, push for programs like the Earned Income Tax Credit by keeping his staff informed of all the ways they are used in Worcester.

Garvin added he likes to speak to Republicans and Democrats in Congress about funding, as he found Republicans tend to like the idea of giving tax money back and getting the government out of people's lives while Democrats like that the programs help the lowest-income taxpayers have more money.

Maydeé Morales, director of the Worcester Community Action Council's resiliency center, said the coalition assisted in over 900 tax returns to 750 households last VITA season.

"The beauty about the VITA program is that we are right here within our community in this space and people continue to come year over year," Morales said.

Those community connections have allowed residents to build trusts with VITA volunteers, Morales said. In addition, the Worcester Community Action Council plans to have people on site to connect those seeking tax returns with other benefits they can qualify for.

Garvin added that serving as a VITA volunteer can help a college student develop skills that "pop off the page" of a résumé.

This article originally appeared on Telegram & Gazette: Worcester Free Tax Service Coalition helping low-income filers