Tax incentives for mixed-use development Barisi Village are in flux. Here's why.

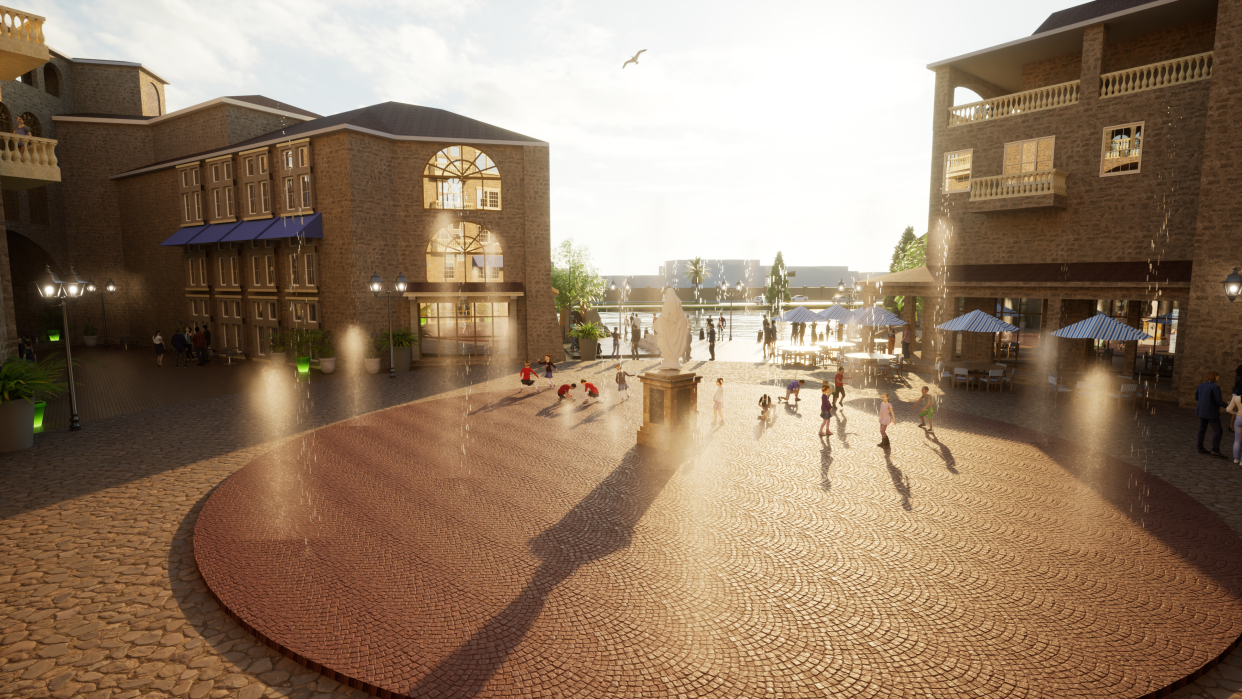

The fate of a European village-inspired development may unfold within the next three months, and may lay in the hands of Nueces County and Del Mar College officials.

Barisi Village – a mixed-use development proposed for construction on the former Pharaoh Valley golf course – is in consideration by city of Corpus Christi officials to benefit from as much as $32 million in tax abatements over a 20-year period, the funding earmarked to support certain planned features of the project.

However, making the city-crafted proposal final is contingent on agreement by Nueces County and Del Mar College officials to join in a tax increment reinvestment zone within roughly 80 days – a pitch that hasn’t yet been publicly discussed among decisionmakers.

Also known as a TIRZ, the economic development approach finances specific improvements within a prescribed “zone,” using a portion of property taxes collected within the zone. In the case of Barisi Village, eligible components include certain infrastructure work – such as streets and water improvements – along with public amenities, with parks, plazas and nature preserves in its scope.

Although it is not clear when – or if – a discussion on the project may come before the Del Mar College's Board of Regents in the near future, it’s a discussion anticipated to come before the Nueces County Commissioners Court as soon as February.

Numbers for the county’s proposed share haven’t yet been determined, said Nueces County Commissioner John Marez, adding that the county’s budget doesn’t have the same capacity as the city’s in offering tax abatements.

But he’s optimistic a deal could be struck.

The county currently garners about $3,000 in property tax revenue from the undeveloped plot, said Marez, whose precinct includes about half of the land where Barisi Village would be constructed.

That could instead grow to an estimated $15 million brought into county coffers over the next 20 years, should the project reach fruition, he said.

“The development is going to help bring revenue into the city and the county in an area that hasn’t seen any development in about two decades,” Marez said.

What is Barisi Village?

Barisi Village would vastly change the profile of the 127-acre defunct golf course, with records showing early plans of building about 2,000 dwellings – including about 60 single-family lots and 1,300 multifamily units – as well as commercial space that could house a combination of retail, offices and a hotel.

Public assets that would be eligible for reimbursement under the preliminary proposal would include plazas, a bell tower, sport courts and a nature preserve, according to city documents.

Plans have also listed walking paths, sport courts and waterside boardwalks among areas open to the public.

Records show certain infrastructure, public parking and public areas – including plazas, a bell tower, sports courts and nature preserve – among items potentially eligible for tax incentive funding.

Officials have estimated a 10- to 12-year timeline for a full buildout of the five-phase venture, with a $800 million to $1 billion taxable value forecasted on completion, city records show.

Current deed restrictions and zoning on the former golf course would not easily enable other projects, said developer Jeff Blackard, CEO of Blackard Companies.

In part, that’s because amending the existing deed restrictions requires support of 75% of eligible neighboring property owners.

Without a TIRZ, the company will not pursue a project, Blackard said.

What is a TIRZ?

Tax increment reinvestment zones work by identifying a specific area – the “zone” – and using a portion of property taxes collected there to fund improvements within the zone’s boundaries.

As the land is developed, its value increases.

The taxes representing the increase – compared to the base taxes prior to the property’s development – is the pool where a certain amount of revenue can be earmarked for reinvestment back into the zone where the tax was collected.

In the case of Barisi Village, the zone would be restricted to the 127-acre plot where the development is proposed, and does not redirect any revenue of prospective appraisal increases in the surrounding areas.

The drafted agreement is structured in a way that reimbursements could not be made on eligible elements of the project until they are complete and until the funding for a reimbursement is available via tax increment revenue growth, Assistant City Manager Heather Hurlbert told the City Council earlier this month.

Should a TIRZ be created, a board would be appointed to oversee the revenue, reimbursements and performance goals.

A developer’s agreement and a project and financing plan must be approved by both the board and the City Council, if the TIRZ is realized.

Tax financing

A second vote by the City Council that would finalize TIRZ creation – requiring incorporation of college and county leaders’ participation, should each enter into the agreement – would need to take place in within a little less than three months.

In a November presentation, the City Council had been requested to grant as much as $44 million in tax abatements.

The number approved by the council earlier this month, as a part of supporting TIRZ creation, represents about $12 million less than the original ask.

Although a lower abatement than had been requested, “we were pleased with the response from city leaders,” wrote Blackard Companies Senior Vice President Jed Rollins in an email to the Caller-Times.

Final numbers on the request to the college and county are pending, he added.

It’s expected the amounts requested of Del Mar College and Nueces County will also be less than what was initially proposed in November, which at the time suggested county tax abatements of as much as $21 million over 20 years, and for Del Mar College, maximum tax abatements of about $20 million.

The tax abatement amount that would be necessary to make the project viable isn’t immediately clear.

The finances are still being analyzed, Rollins wrote.

“The reality of large projects like this is that there's not often a clear red light/green light threshold,” he wrote, citing variables to include interest rates and home prices.

A lower amount of tax abatements means that “it's likely that there is still a small shortfall that we will need assistance with to deliver the unprecedented public benefits we're planning in this project,” Rollins added.

Should the college and county decline participation in creating the TIRZ, city officials have said they intend to explore other economic development options.

It was not immediately clear Thursday morning what those alternatives may include.

More: Negotiations are underway for a European-style development. This is what's in play.

More: A preliminary plan is on the table for a European-styled development. Here's what it is

This article originally appeared on Corpus Christi Caller Times: tax incentives barisi village development corpus christi in flux