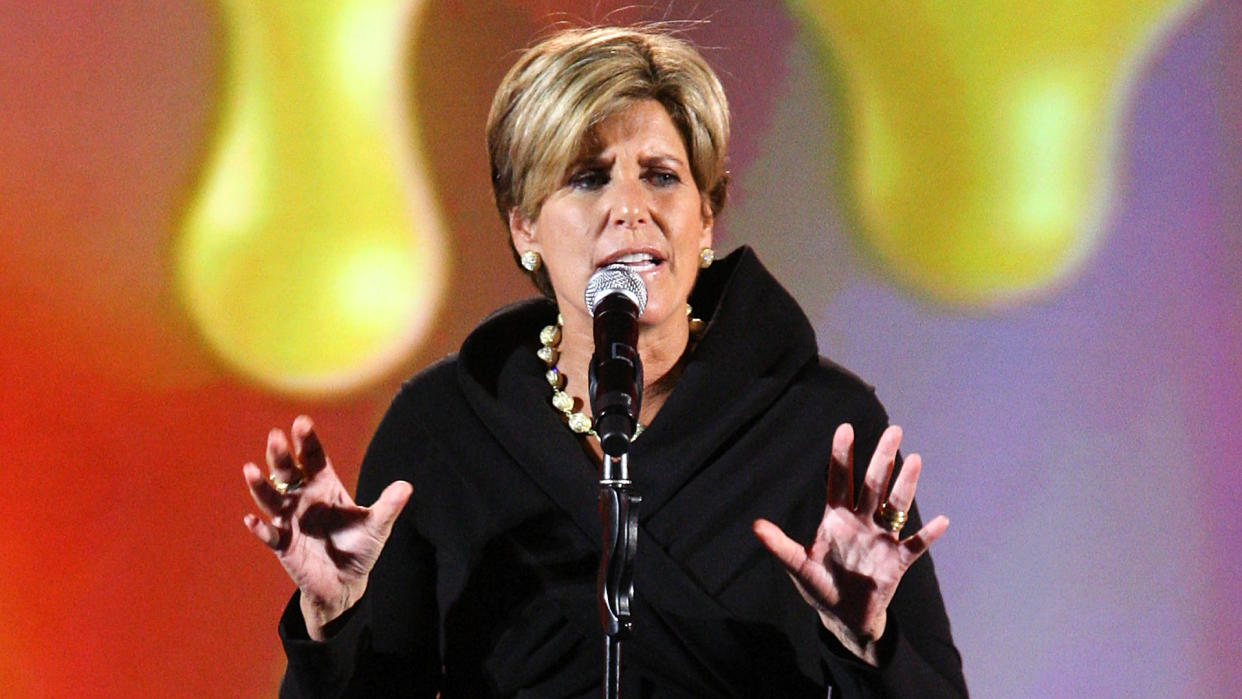

Suze Orman: 3 Key Things To Consider After You Retire

Famed financial personality Suze Orman pointed out in a recent blog post that many Americans are neglecting a key aspect of retirement planning: what happens after the first spouse dies.

This is a burden that generally falls on women more than men, as women generally outlive men and often marry older spouses. Thus, it’s essential that women in relationships start planning early for how their financial lives may look if they end up on their own.

Read Next: Suze Orman: 5 Social Security Facts Every Soon-To-Be Retiree Must Know

Discover More: 4 Genius Things All Wealthy People Do With Their Money

Orman believes there are three areas that couples should focus on when planning for their post-retirement lives: financial decisions for the surviving spouse, document preparation, and living arrangements. Here’s a look at Orman’s concerns, and how you can prepare yourself to deal with them now.

Make Financial Decisions To Help the Surviving Spouse

After accepting the fact that one spouse is likely to outlive the other — and that it is usually the woman — it’s time to plan for that inevitability. With proper planning, the surviving spouse can be left financially adrift, with little recourse to generate additional income. But by dealing with this scenario ahead of time, you can not only avoid this problem but actually position your spouse to be worry-free for the rest of their days.

Social Security plays a big role when it comes to this type of planning. Whether you’re relying on Social Security to cover most of the surviving spouse’s expenses or not, it’s essential to have a well-planned strategy to claim Social Security in the best way to maximize benefits.

When the first spouse in a couple dies, the survivor can collect one of two types of benefits. The first option is for the survivor to collect benefits based on their own work record. The second is the survivor’s benefit, which is up to 100% of the deceased spouse’s benefit.

To maximize the survivor’s benefit, the smart strategy, according to Orman, is to have the higher earning spouse wait to file for benefits until age 70. This will provide the maximum possible payout, more than 75% higher than if you claim at age 62 instead. This helps protect the surviving spouse because they will continue to collect that maximum benefit as a survivor’s benefit, unless their own payout is higher.

Find Out: 6 Ways To Lower Expenses in Retirement While Still Living a Luxury Lifestyle

Have All the Essential Docs in Place Today

The unfortunate truth about planning for a successful retirement is that it involves paperwork. If you want to plan out both the rest of your life and the disposition of your estate after you pass away, you’ll need to buckle down and complete those documents.

Orman says that the four essential documents you need to put in place today are a will, a revocable trust, a financial power of attorney, and a durable power of attorney for health care. Here is what each document accomplishes, in a nutshell:

Will: states where you want your assets to go after death, appoints guardians for minor children

Revocable trust: moves assets into a trust to avoid probate and allow you to direct their disposition

Financial power of attorney: gives someone else the authority to manage your financial accounts, particularly in the event of illness

Durable power of attorney for health care: appoints someone to manage your health care choices if you are incapacitated

The sooner you can get these documents set up, the better, because no one knows what the future holds.

Consider the Best Place To Live … Alone

When one spouse dies, the survivor often ends up moving. Sometimes, it’s for financial reasons, as they can no longer afford living where they were with their spouse. Other times, there’s a desire to move closer to family or friends. While there’s nothing wrong with this, it’s a hard thing to figure out when burdened with the emotional pressure of losing a spouse, not to mention the new financial reality that most survivors face.

Orman’s suggestion is to plan this scenario out in advance, long before it actually happens. For example, you might want to make that move long before the first spouse dies, or downsize your home while you’re still living as a couple. At the very least, planning out where a surviving spouse will go is a way to make the process less stressful when it actually happens.

The Bottom Line

Saving and investing aren’t the only steps you’ll have to take to ensure a successful retirement. By considering some of the practical issues you’ll encounter during retirement that many people overlook, Suze Orman says you’ll be ahead of the game.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Suze Orman: 3 Key Things To Consider After You Retire