Student loans: Women borrowers really don't feel ready to return to repayments, survey finds

The pandemic payment pause on federally-backed student loans is set to expire at the end of September, and a new survey reveals that women student debtors are particularly uneasy about repayments restarting.

According to a poll by Student Loan Hero of 1,020 borrowers between July 1 and July 8, 31% of respondents said they “aren’t prepared to resume student payments on their loans” when the payment pause expires. Out of this group, women were far more likely than men to say they didn’t feel ready, with 40% of women versus 21% of men expressing the sentiment.

While roughly 68% of students borrow money to pay off their undergraduate education, the survey highlighted a student loan gender divide: Women tend to take on more debt than men and tend to pay less once entering the workforce.

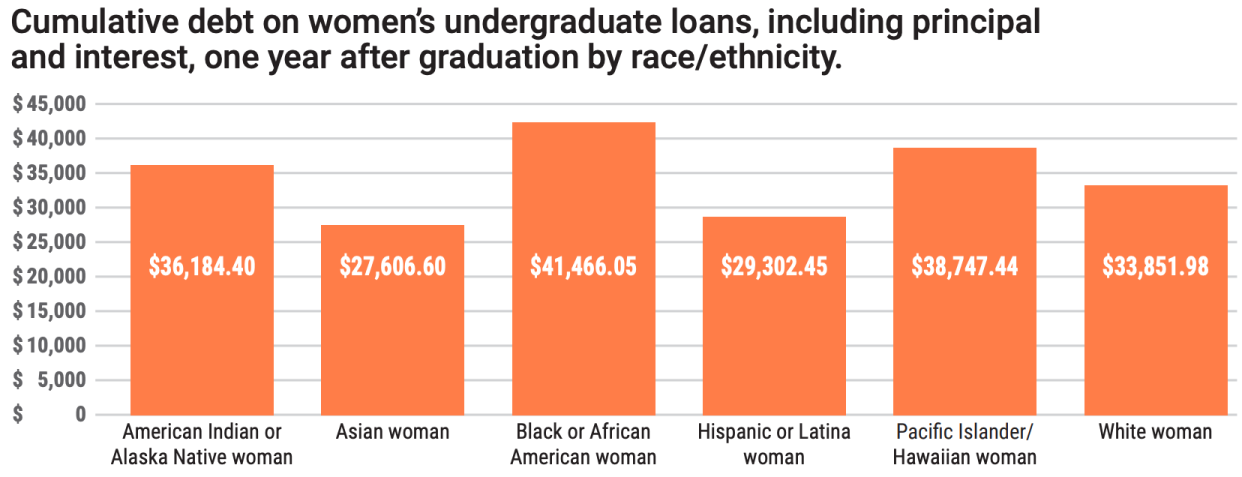

Women take on an average of $31,276 in student loans while men borrow an average of $29,270, according to the American Association of University Women (AAUW). (Women of color, particularly Black women, take on the most substantial amount of debt.)

Overall, women hold about two-thirds of $1.7 trillion in outstanding student loans.

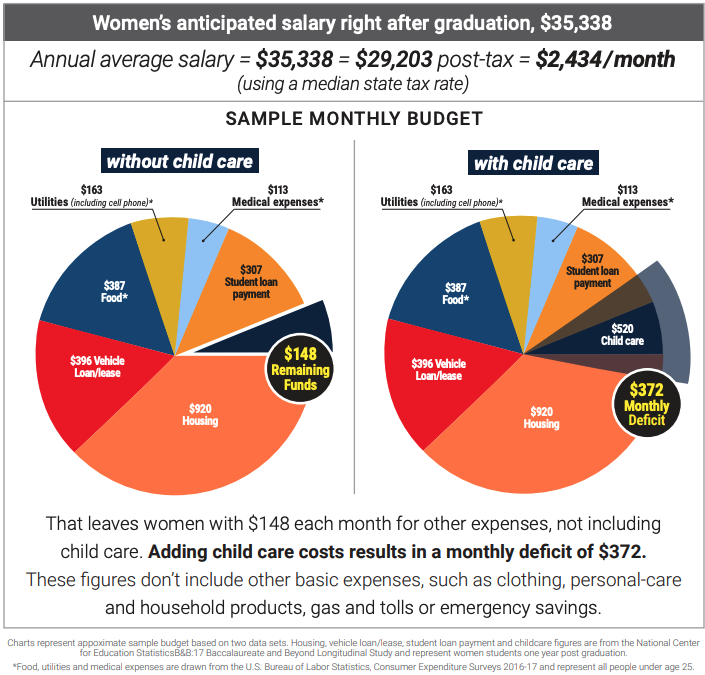

Women also earn $35,338 on average in the first year out of college, AAUW found, which is about 81% of what men are expected to earn.

The difference in debt levels and earnings is also likely to be compounded by the fact that women also have to shoulder child care and elderly caregiving costs.The AAUW noted that for the 16.3% of women who have a child, child care costs are roughly $520, which causes a heavy strain on their budget on top of repaying student loans.

Furthermore, many women lost or left their jobs during the pandemic. As of June 2021, women’s labor force participation rate has also fallen to its lowest level since 1988.

'We are facing a student loan time bomb'

Student loan forgiveness, which would benefit women borrowers immensely, is not off the table.

During his presidential campaign, President Biden promised to forgive $10,000 in student debt for all federal student loan borrowers. While that promise is yet to be fulfilled, other lawmakers have pushed for bigger levels of cancellation.

Senators Elizabeth Warren (D-MA) and Chuck Schumer (D-NY), along with Congresswoman Ayanna Pressley (D-MA), have repeatedly called on Biden to cancel $50,000 in student loan debt immediately via executive order.

If the payment pause is lifted without cancellation in October, Warren previously told Yahoo Finance, "we are facing a student loan time bomb that when it explodes could throw millions of families over a financial cliff."

Solving this problem with student loan cancellation is a blunt tool, according to Kevin Carney, vice president for education policy at New America, given the underlying problem of tuition inflation: The average tuition, fees, and room and board for full-time undergraduate students have increased from $11,369 during the 1985-86 school year to $24,623 during the 2018-19 year, according to the National Center for Education Statistics, a whopping 116% increase.

A more lasting fix to the student loan machinery, Carey previously told Yahoo Finance, would involve “some stronger federal role in perhaps controlling the prices” that colleges charge students.

In any case, according to Student Loan Hero’s survey, one in four borrowers still think it’s “extremely likely” that their debt will be cancelled during the Biden administration while 29% said they believed it would be “somewhat likely.”

—

Aarthi is a reporter for Yahoo Finance. She can be reached at aarthi@yahoofinance.com. Follow her on Twitter @aarthiswami.

Read more:

Student loan forgiveness 'doesn't solve the crisis long term,' expert explains

Student loan forgiveness: Biden promise to forgive $10,000 in debt remains unfulfilled

Data highlights the difference in perceived and actual value of a college degree in America

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.