Student loans: How will the restart in payments affect the economy? Experts are split.

The clock is ticking down for student loan borrowers who will have to restart monthly payments in September. How that will impact the economy is up for debate.

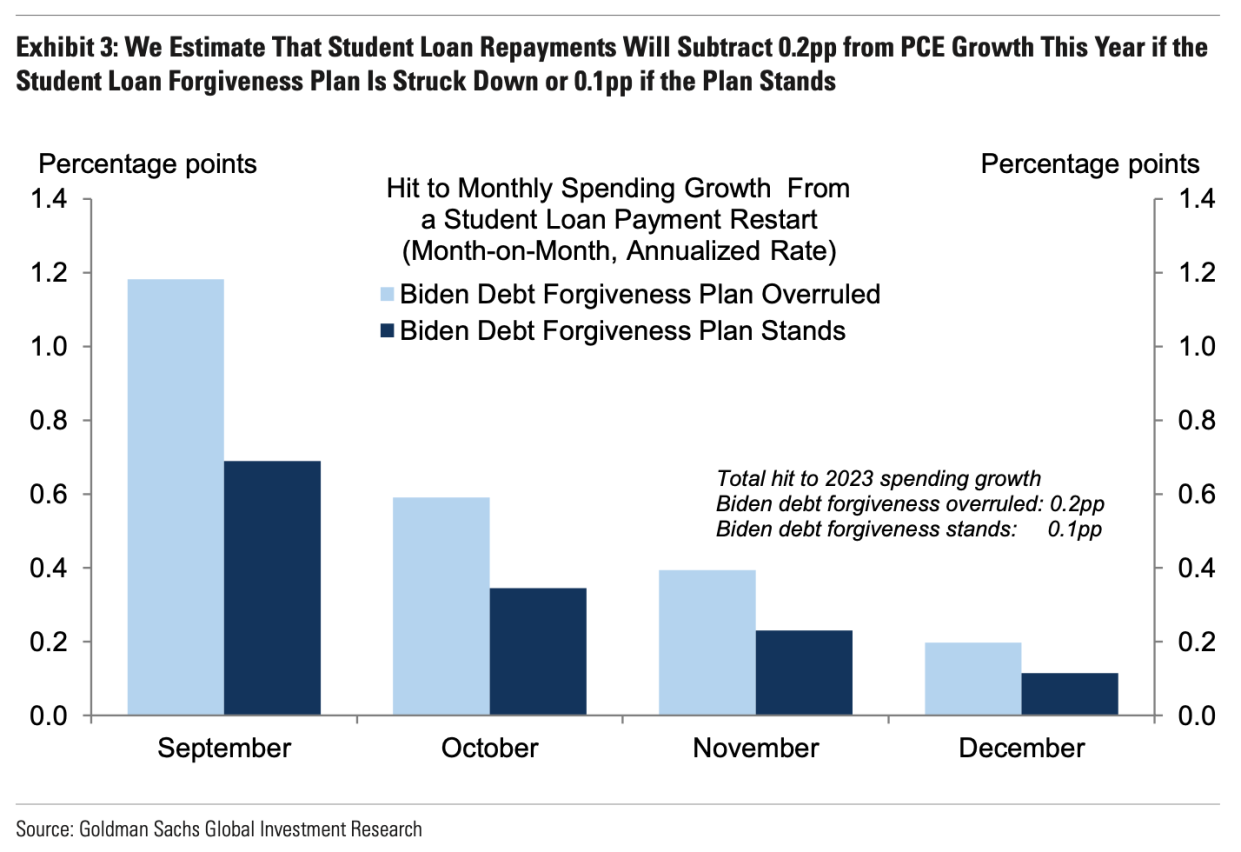

On the one hand, Goldman Sachs analysts predict a modest drag on spending this year when payments restart — no matter how the Supreme Court rules on the president’s debt forgiveness plan.

“On net, the end of the student loan payment pause is likely to more than offset any boost to consumption from the student loan forgiveness plan,” the researchers wrote in a recent research note. “However, in either case, the impact on spending is likely to be modest in the medium term.”

But other experts aren’t so sure, pointing to the extra financial stress that Americans have had to deal with recently and raising the specter of a downturn.

“I've been expecting that we're going to get a recession towards the second half of this year for a long time now,” Thomas Simmons, US economist at Jefferies, told Yahoo Finance Live recently (video above). “And the student loan issue just kind of compounds issues that I think are already sort of set in place.”

The debate follows the debt limit deal the White House struck with House Speaker Kevin McCarthy (R-Calif.) this week that includes a provision prohibiting the president from extending the student loan forbearance and requiring payments to restart in September. It also comes as the Supreme Court is scheduled this month to rule on the legality of President Joe Biden’s up to $20,000 student loan cancellation plan.

If the court rules in favor of forgiveness, the Goldman Sachs researchers estimate $400 billion in student loan balances would be discharged if all borrowers eligible for the program enroll. That would reduce the outstanding federal student debt by about 25% and lower debt payments to 0.3% from 0.4% of personal income, they calculated.

“Middle income households would likely receive the biggest effective income boost from the debt forgiveness plan,” the researchers wrote.

On the other hand, the restart of payments would increase student debt payments by 0.3% of disposable personal income, the researchers estimated, creating a drag on spending.

Taken together, student loan payments would subtract 0.2 percentage point from personal consumption expenditure (PCE) growth this year if forgiveness is denied — the outcome the researchers think is the most likely. If forgiveness is upheld, the repayments will lower PCE growth by just 0.1 percentage point.

In either scenario, the greatest impact would occur in September and decrease each month until December, according to a chart published by the researchers.

Simmons, though, is much less sanguine.

“I'm much more concerned because consumers have taken down all of their excess savings from the period of time during the pandemic when they couldn't be spending money. They've again had to use those savings to offset the impact of inflation,” Simmons said. “I think now it's just the worst possible time for many of those households to be hit with this extra bill.”

Several borrower advocates echoed Simmons’ concerns.

“In our most recent survey in November, the vast majority of borrowers told us that they have yet to recover from the financial impacts of the pandemic and they financially depend on the payment pause to get by,” Cody Hounanian, executive director of the Student Debt Crisis Center, told Yahoo Finance.

A more March/April Credit Karma survey of 1,006 adults found that 43% of borrowers do not feel financially stable and 21% had no savings. A similar survey conducted in February found that 53% of borrowers said their financial stability depends on loan forgiveness or the federal forbearance period, with 26% using money they previously paid on loans for bills and necessities.

Many borrowers have also taken on more credit card, mortgage, and auto loan debt since the moratorium began, according to a working paper by the Becker Friedman Institute at the University of Chicago, further straining their budgets.

At the same time, missed debt payments are higher than before the pandemic, especially among younger borrowers, according to data from the Federal Reserve Bank of New York. This could be a sign of more financial problems for borrowers once the federal forbearance ends.

“Ending the payment pause will put many borrowers' financial stability at risk and the Department of Education expects a significant increase in defaults once payments restart,” Katherine McKay, associate director of insights and evidence at the Aspen Institute Financial Security Program, told Yahoo Finance.

Simmons seemed to agree.

“There's obviously the direct sort of headline impact in terms of having less to spend elsewhere. But the other issue is not just spending on goods and services, but also servicing debt as well,” he said. “We saw delinquency rates on credit card loans and mortgages, auto loans, any sort of consumer loan fall to very, very low levels during the immediate aftermath of the pandemic. And that's as student loan delinquencies essentially fell to zero.”

“It's hard to be delinquent on a payment that isn't necessarily required of you at that point,” he said.

Ronda is a personal finance senior reporter for Yahoo Finance and attorney with experience in law, insurance, education, and government. Follow her on Twitter @writesronda.

Read the latest financial and business news from Yahoo Finance