Student loans: Predatory lending isn’t just coming from for-profit schools

Billions of dollars in student loans have been discharged for borrowers defrauded by their schools.

A lot of times those borrowers went to for-profit colleges. But not all of them.

Some highly regarded universities are licensing their name for use by for-profit schools, one expert said, but the education students receive isn’t from the institution.

"There's been a real uptick in recent years of legitimate, even highly prestigious institutions, offering programs in partnership with some for-profit companies where they are essentially outsourcing the entire education," Dan Zibel, chief counsel and vice president of Student Defense, told Yahoo Finance Live (video above). "So you think you're getting an education from XYZ university, a top tier internationally known university, when in reality what you're getting is they're licensing their name…primarily for revenue for the institution and perhaps the company that they're in partnership with."

Read more: Student loan issues? Here's how to file a complaint with the Department of Education

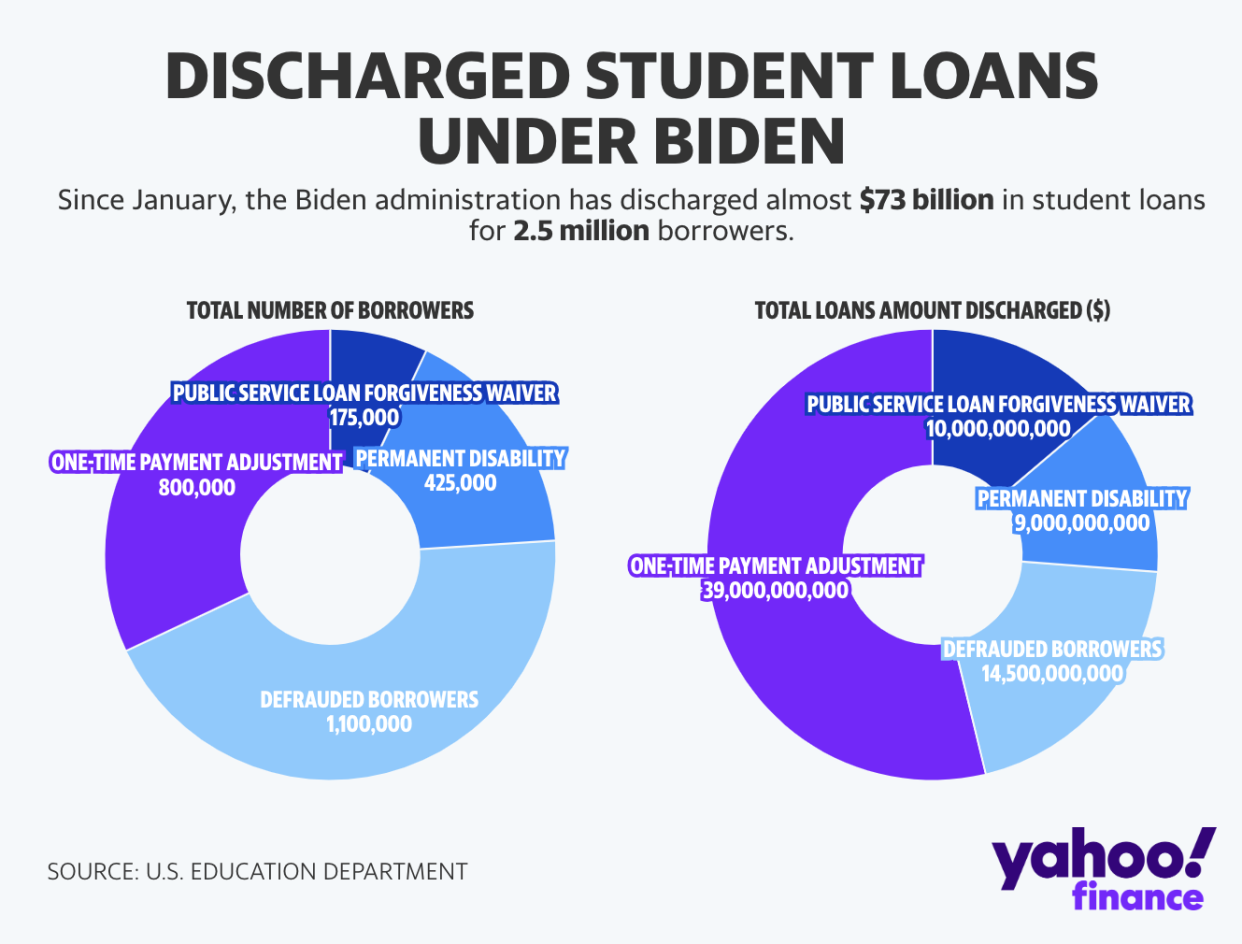

Since January, the Biden administration has discharged almost $73 billion in student loan debt for more than 2.5 million borrowers. That includes $14.5 billion in discharged debt related to the "closed school loan discharge" and "borrower loan defense discharge" programs, the latter of which is a legal ground borrowers can take against a school that engaged in misconduct related to the loan or the educational services it provided.

More than 1 million defrauded borrowers attended for-profit or formally for-profit schools such as Westwood College, DeVry University, Corinthian College, Ashford University, CollegeAmerica, and ITT Tech, to name a few.

"Most of the discharges with specific schools have come about based on findings that institutions, largely for-profit institutions, have actually defrauded students," Zibel said. "They lied to the students, promised them jobs, promised them outcomes, and they didn't deliver."

However, there's a lawsuit to prevent the Department of Education from discharging debt for defrauded borrowers using the borrower's defense discharge.

"The Fifth Circuit Court of Appeals has enjoined the Department from imposing new regulations that were designed to ease the path to loan forgiveness for those borrowers," Zibel said. "The Department in 2021 undid a series of regulations imposed by then-Secretary DeVos to try and ease the path for borrowers. An organization that represents for-profit colleges has sued to enjoin those rules, essentially trying to make it harder for borrowers who have been victimized by some of these schools to get relief."

Ronda is a personal finance senior reporter for Yahoo Finance and attorney with experience in law, insurance, education, and government. Follow her on Twitter @writesronda.

Read the latest financial and business news from Yahoo Finance