Student loans: New loan servicers may complicate payment restart for borrowers

Many student loan borrowers may be surprised they have a different loan service provider when payment pause lifts this fall. That could complicate restarting their monthly payments.

Around 44% of federal student loan borrowers who begin repayment in October have a new loan service provider, according to the Consumer Financial Protection Bureau, after three loan service providers didn’t renew their contracts in 2021.

That means borrowers shouldn’t assume the provider they had before the pandemic is the same, and for those who had their accounts transferred to new loan servicers, they should anticipate some issues and possible mistakes as repayment starts.

"Communication leading up to the resumption of student loan repayments over the next several months will be key to ensuring borrowers are set up for success," Justin Draeger, CEO and president of the National Association of Student Financial Aid Administrators, said in a press release. "Transitioning millions of borrowers back into repayment cannot happen at the drop of the hat."

Read more: Worried about when student loan repayments resume? These programs could help

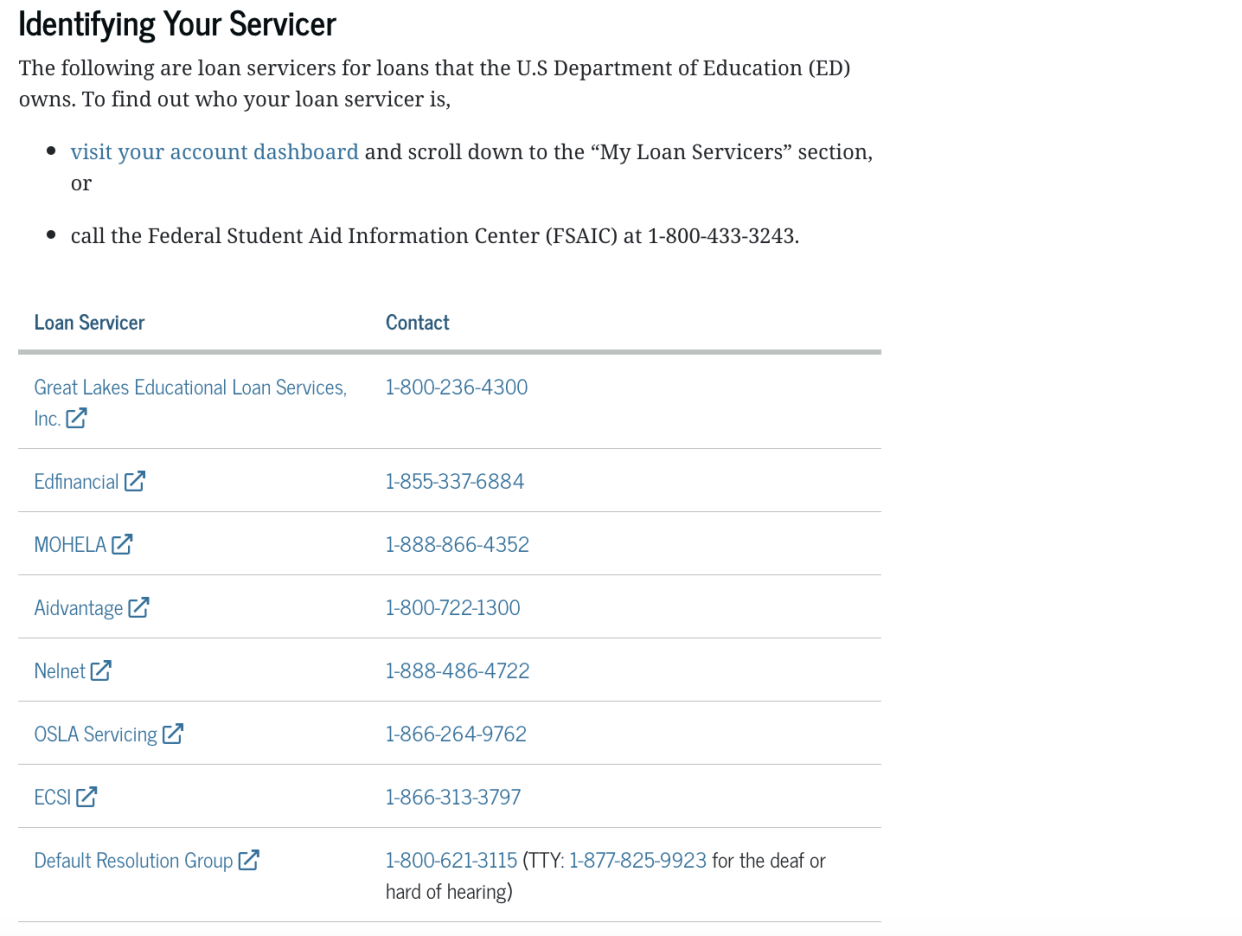

Who are the loan service providers?

Navient, Pennsylvania Higher Education Assistance Agency (PHEAA), and Granite State Management and Resources are no longer loan service providers.

"The big changes were PHEAA, which serviced more than 9 million borrowers and Navient, which serviced 6-7 million borrowers," Mark Kantrowitz, author and student loan expert, told Yahoo Finance.

PHEAA had been accused of mismanagement of the Public Service Loan Forgiveness (PSLF) program and ended its servicing contract with the Education Department in 2021 amid lawsuits from state attorneys general in New York and Massachusetts.

Granite State Management and Resources announced it would not renew its contract two weeks after PHEAA.

Navient, formerly part of Sallie Mae, was accused of "systematically and illegally failing borrowers at every stage of repayment" by the Consumer Financial Protection Bureau. Lawsuits were filed before the servicer terminated its contract with the Education Department in 2021.

The current loan service providers for the Federal Student Aid (FSA) program are: Great Lakes Educational Loan Services, Edfinancial, MOHELA, Aidvantage, Nelnet, OSLA Servicing, ECSI, and the Default Resolution Group.

"Although Great Lakes is listed separately in the U.S. Department of Education's list of servicers, it is now owned by Nelnet," Kantrowitz said.

Common issues and mistakes

When a new loan service provider is added, the chance for mistakes increases as accounts are transferred.

"Common issues that occur with a change of servicer include errors in the loan balance and interest rate, incorrect payment status reported to credit bureaus, missing payments in the borrower's payment history, and changes in due dates," Kantrowitz said.

More concerning are instances of a lack of communication with borrowers about loan service provider changes.

"The transition itself can be disruptive and introduce unforeseen challenges including lost paperwork, communication breakdowns, and program confusion," Cody Hounanian, executive director at the Student Debt Crisis Center, told Yahoo Finance. "We are already seeing cracks in the system, whether it is MOHELA's failure to implement Public Service Loan Forgiveness reforms, erroneous communications sent to Nelnet's new accounts, and much more."

Recently, Democratic senators released a joint statement regarding concerns over the transition to new loan service providers, including the more than 7 million borrowers who have yet been assigned to a payment plan.

"Most of these borrowers have graduated or are otherwise no longer enrolled in a school, raising concerns that servicers may have trouble locating or contacting these borrowers ahead of the payment resumption," Sens. Elizabeth Warren (D-Mass.), Richard Blumenthal (D-Conn.), Sherrod Brown (D-Ohio), Edward Markey (D-Mass.), Bob Menendez (D-N.J.), and Chris Van Hollen (D-Md.) said in a press release.

Additionally, EdFinancial is transitioning to a new servicing platform. It is unclear how this will impact borrowers. The servicer said in its announcement that it will send several notices during the process of transferring loans.

"Please read each notice closely for instructions and additional details about the transition," the servicer said.

Read more: Will I be taxed on student loan forgiveness?

Steps borrowers can take

Borrowers should not assume their provider before the pandemic is the same.

The Education Department has begun sending notifications to borrowers about loan servicers, but borrowers who haven’t updated their accounts and contact information, may not receive them.

“For borrowers preparing for repayment and dealing with new loan servicers, it is crucial to stay informed by making sure their contact information is up to date at the Department of Education and their new student loan servicer,” Hounanian said. “Borrowers should also maintain their account records. These records can serve as evidence in case of any discrepancies or disputes.”

Update your account on FSA

You can find out who your servicer is by logging into StudentAid.gov. Make sure your contact information is correct and change it if it’s not. Once logged in, you can find out who your loan service provider is and what your expected monthly payment will be.

Consolidate commercially held FFEL loans

If you have commercially held FFEL, Perkins, and HEAL loans, you must consolidate to Direct Consolidation Loan to take advantage of the new Saving on a Valuable Education (SAVE) plan — a new income-driven repayment plan the Biden administration is rolling out — and the one-time payment adjustment by Dec. 31.

When you consolidate your loan, you may have a new loan service provider.

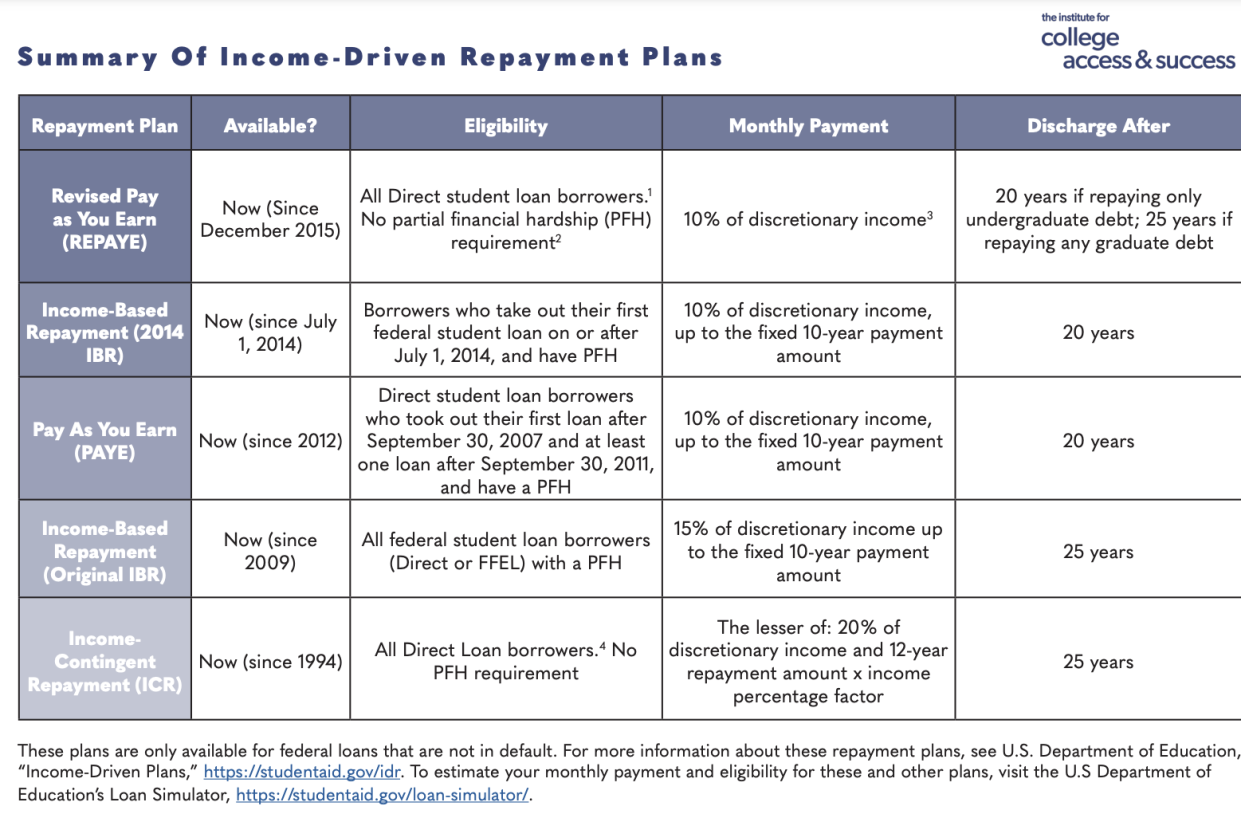

Enroll in an income-driven repayment plan

Enroll in an income-driven repayment plan to lower your monthly payment.

The Saving on a Valuable Education (SAVE) plan is the replacement for the REPAYE income-driven repayment plan and available to all borrowers regardless of income. Borrowers already in the REPAYE plan will automatically be transferred to SAVE.

Borrowers on other income-driven plans can apply to switch to SAVE later this summer. The Education Department will send out notices when the application is available.

Enrolling or switching an income-driven plan does not change your loan service provider.

Enroll in other loan forgiveness programs

Borrowers with a total and permanent disability are eligible for disability discharge. Typically, military veterans who have a 100% disability connected to military service or who have a serious disability and are receiving Social Security benefits qualify.

If you work in public service with federal, state, local government or certain nonprofit organizations, you are eligible to have your student debt forgiven after 10 years of payments through the Public Service Loan Forgiveness (PSLF) program.

Enrolling in PSLF may change your loan service provider.

Enroll in autopay

Once you know who your servicer is, enrolling in autopay can help lower your interest rate.

“Loan servicers provide a quarter of a percentage point interest rate reduction as an incentive to sign up for autopay, so you will also save money,” Kantrowitz said.

Even if you had autopay before the pandemic, you may need to sign up again because auto-debit likely won’t restart for most borrowers, according to the FSA.

“Borrowers may need to sign up again for autopay, since the autopay agreements don't necessarily transfer, even if their servicer didn't change, as it has been more than three years since the last payment was made through autopay,” Kantrowitz said.

Check your credit report

President Biden announced his “on-ramp” program that won't penalize borrowers for late, missed, or partial payments for 12 months.

Kantrowitz recommends that borrowers check their credit reports a few months after the change of a loan servicer to make sure there are no errors on their credit report.

Ronda is a personal finance senior reporter for Yahoo Finance and attorney with experience in law, insurance, education, and government. Follow her on Twitter @writesronda

Read the latest personal finance trends and news from Yahoo Finance.

Follow Yahoo Finance on Twitter, Instagram, YouTube, Facebook, Flipboard, and LinkedIn