Student loans: Borrowers should beware of 'Biden loan forgiveness' scams

Scammers have long capitalized on the burden of student loans to prey on unsuspecting borrowers, and experts worry more could get caught up as debt payments restart this month.

Since last year, the Federal Trade Commission (FTC) has received more than 4,000 complaints related to student loan debt relief scams. The number of complaints spiked last October when the loan forgiveness application went live and in June after the Supreme Court struck down Biden's loan forgiveness plan.

The FTC has also gone after numerous entities operating scams promising forgiveness or other relief.

The restart in loan payments this month could make it harder for borrowers to distinguish between a legitimate company and scammers because so many borrowers are making payments for the first time or have been assigned a new loan servicer.

For student loan borrowers, this means they should double check who they are working with on their loans before making any moves, especially if someone is promising relief that seems too good to be true.

Read more: Student loan issues? Here's how to file a complaint with the Department of Education

"Unfortunately, potential scammers will also be using this time as an opportunity to take advantage of unsuspecting borrowers looking for relief or assistance," New York Secretary of State Robert Rodriguez said this month in a statement. "I’m reminding all student loan borrowers to be extra vigilant during this time and to read our tips to protect yourself from falling victim to a student loan scam."

Borrowers scammed by Ameritech Financial get relief

In August, the FTC and the Department of Justice (DOJ) announced that over 22,000 borrowers will receive refunds from a $9 million settlement for the Ameritech Financial student loan debt relief scheme operated by Brandon Frere through 2018.

Frere targeted public servants who would be eligible for the Public Service Loan Forgiveness program, pretending to be affiliated with the Department of Education.

Frere charged up to $800 in illegal upfront fees, required $100 to $1,200 in advance fees for enrollment in a "financial education" program, and monthly payments of up to $99 that were supposedly going toward student loan balances. Overall, his entities bilked borrowers out of $28 million.

Also in August, the FTC shut down additional scams operations that falsely promised to reduce or eliminate student loan payments under "Biden Loan Forgiveness," even though the president’s up to $20,000 debt cancellation plan was struck down by the Supreme Court in June. These scammers also falsely claimed to be affiliated with the Department of Education and persuaded borrowers to halt communications with their federal loan servicers.

"During a period of uncertainty for borrowers saddled with student loan debt, these defendants bilked consumers out of millions of dollars with junk fees and phony promises of loan forgiveness and lower monthly payments," said Samuel Levine, director of FTC’s Bureau of Consumer Protection. "We are pleased that the court shut down this operation and froze its assets, and we will continue the agency’s ongoing efforts to pursue scammers that target the tens of millions of Americans with student loan debt."

New loan servicers complicate confusion for borrowers

Many borrowers may find it difficult to spot potential scammers because they may not know who they should be dealing with when it comes to their loans.

Around 44% of federal student loan borrowers who began repayment this month have a new loan service provider, according to the Consumer Financial Protection Bureau, after three loan service providers didn’t renew their contracts in 2021.

That means the loan service provider a borrower had before the pandemic may have changed, making it easier for scammers to step in if borrowers haven’t verified who their loan servicer is.

Read more: Can you change your student loan repayment plan?

At the same time, some servicers have struggled to help confused borrowers. For instance, the call center line for the loan service provider Nelnet shut down in August when borrowers tried to access the platform.

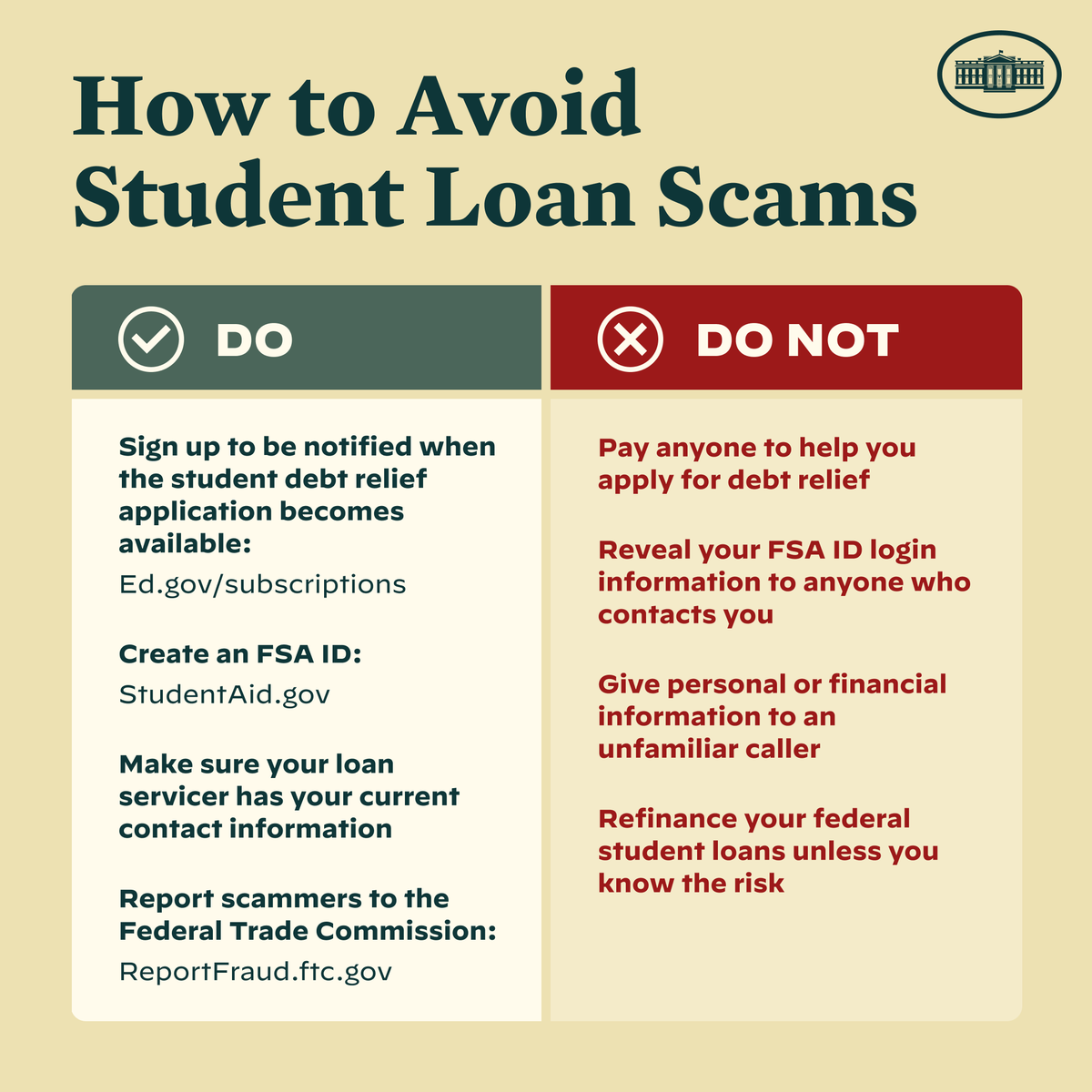

The best way for borrowers to protect themselves is to be a step ahead.

"Go to StudentAid.gov to find out who your lender is, verify and learn options [because] you don’t have to pay any upfront fees or pressure to sign up. Pause, do research go to StudentAid.gov," an FTC official told Yahoo Finance.

Borrowers should also be wary of anyone stating that they are "federally affiliated" or related to the Department of Education. Other red flags include upfront fees, prequalification notices, or checks. Some even used the Better Business Bureau logo in mailers. There is never a fee for any federal student loan discharge or forgiveness program.

Borrowers who spot a scam can submit a complaint at the Federal Student Aid website or with the Federal Trade Commission.

Ronda is a personal finance senior reporter for Yahoo Finance and attorney with experience in law, insurance, education, and government. Follow her on Twitter @writesronda.