Student loans: Bipartisan bankruptcy reform bill proposes alternative to forgiveness hope or lifelong debt

While some progressive Democrats continue to push the president to cancel student loan debt, there's a bipartisan effort underway to overhaul the student loan system in another way: by making bankruptcy discharges more accessible for student debtors.

Senate Majority Whip Dick Durbin (D-IL), who chairs the Senate Judiciary Committee, and Senator John Cornyn (R-TX) announced a new bill called the "FRESH START Through Bankruptcy Act of 2021" last week to better enable borrowers to seek a student loan discharge in bankruptcy.

"Student loan debt follows you to your grave," Durbin stated. "Our bipartisan bill finally gives student borrowers — some who were misled into taking out costly loans by predatory for-profit colleges — a chance to get back on their feet when they have no other realistic path to repay their loans."

If passed, the bill would allow federal student loans to become eligible for discharge in bankruptcy proceedings 10 years after the borrower's first loan payment comes due. (Borrowers with loans less than 10 years old would have to go through the current process.)

Jason Iuliano, associate professor of law at the University of Utah and an expert on student loan bankruptcy law, told Yahoo Finance that the bill's 10-year waiting period was noteworthy.

"First, it would ensure that people who have struggled to repay their student loans for at least a decade can benefit from bankruptcy’s fresh start and get their lives back on track," Iuliano said. "And second, it would ensure that the student loan credit market continues to function."

The bill also proposes to increase "institutional accountability" by making colleges that receive federal loans from more than a third of their students "partially reimburse" the Department of Education (ED) if student loans are later discharged in bankruptcy or "if the colleges had consistently high default rates and low repayment rates."

"This is an excellent proposal that would help align schools’ incentives with their students’ incentives," Iuliano explained. "Instead of engaging in an ever-increasing tuition arms race, underperforming schools would be forced to cut tuition or improve employment prospects for their students."

Roughly 45 million Americans hold more than $1.7 trillion in federally-backed student loan debt.

Student loan bankruptcy discharge

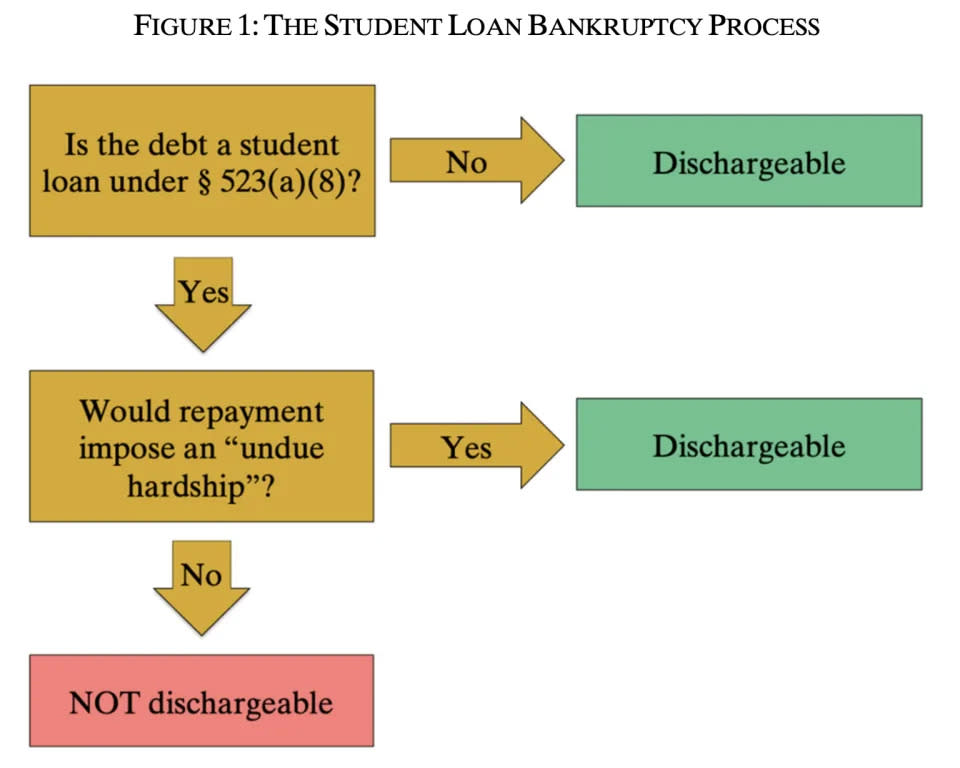

Discharging student loans through bankruptcy, while difficult, is not impossible.

That said, there was an era when it was a much easier process.

"Before 1976, student loans were treated like other types of unsecured debt bankruptcy. If you were facing financial ruin, you could get relief," Durbin explained. "But then Congress got the idea that student borrowers were running to bankruptcy court, right after graduation. This notion was based on more anecdote than data. Congress started passing laws to make it harder."

Over time, the bankruptcy code became more restrictive for all student debtors.

In most personal bankruptcy cases involving student debt, a judge now applies the Brunner test — a three-pronged test applied to student loan borrowers who filed adversary proceedings seeking to discharge educational debt — to determine if specific student loans caused a borrower to suffer undue hardship.

"Starting with the 1987 case called Brunner, courts have interpreted the phrase to set an impossibly high bar for relief," Durbin said. "To pass the Brunner test of undue hardship, you have to convince a bankruptcy judge that it’s hopeless that you’d ever repay, while the Department of Education or its guaranty agencies are on the other side arguing against you."

While Durbin went on to stress that "proving undue hardship is nearly impossible," Iuliano disagreed.

The impossibility of proving undue hardship specifically "is not the case," Iuliano said. Based on his research of bankruptcy cases, an estimated "60% of people who attempt to discharge their student loans in bankruptcy are successful."

'This is the first time it’s been bipartisan'

Forced to choose between student loan forgiveness — favored by some prominent Democrats but taboo to most Republicans — and bankruptcy reform, many Republicans opted for the latter during the hearing.

"While I don't support cancellation of all student debt... I can't think of very many good reasons to keep students with massive amounts of debts as lifelong serfs of banks and lifelong serfs of universities by not allowing them to discharge a bankruptcy of their debt under appropriate circumstances," Sen. Josh Hawley (R-MO) said during the hearing, adding that the bipartisan bill was "a very sensible approach."

Sen. Elizabeth Warren (D-MA), a leading proponent of student loan cancellation, previously told Yahoo Finance that the U.S. bankruptcy system is "fundamentally wrong" on student debt discharges.

"I’ve been introducing student loan bankruptcy [bills] for a long time," Durbin said during the hearing. "This is the first time it’s been bipartisan. With this bill, we see a growing bipartisan consensus that the status quo isn’t working, and that we need student loan bankruptcy reform.”

One appealing aspect of the bill, according to Iuliano, is that the legislation addresses the fundamental issue of tuition inflation by making schools reimburse the federal government when students discharge their loans via bankruptcy.

"Schools are... selling a product for a price, and that price needs to match what these students get out of it," said Cornyn, one of the co-sponsors. "That's why the second part of the [bill] creates a limited risk-sharing framework for schools but enough students default on their loans, and fail to continue to repay them."

Coryn added that some schools have "taken advantage of the American taxpayer for too long, and the students are the ones harmed by their excess, so I'm glad to see this bill introduced today."

—

Aarthi is a reporter for Yahoo Finance. She can be reached at aarthi@yahoofinance.com. Follow her on Twitter @aarthiswami.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.