Student loans: Accelerated provision of SAVE plan provides forgiveness for more borrowers in February

A key provision of President Joe Biden’s Saving on A Valuable Education, or SAVE income-driven repayment plan, will be implemented next month, providing loan forgiveness for more borrowers.

This provision was not expected to take effect until July and will provide immediate debt cancellation for borrowers who have an original loan balance of $12,000 or less and have been in repayment for 10 years.

"This action will particularly help community college borrowers, low-income borrowers, and those struggling to repay their loans," Biden said in a press release.

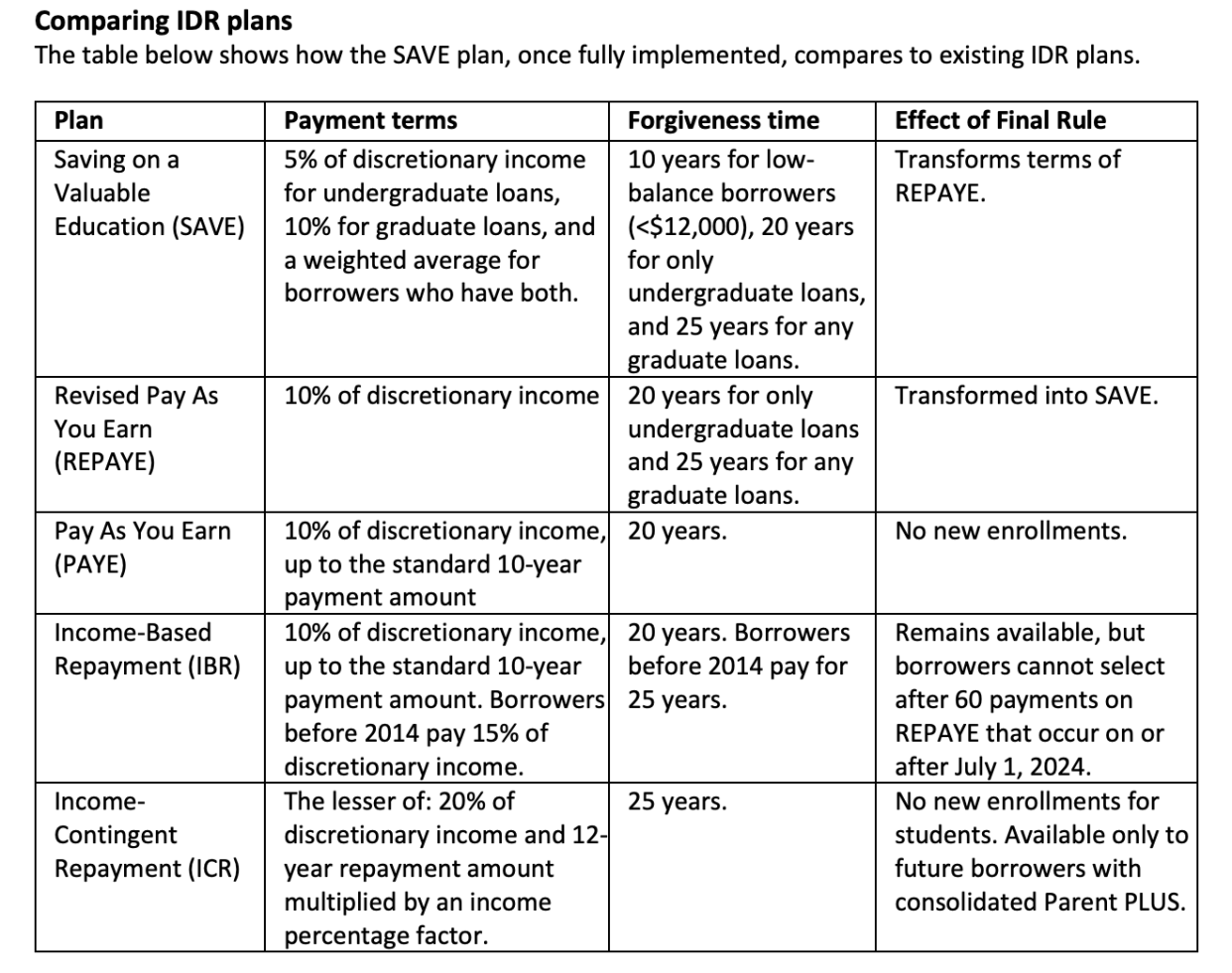

One of the benefits of enrolling in an income-driven repayment (IDR) plan is that after 20 or 25 years of repayment — depending on the plan — any remaining balance is discharged. The new provision cuts that timeline to 10 years for borrowers with smaller balances.

Beyond that, for every $1,000 borrowed above $12,000, a borrower can receive forgiveness after an additional year of payments, which means those who originally borrowed less than $21,000 will be eligible for forgiveness faster than the 20-year timeline, James Kvaal, undersecretary of Education, said in a press call this week.

"Giving borrowers with smaller loans a faster path to being debt free will help many borrowers avoid financial distress and have peace of mind," Kvaal said.

Around 6.9 million borrowers are enrolled in the SAVE plan, of which 2.8 million are new enrollees to income-driven repayment plans, 3.4 million were automatically transferred from the REPAYE plan which became SAVE, and 700,000 switched from other IDR plans, according to an Education Department spokesperson.

With over 44 million borrowers in repayment, the goal is to get more enrolled in SAVE, which is available to borrowers regardless of income.

"This especially impacts first-generation college students who went to school, couldn’t finish, and had their earning power diminished due to the debilitating effect of interest accrual — making them worse off than when they took out the loan," Education Secretary Miguel Cardona told Yahoo Finance. "Interest accrual causes 1 million borrowers to go into default per year and disproportionately impacts Black and brown borrowers."

"With lower monthly payments, protection from runaway interest, and faster timelines to debt forgiveness, President Biden’s SAVE plan is not only benefitting millions of current borrowers but also providing the students of today and tomorrow with a more affordable pathway to college degrees and credentials," Cardona said.

Here are some key aspects of SAVE that makes it different from other income-driven repayment plans:

The most borrowers must pay toward their undergraduate loans is 5% of their discretionary income, down from 10%.

No borrower making less than 225% of the federal poverty level will have to make a monthly payment.

Loan balances will be forgiven after 10 years of payments — instead of 20 years — if the original loan balance is $12,000 or less.

Borrowers won't be charged with unpaid monthly interest, so balances won't grow if they make their payments — even if the monthly payment is $0 because their income is low.

Some aspects of SAVE are still rolling out. For instance, the cut in the percentage of discretionary income for undergraduate debt from 10% to 5% will not be implemented until July, Mark Kantrowitz, author and student loan expert, previously told Yahoo Finance.

How to enroll in SAVE

Usually, borrowers sign up for income-driven repayment plans through their loan servicer. With the rollout of SAVE, borrowers have the option to sign up with their loan servicer or directly on StudentAid.gov.

However, as repayments restarted in October, loan servicers have been accused of "gross servicing failures" by the Education Department, which recommended that borrowers apply directly on the Federal Student Aid (FSA) website, where applications would be processed quicker.

Read more: Student loan issues? Here's how to file a complaint with the Department of Education

The Consumer Financial Protection Bureau also found loan servicers had long hold times, abandoned calls, significant delays processing income-driven repayment plan applications, and inaccurate billing statements.

Recently, an Education Department spokesperson said that the vast majority of backlogged SAVE applications have been cleared.

To date, the Biden administration has approved nearly $44 billion in IDR relief for around 901,000 borrowers and $53.5 billion for almost 750,000 borrowers through the Public Service Loan Forgiveness (PSLF) program.

Borrowers should be aware of student loan scams pretending to be President Biden’s loan forgiveness. You never have to pay for federal student loan forgiveness or discharge, and there are only four ways to get your federal student loans discharged: Public Service Loan Forgiveness (PSLF); Disability Discharge, Borrower's Defense; and the IDR discharge.

Ronda is a personal finance senior reporter for Yahoo Finance and attorney with experience in law, insurance, education, and government. Follow her on Twitter @writesronda