Student loan servicers’ ‘gross servicing failures’ impact borrower repayment

Three months after student loan payments restarted, some borrowers are experiencing delays and seeing billing errors from student loan servicers.

What’s causing the turmoil, in part, is the entry of new loan providers into the process after three companies bowed out in 2021.

Around 44% of federal student loan borrowers who had payments resume in October have a new loan service provider. That transition has been fraught with delays and errors, causing some borrowers to be put on administrative forbearance while loan servicers correct the errors.

Additionally, some borrowers who were supposed to have their loans discharged were erroneously placed into repayment.

“Our oversight efforts have uncovered errors from loan servicers that will not be tolerated [and] actions we've taken send a strong message to all student loan servicers that we will not allow borrowers to suffer the consequences of gross servicing failures,” Miguel Cardona, secretary of Education, said in a press statement. “We are committed to fixing our country’s broken student loan system, and that includes strengthening oversight and accountability and taking every step possible to improve outcomes for borrowers.”

Read more: Student loan issues? Here's how to file a complaint with the Department of Education

Common loan servicer issues and mistakes

When a new loan service provider is added, the chance for mistakes increases as accounts are transferred.

“Common issues that occur with a change of servicer include errors in the loan balance and interest rate, incorrect payment status reported to credit bureaus, missing payments in the borrower's payment history, and changes in due dates,” Mark Kantrowitz, student loans expert and author, previously told Yahoo Finance.

In November, the Education Department identified issues borrowers experienced as a result of loan servicer mistakes that caused some borrowers to become delinquent, miss payments, get charged fees, or miss out on forgiveness credit and interest subsidies.

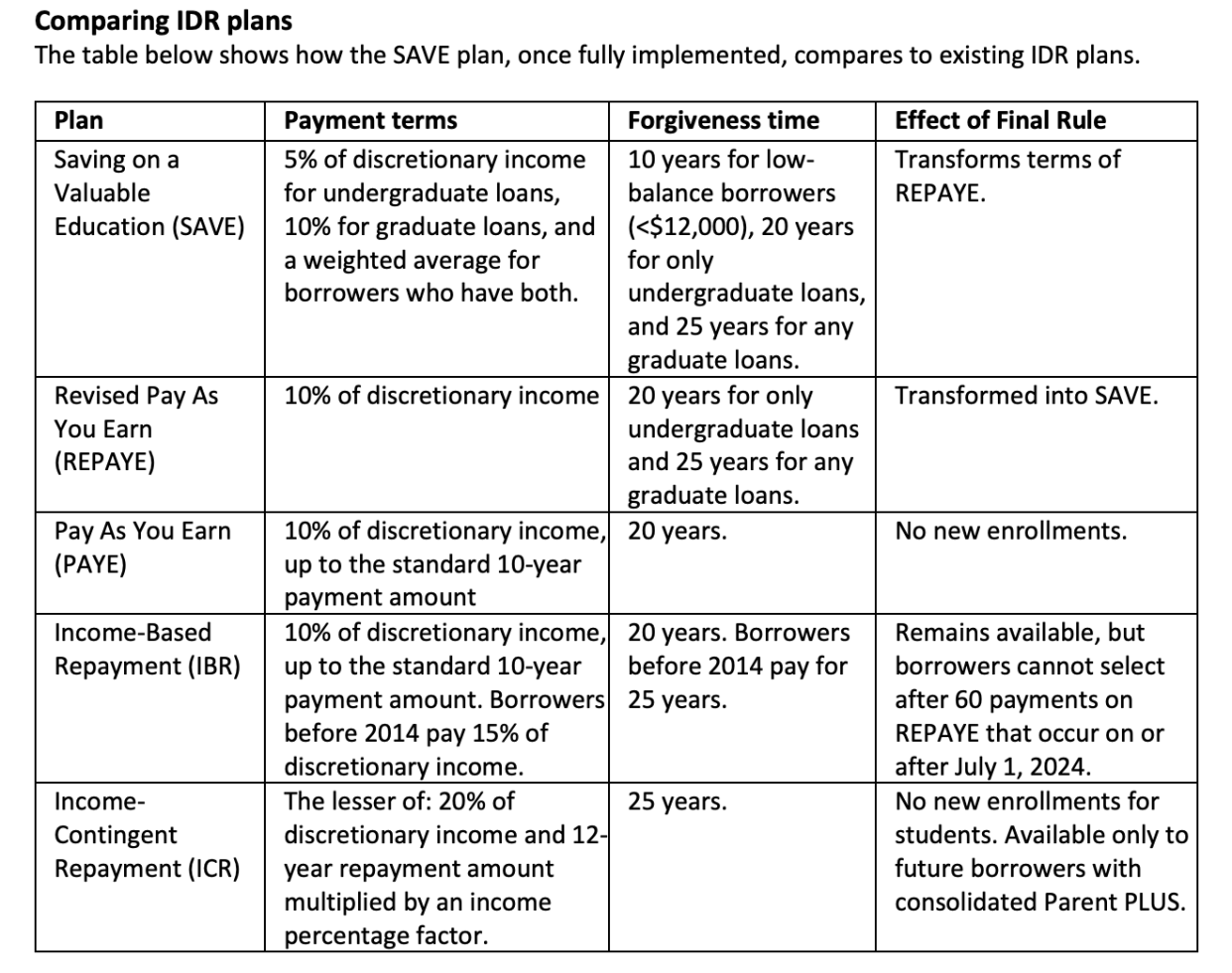

The four main issues were: miscalculated payments when enrolling in Saving on a Valuable Education (SAVE), incorrect billing amounts, late or no billing statements sent, and no income-driven repayment (IDR) disclosures sent.

“Our top priority is to support borrowers as they return to repayment and fix the broken student loan system, and we will not tolerate errors from loan servicers that cause confusion and unwarranted financial instability for borrowers and families,” Richard Cordray, chief operating officer of Federal Student Aid (FSA), said in a statement.

Borrowers with pending discharges erroneously placed in repayment

Some borrowers whose debt was pending discharge as part of the borrowers defense discharge were put back in repayment status.

Around 200,000 borrowers in Sweet v. Cardona, a class-action suit against more than 100 for-profit colleges, received notices that their debt would be discharged in February. But in August some received letters from loan servicer Higher Education Loan Authority of the State of Missouri (MOHELA) that repayment would begin in October for the discharged debt, according to a press release by the Project on Predatory Lending, which represents the borrowers.

“The law is clear: no borrowers with pending borrower defense claims should enter repayment, and no Sweet class member should receive a bill,” Eileen Connor, president and director of the Project on Predatory Student Lending, said in an emailed press statement. “MOHELA's failure has caused significant stress and financial harm for borrowers. We are pleased to see that the Department of Education is holding MOHELA accountable by withholding payment, demonstrating that there are consequences for servicers who cannot fulfill their basic obligations.”

Recently, the Education Department announced that it was withholding a $7.2 million payment to MOHELA for failing to meet its basic obligation to send billing statements on time to 2.5 million borrowers and for incorrectly placing borrowers who have pending borrower defense claims back in repayment status.

"Throwing these borrowers back into repayment is not merely harmless ineptitude — MOHELA is hurting borrowers and they are breaking the law,” Ella Azoulay, a research and policy analyst at the Student Borrowers Protection Center, told Yahoo Finance. “Borrowers who were scammed by greedy institutions failing to deliver a quality education were for years failed by the Department of Education, and are now being failed by the servicer who is supposed to be delivering discharges. MOHELA must be held accountable for how it's treating borrowers entitled to relief."

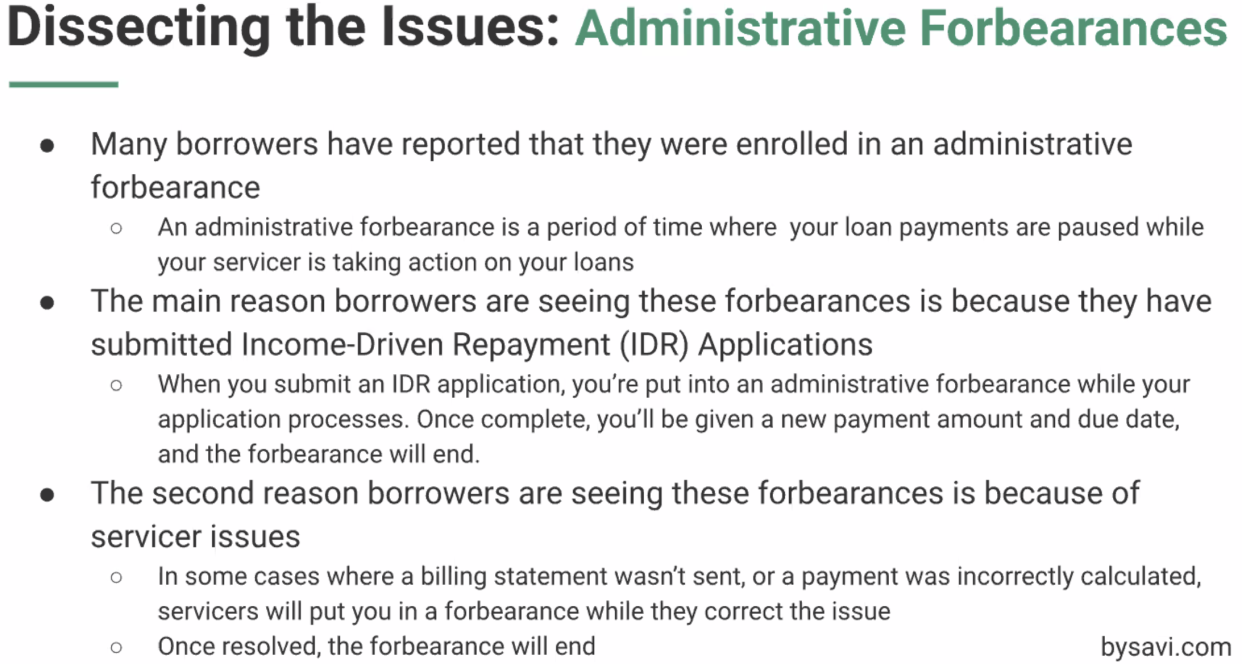

What to expect while in administrative forbearance

If you were placed on administrative forbearance, your servicer is allowed time to correct errors. Once these are corrected, you will be taken out of administrative forbearance and put into repayment.

All borrowers placed in administrative forbearance by their loan servicer will have any months in forbearance count as credit toward loan forgiveness through Public Service Loan Forgiveness (PSLF) or income-driven repayment (IDR) plans.

Steps borrowers should take

Ignoring your federal student loans is not a good idea.

Even though there’s a 12-month “on-ramp” when the Education Department isn't reporting missed or late payments to credit reporting bureaus, interest is still accruing.

Update your account on FSA

You can find out who your servicer is by logging into StudentAid.gov. Make sure your contact information is correct and change it if it’s not. Once logged in, you can find out who your loan service provider is and what your expected monthly payment will be.

Enroll in an income-driven repayment plan

Enroll in an income-driven repayment (IDR) plan to lower your monthly payment.

One misconception is that you must be low-income to use an IDR plan. You do not need to be low-income to qualify for SAVE.

SAVE, or Saving on a Valuable Education, is the replacement for the REPAYE income-driven repayment plan and available to all borrowers regardless of income. Borrowers already in the REPAYE plan will automatically be transferred to SAVE.

Enrolling in or switching an income-driven plan does not change your loan service provider.

Consolidate commercially held FFEL loans

If you have commercially held FFEL, Perkins, or HEAL loans, you must consolidate to Direct Consolidation Loan to take advantage of the new SAVE plan and the one-time payment adjustment by Dec. 31. However, on December 18th the Education Department extended the deadline to April 30, 2024 to allow for the 60 days of processing.

When you consolidate your loan, you may have a new loan servicer.

Use Fresh Start program to get out of default

If your loan was in default before the pandemic, you have until Dec. 31 to apply for the Fresh Start program to get out of default and in good standing.

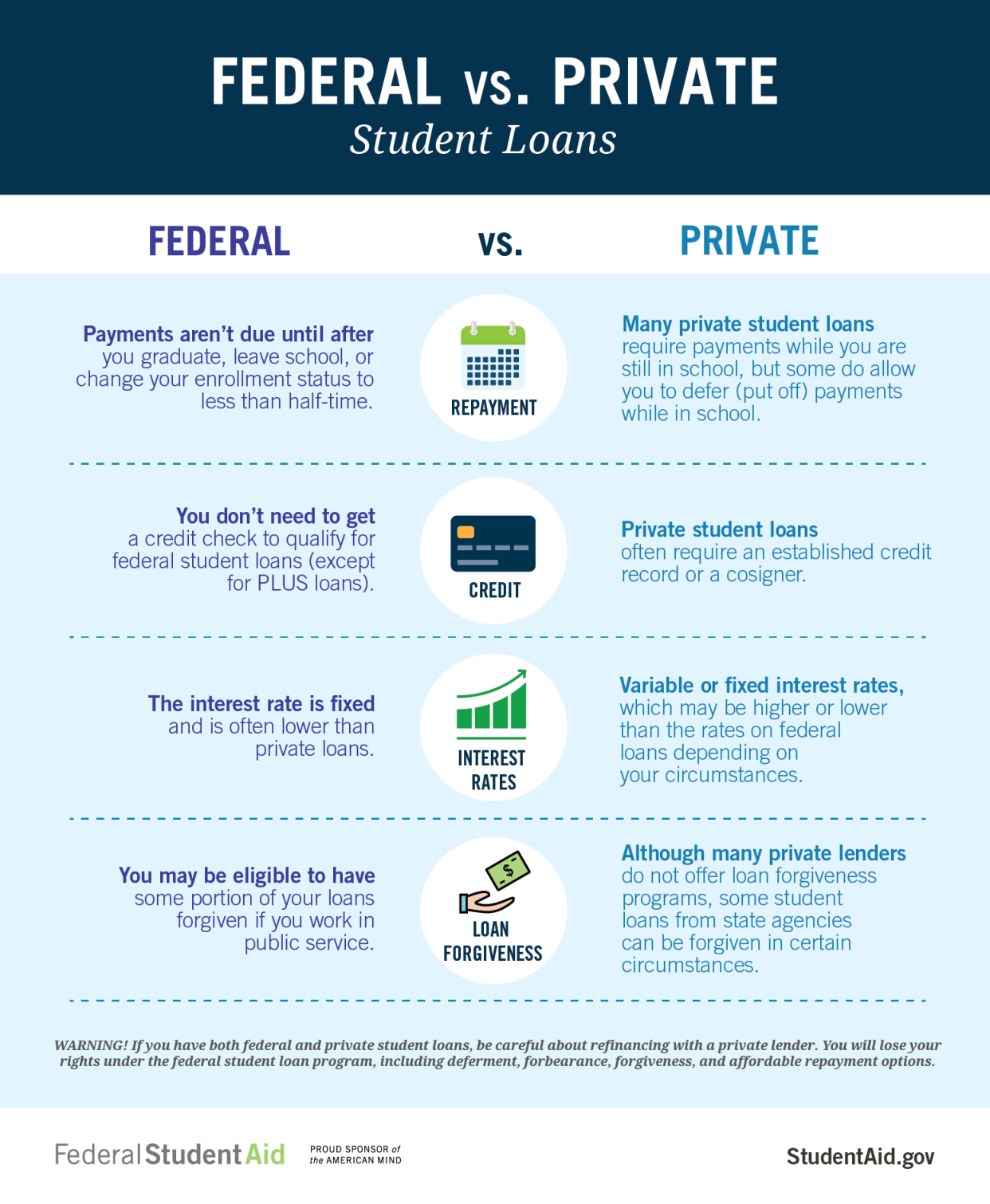

Refinance vs. consolidation

If you have federal and private student loans, there are things to consider.

A direct loan consolidation of federal loans consolidates all of your federal loans into one payment. There’s no fee for a direct loan consolidation.

If you refinance a federal loan into a private loan, you become ineligible for federal benefits like income-driven repayment plans, public service loan forgiveness, any future loan forgiveness, and a discharge for disability.

If you die, your federal student loan debt dies with you if unpaid. Private student loans pass on to your estate, spouse, or heirs.

Ask your employer about SECURE 2.0

If your company has a matching retirement plan, ask about this new provision in SECURE 2.0 that counts student loan payments toward your 401(k). It's effective in 2024.

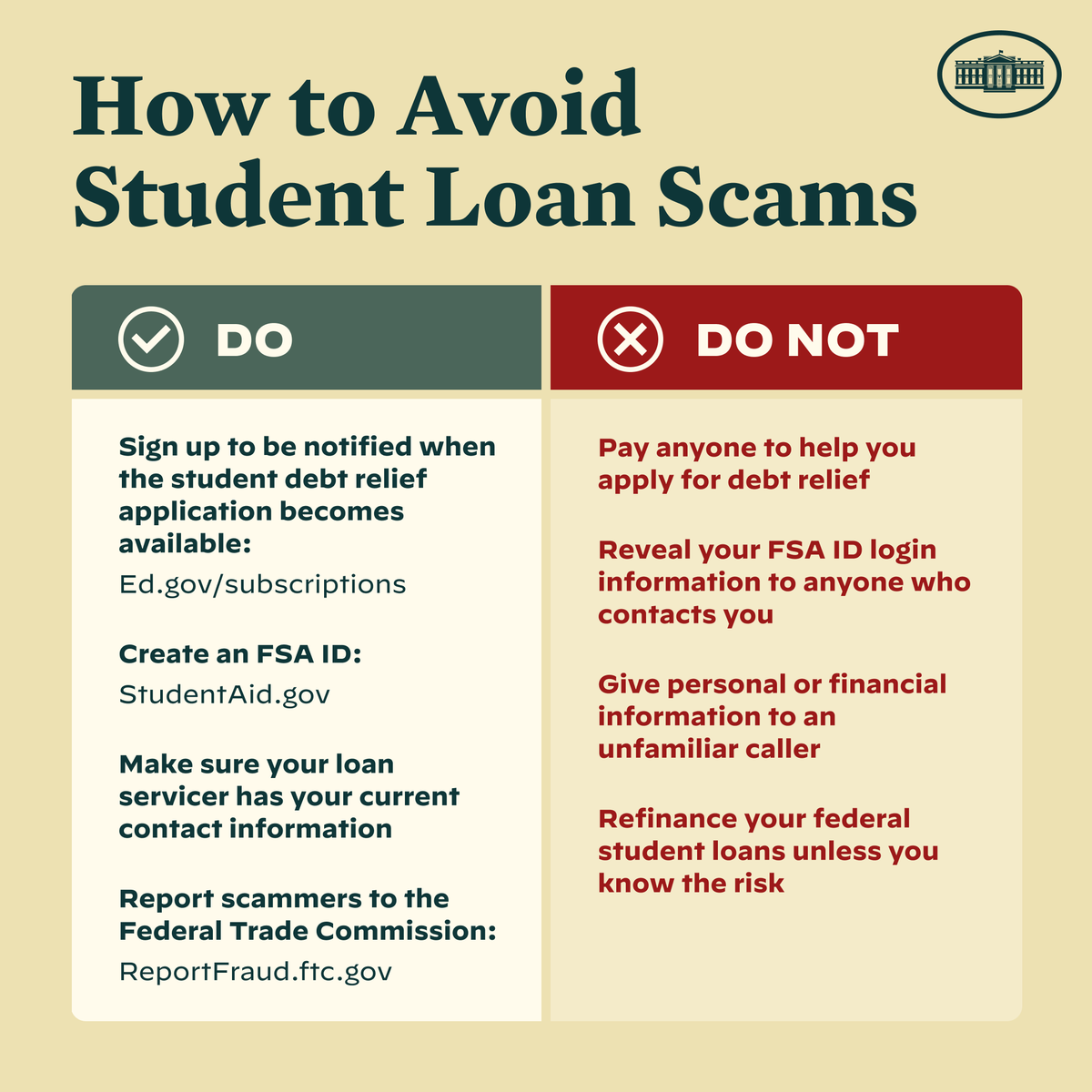

Beware of student loan scams

There are several student loan scams pretending to be President Biden’s loan forgiveness. You never have to pay for federal student loan forgiveness or discharge.

Currently, there are only four ways to get your federal student loans discharged: Public Service Loan Forgiveness (PSLF); Disability Discharge, Borrower's Defense; and the IDR discharge.

Ronda is a personal finance senior reporter for Yahoo Finance and attorney with experience in law, insurance, education, and government. Follow her on X @writesronda.

Read the latest personal finance trends and news from Yahoo Finance.

This post was updated to reflect a deadline extension announced by the Department of Education in December.