Student loan forgiveness: The closed school discharge system is not working, government watchdog finds

The cancellation of a key provision in a federal student loan forgiveness program likely left thousands struggling to repay their debt, according to a new report by a government watchdog, the vast majority being students of for-profit colleges.

In 2018, the Education Department (ED) created a process to automatically forgive loans, particularly for students whose colleges abruptly closed while they were in school. But two years later in July 2020, the Trump administration made loan forgiveness optional — rather than automatic.

The move meant that "borrowers impacted by future closures will have to apply to receive a discharge," according to a preliminary report by the Government Accountability Office obtained by Yahoo Finance, warning that for those who do not know to apply "may face long term financial burdens from student loans that are past due or in default, even though those loans are eligible to be discharged."

Students enrolled in a college that closes may be eligible for full student loan forgiveness if they are unable to complete their program because of the closure. If they qualify, ED reimburses the borrowers "of any amounts previously paid or collected on those loans" and removes credit implications from borrowers' reports. This could also include Parent PLUS borrowers.

Currently, borrowers have one major option to get a closed school discharge: They must submit an application.

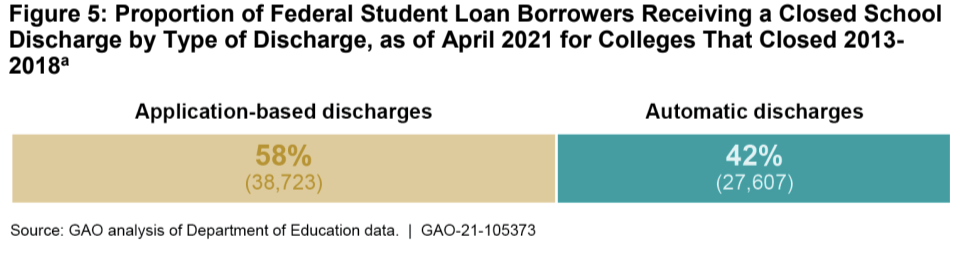

But between October 2018 and July 2020 when the automatic cancellation provision was in place, the ED discharged around $360 million worth of student loans for over 27,600 borrowers who never filed a single form, according to the GAO report. (At the same time, ED also discharged $529 million in loans to over 38,700 borrowers who did apply for loan forgiveness.)

The automatic discharge was exceptionally helpful for the group that didn't proactively apply, the GAO said, because more than 70% of them "were in default or past due on their loans," 52% had defaulted on their loans, and 21% were seriously delinquent on their debt.

The borrowers had been facing wage garnishment, credit score hits, and even seizures of their tax refunds, while they were unaware that their loans were eligible to get cancelled, said the GAO.

On top of that, having debt and no degree meant that "borrowers receiving automatic discharges defaulted at about five times the national average," the GAO said. Not knowing that they qualified for loan forgiveness also meant that "borrowers receiving automatic discharges defaulted at about nine times the rate of those who applied for and received discharges."

But since the Trump administration's ED killed the automatic discharge process in July 2020, the GAO said, borrowers will need to know that they can apply for loan forgiveness if schools end up closing in the future. If they don't realize they have that option, they could suffer severe financial distress — without a degree to justify.

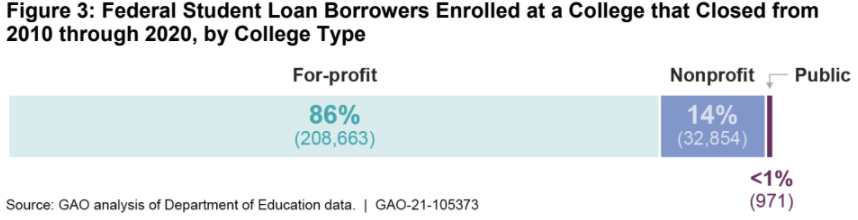

The GAO report also found that the majority of students affected by a closing institution were enrolled at a for-profit college.

For instance, between 2010 and 2020 around 246,000 student loan borrowers were enrolled at 1,100 schools that closed. 43% of them did not complete their program before the closure and about 86% of them were enrolled at a for-profit college. Just over 80,000 ended up having their loans forgiven through the closed school discharge process.

The GAO's findings "once again demonstrate that low-quality, for-profit schools are costing students and taxpayers billions of dollars," Subcommittee on Higher Education and Workforce Investment Hearing Chair Frederica Wilson (D-FL) said in her prepared remarks. "Congress and the Education Department must work together to crackdown on predatory schools that continue to cheat students and taxpayers."

The report, which underscores the plight of Americans who have debt but no degree, comes as the ED announces its negotiated rule-making committee, which will meet in the upcoming weeks to address a wide range of student loan issues.

The government watchdog's findings "demonstrate that students affected by abrupt college closures are not getting the timely support they need," Congressman Bobby Scott (D-VA), chairman of the House Education and Labor Committee, said in a statement.

"The Biden administration has already taken steps in the right direction to help student borrowers affected by school closures," Scott added. But as ED "begins considering changes to the closed school discharge process, I hope and expect that it will focus on streamlining relief for students and improving oversight of failing colleges."

—

Aarthi is a reporter for Yahoo Finance. She can be reached at aarthi@yahoofinance.com. Follow her on Twitter @aarthiswami.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit