Student loan forgiveness: New analysis highlights who cancellation would help most

Student loan forgiveness would significantly help Black borrowers and reduce racial inequality, according to a new analysis by academics at UC Merced and Princeton University.

The analysis, prepared for and released by Sen. Elizabeth Warren (D-MA), showed that canceling $10,000 in student debt would zero out loan balances for two million Black borrowers, reduce the share of Black individuals with student debt, and improve Black households' net worth.

"As this analysis clearly shows, cancelling student debt is a matter of racial justice and about providing relief to millions of hardworking people who invested in their education but are now drowning in debt," Warren said in a press release. "The more President Biden cancels, the more we narrow the racial wealth gap among borrowers and the bigger the boost to Americans' economic futures. This is the right thing to do."

Prominent Democrats, including Warren, Senate Majority Leader Chuck Schumer (D-NY) and Rep. Ayanna Pressley (D-MA), have repeatedly called on Biden to cancel $50,000 in student loan debt immediately via executive order on the premise that there is sufficient legal backing for the administration to do so.

Pressley has stressed that women and people of color hold significant levels of student loan debt and that cancellation would represent a massively impactful form of relief given the disproportionate burden.

“Our new analyses show that every level of student debt cancellation will provide relief to millions of borrowers who have experienced financial distress from their student loans," stated Charlie Eaton, assistant professor of sociology at the University of California Merced and the study's primary author. "But bigger is better with higher levels of cancellation completely zeroing out debts for most of these borrowers, a disproportionate share of whom are Black and lack inherited household wealth."

Student loan forgiveness by the numbers

The analysis broke down the impact of debt cancellation of $10,000, $20,000, $30,000 and $50,000.

According to the academics, canceling $10,000 would erase the full balance of 32% of all borrowers:

$10,000 zeroes out balances for 32% of borrowers (13 million in total)

$20,000 zeroes out 50% of borrowers (20 million in total)

$30,000 zeroes out 61% of borrowers (24 million in total)

$40,000 zeroes out 71% of borrowers (28 million in total)

$50,000 zeroes out 76% of borrowers (30 million in total)

That breakdown was similar to a previous analysis of student loan data.

The $10,000 forgiveness level "reduces the share of Black individuals with student debt from 24% to 17% and closes the Black-white gap in the share of individuals with student debt from 9 percentage points to 6 percentage points," the analysis stated.

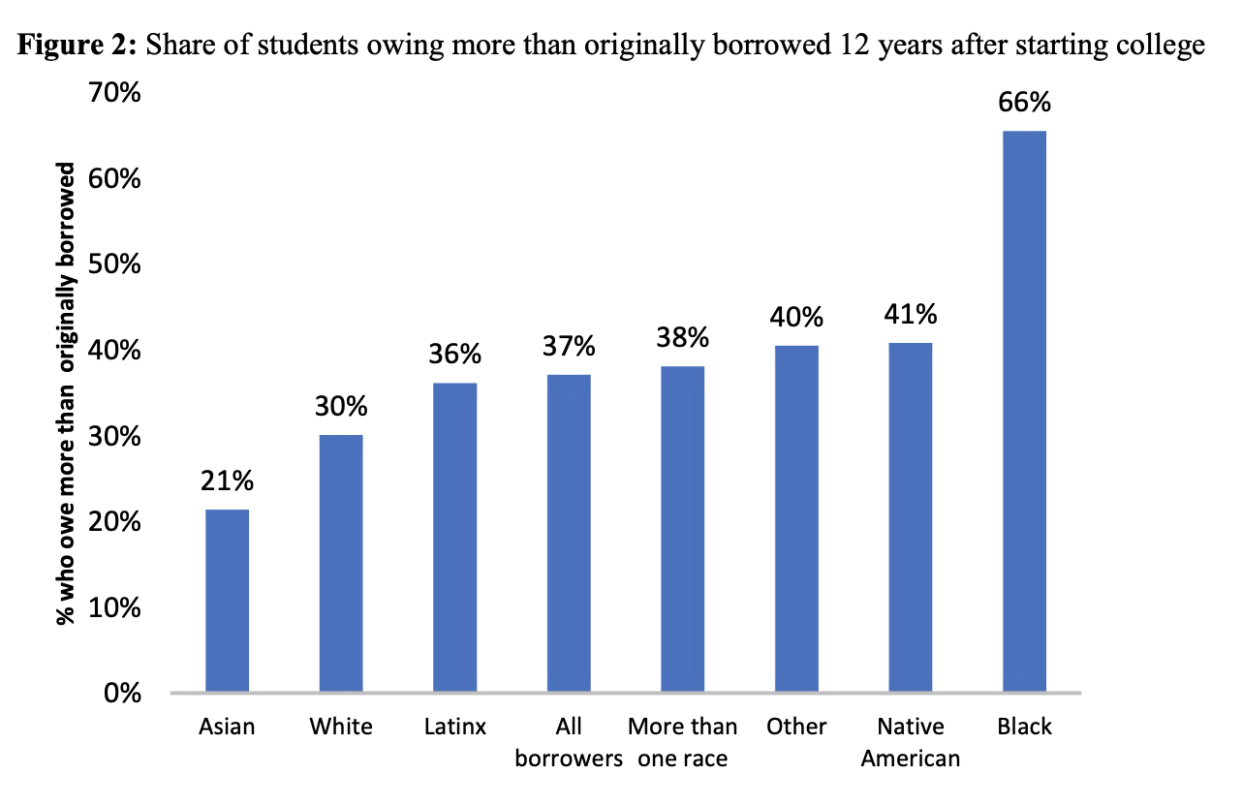

The research noted that about 66% of Black borrowers owe more than they originally borrowed 12 years are they started school, compared to 37% Latinx borrowers and 30% of white borrowers.

The study found that:

$10,000 zeroes out 14% of borrowers who owe more after 12 years.

$20,000 zeroes out 32% of borrowers who owe more after 12 years.

$30,000 zeroes out 46% of borrowers who owe more after 12 years.

$50,000 zeroes out 67% of borrowers who owe more after 12 years.

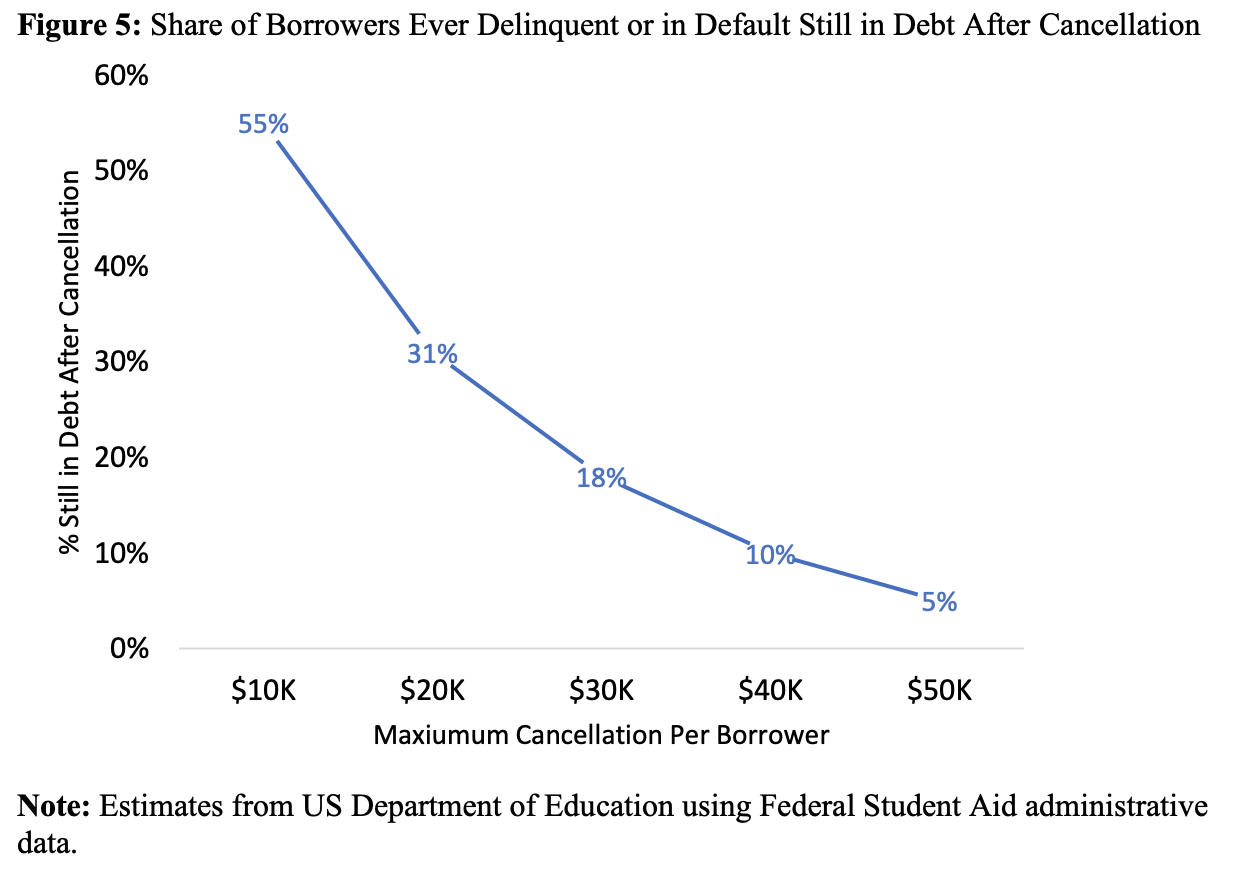

For borrowers in distress, $10,000 cancellation would zero out five million borrowers' balances — around 45% of the total number of debtors who are in default.

'The more debt we cancel, the more people we will help'

Warren's press release quoted NAACP President and CEO Derrick Johnson as saying that amid rising inflation, "the more debt we cancel, the more people we will help."

President Biden, who backed broad student loan forgiveness of $10,000 on the campaign trail in 2020 amid more generous proposals from then-rivals Sen. Bernie Sanders (D-VT) and Warren, had heretofore been reluctant to forgive debt through executive action.

Recently, however, Biden said he was "considering dealing with some debt reduction." Bloomberg reported that he was considering canceling "at least $10,000" per borrower, and the president is also reportedly considering introducing income caps to limit the benefit to certain borrowers.

—

Aarthi is a reporter for Yahoo Finance. She can be reached at aarthi@yahoofinance.com. Follow her on Twitter @aarthiswami.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Instagram, YouTube, Facebook, Flipboard, and LinkedIn