Student loan debt is a 'crisis for Black America,' Democratic lawmaker says

Rep. Ayanna Pressley (D-Mass.) emphasized the disproportionate impact of student loans on Black borrowers during her latest call for debt cancellation.

"The student debt crisis is an economic justice, gender justice, and racial justice issue — Black borrowers — especially Black women — are among the most impacted by the student debt crisis," Pressley said at the recent Congressional Black Caucus Foundation’s (CBCF) annual legislative conference. "It is a crisis for Black America affecting our elders, our caregivers, our educators, and our families."

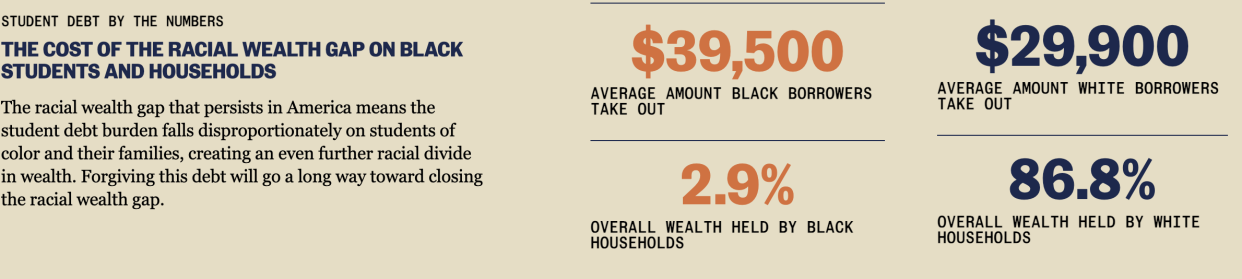

Black borrowers hold the most student loan debt, according to a study by the NAACP, with 86.4% of Black bachelor’s degree holders and 81% of Black students pursuing master's and doctoral degrees borrowing for school.

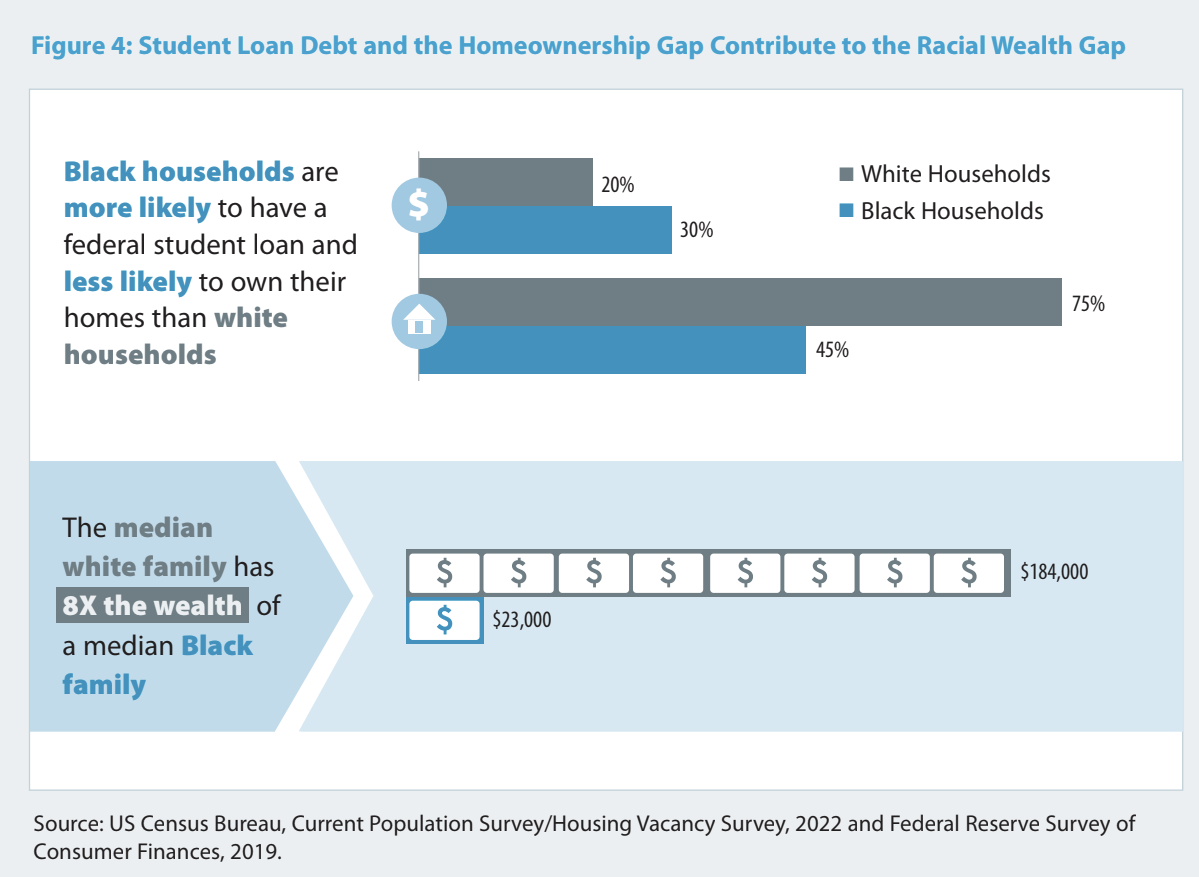

That greater debt burden is a barrier to building wealth and contributes to the racial wealth gap, preventing borrowers from homeownership, starting businesses, or paying for their kids’ college.

"It is an intergenerational crisis," Pressley said. "We must deliver student debt cancellation for Black America and borrowers everywhere."

The CBCF conference also underscored how student loan debt has a disproportionate impact on Black teachers.

"The student debt crisis impacts the education community and Black educators to a greater degree," Becky Pringle, president of the National Education Association, said at the CBCF conference. "When college students make that initial choice to go into education, the cost of higher education disproportionately impacts Black borrowers who become teachers with an average debt of $68,000 compared to $55,000 for white teachers."

In addition, Black educators are less likely to pursue Public Service Loan Forgiveness (PSLF) or Teacher Loan Forgiveness programs.

Only 17% of teachers take advantage of the teacher loan forgiveness, with Black teachers among the groups who are less likely to apply for forgiveness than their counterparts, according to a recent WGU and Savi survey. Overall, only 28% of all borrowers understand all the repayment options available.

"I've traveled all over the country and educators said: 'Cancel our student debt, or we're going to have to leave the profession,'" Pringle said. "The educator crisis disproportionately affects our Black community as we're losing more Black teachers at a time when we know how important it is to have a diverse teaching force."

Even though reform is happening, the exclusion of ParentPlus loans from income-driven repayment (IDR) plans like SAVE hurts the most vulnerable borrowers. The administration’s new Saving on A Valuable Education (SAVE) income-driven repayment plan replaces and improves on an earlier repayment plan for federal student loan borrowers by lowering monthly payments, providing faster forgiveness for some, and preventing balances from growing due to unpaid interest.

Read more: Federal PLUS loans: How do they work?

But the SAVE plan "excludes ParentPLUS borrowers who are also part of the student debt process," Wisdom Cole, director of youth strategy at the NAACP, said at the CBCF conference. The NAACP is one the national organizations who’ve partnered with the Department of Education to educate borrowers on repayment options and the SAVE plan.

"When a young person commits to going to school, their parents are also committing to supporting them, and we need to make sure that we are finding solutions to support them finding solutions to ensure that ParentPLUS borrowers also see relief," Cole said.

Student debt can also ripple from one generation to the next, those at the CBCF conference emphasized.

That debt makes it harder to build wealth as "the disproportionate impact of student loan debt on Black borrowers…has been demonstrated to exacerbate the racial wealth gap," a study from the Center for Responsible Lending found.

Black parents are more likely to have child-related student debt than white parents, according to a report by the NAACP Legal Defense Fund.

And a study by the Federal Reserve Board found that a $1,000 increase in student loan debt lowers the homeownership rate by 1-2 percentage points for borrowers during their late 20s and early 30s. In the second quarter, the Black homeownership rate was 45.7%, far lower than the 74.5% rate for non-Hispanic white households.

"The most effective way to narrow the wealth gap for communities of color and working-class households is to provide significant student loan relief to borrowers and reform our educational system to ensure it is equitable for future students," Jaylon Herbin, director of federal campaigns at the Center for Responsible Lending, said at the CBCF conference. "We continue to support President Biden in his quest to make our educational system fairer and urge him to explore all his options to provide student debt relief to millions of Americans."

Although the Supreme Court struck down Biden’s up to $20,000 in student loan forgiveness plan, the administration is pursuing forgiveness options using the rule-making process under the Higher Education Act, a move that Pressley and other Democratic lawmakers supported in a recent letter to the president.

"We're doing this fight to meet the acute need right now to advance policies to go as broad and as deep as the hurt," Pressley said at the CBCF conference. "But, ultimately, what I want us to do is to deliver a love letter to future generations. In this moment, for this 52nd annual CBCALC, it is about the future, not just right now."

Ronda is a personal finance senior reporter for Yahoo Finance and attorney with experience in law, insurance, education, and government.

Follow her on Twitter @writesronda Read the latest personal finance trends and news from Yahoo Finance. Follow Yahoo Finance on Twitter, Instagram, YouTube, Facebook, Flipboard, and LinkedIn