Student loan borrowers get more clarity on Biden’s plan to adjust payment history

The federal government provided more details on its plan to adjust the payment histories of millions of student loan borrowers, a move that will get them closer to debt forgiveness.

The Education Department this month specified which old loans are eligible for this one-time payment adjustment, how borrowers with certain loans can qualify, what borrowers in default can expect, when the adjustment will occur, and when repayment will begin.

The adjustment announced last April counts certain months that were previously ineligible toward student loan discharge under income-driven repayment plans, or IDRs. Around 3.6 million borrowers will receive at least three years of credit toward loan discharge as a result of the adjustment, according to Federal Student Aid (FSA).

The move is separate from the president’s up to $20,000 in student loan forgiveness that has been held up as the Supreme Court rules on its legality. The adjustment is not contingent on the Supreme Court’s decision.

Here’s what to know about the one-time payment adjustment, including the newest details.

What is the one-time payment adjustment?

In April 2022, the Education Department announced the one-time payment adjustment for all Direct Loans and federally-owned Federal Family Education Loans (FFELs).

The one-time payment adjustment helps to reverse some of the damage caused by loan servicers that did not properly track deferments or steered borrowers to forbearance instead of income-driven repayment plans that would have counted toward years of payment.

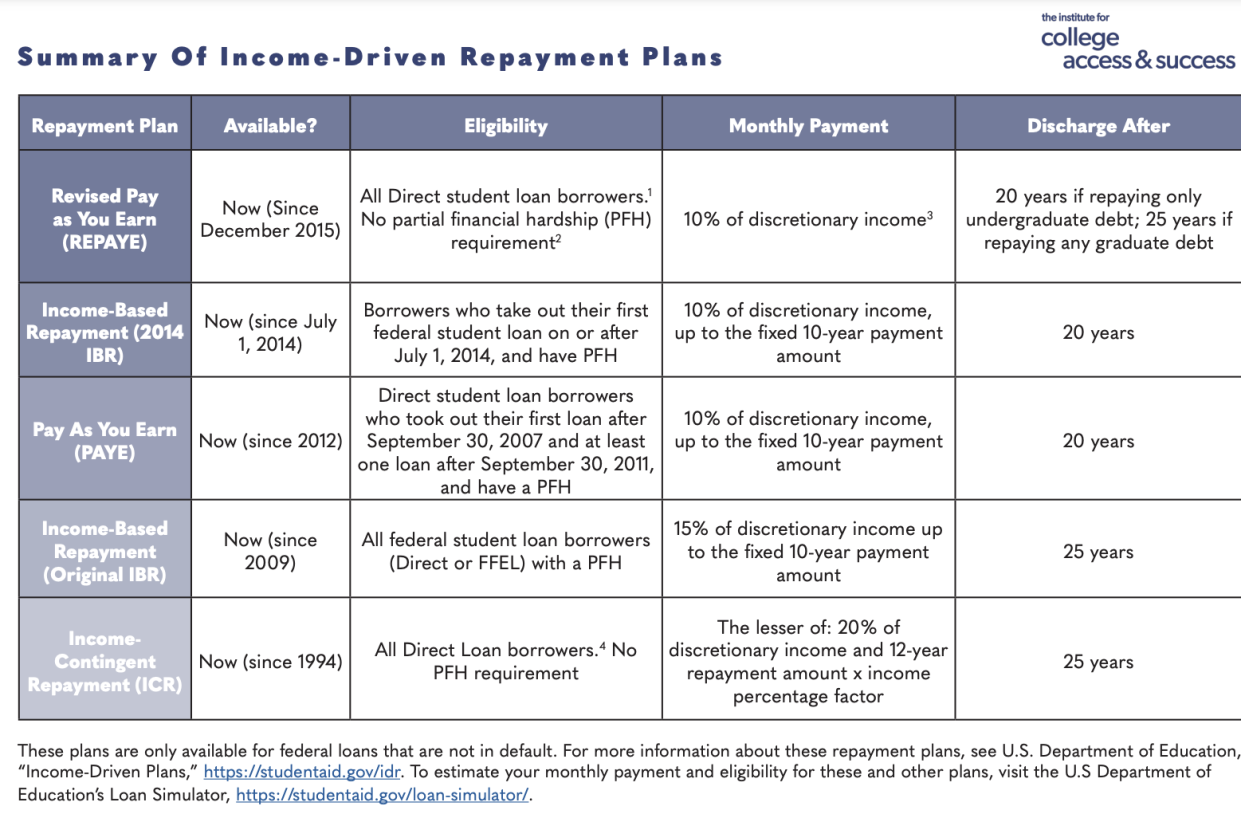

The adjustment to student loan accounts would go toward helping borrowers get closer to discharge under income-driven repayment plans, which offer discharge after 20 or 25 years of repayment, depending on the particular IDR plan.

The Education Department clarified this month that the adjustment will look at loans in repayment since July 1, 1994, that are still owed by the borrower or included in a consolidation loan by the borrower.

Who is eligible for the one-time IDR payment adjustment?

Borrowers with William D. Ford Federal Direct Loan (Direct Loan) Program and federally owned Federal Family Education Loan (FFEL) Program loans are eligible.

The government this month extended the deadline for consolidating commercially-held FFEL, Perkins, or Health Education Assistance Loan (HEAL) with Federal Student Aid to become eligible for the adjustment. The new deadline is December 31, 2023. Previously, the deadline was May 1, 2023.

Borrowers in default have until December 31, 2023, to use the government's Fresh Start Program to become in good standing and take advantage of the one-time payment adjustment. Time in default will not be counted toward IDR.

Are there income restrictions?

Unlike Biden’s up to $20,000 in loan cancellation, there are no income restrictions for the one-time payment adjustment.

How do I get the one-time payment adjustment?

The adjustment will happen automatically, unless your loans are in default or you have commercially-held FFEL loans.

Beware of scams. If you have federal loans, you do not have to pay to receive federal loan forgiveness, discharge, or the one-time payment adjustment.

What will happen to my account after the one-time adjustment is applied?

Income-driven repayment plans offer loan discharge after 20 or 25 years, depending on the particular IDR plan. One of three things will happen to your federal student loan account once the adjustment is applied:

Depending on your IDR plan, you will be closer to loan discharge; (or)

If you have reached 20-25 years of repayment, your remaining balance will be discharged; (or)

If you have been in repayment for longer than your IDR plan, you will likely receive a refund.

What if my loan is in default?

Default borrowers have until December 31, 2023 to use the Fresh Start Program to become in good standing and take advantage of the one-time payment adjustment.

Time in default is not normally counted toward IDR or PSLF, but borrowers who get out of default during Fresh Start will receive credit from March 2020 through the date they leave default, the Education Department clarified this month.

After the Fresh Start period, only borrowers who rehabilitate to leave default will benefit from the adjustment, the department ruled.

How much time will be credited to my account?

Under the initiative, the department will add the following months to an account’s payment history:

Months in repayment status, regardless of the payments made, loan type, or repayment plan;

12 or more straight months of forbearance or 36 or more months of total forbearance;

Months in an economic hardship or military deferments after 2013;

Months in any deferment (except in-school deferment) before 2013; and

Any months in repayment on earlier loans before loans were consolidated.

What about PSLF borrowers?

Public Service Loan Forgiveness (PSLF) borrowers will get the following credit:

Any months in a repayment status, regardless of the payments made, loan type, or repayment plan;

12 or more months of consecutive forbearance, or 36 or more months of cumulative forbearance;

Months spent in economic hardship or military deferments in 2013 or later;

Months spent in any deferment (except in-school deferment) prior to 2013; and

Any time in repayment (or deferment or forbearance, if applicable) on earlier loans before consolidation of those loans into a consolidation loan.

What is the distinction between 20 and 25 years of repayment?

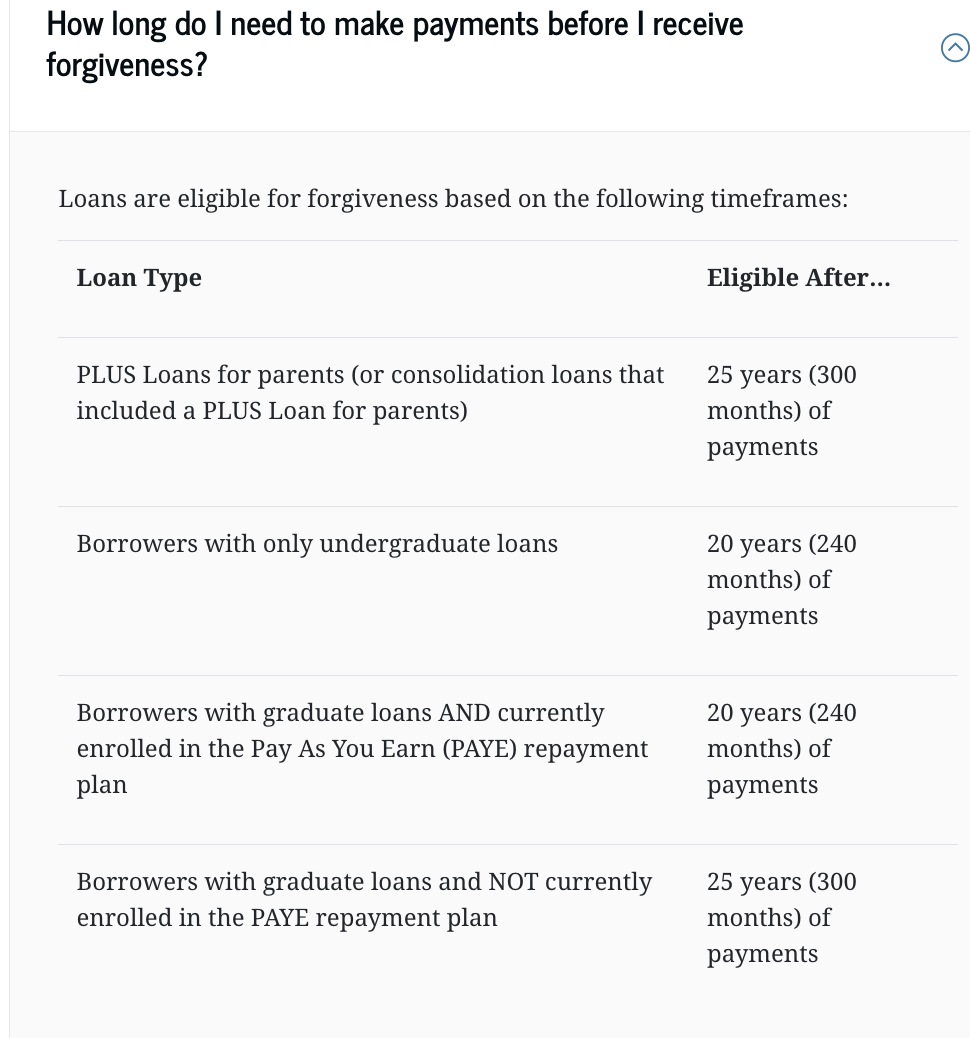

Depending on the IDR program you enrolled in, the remaining balance on your student loan is discharged after 20 or 25 years of repayment.

What is the timeline for the one-time payment adjustment?

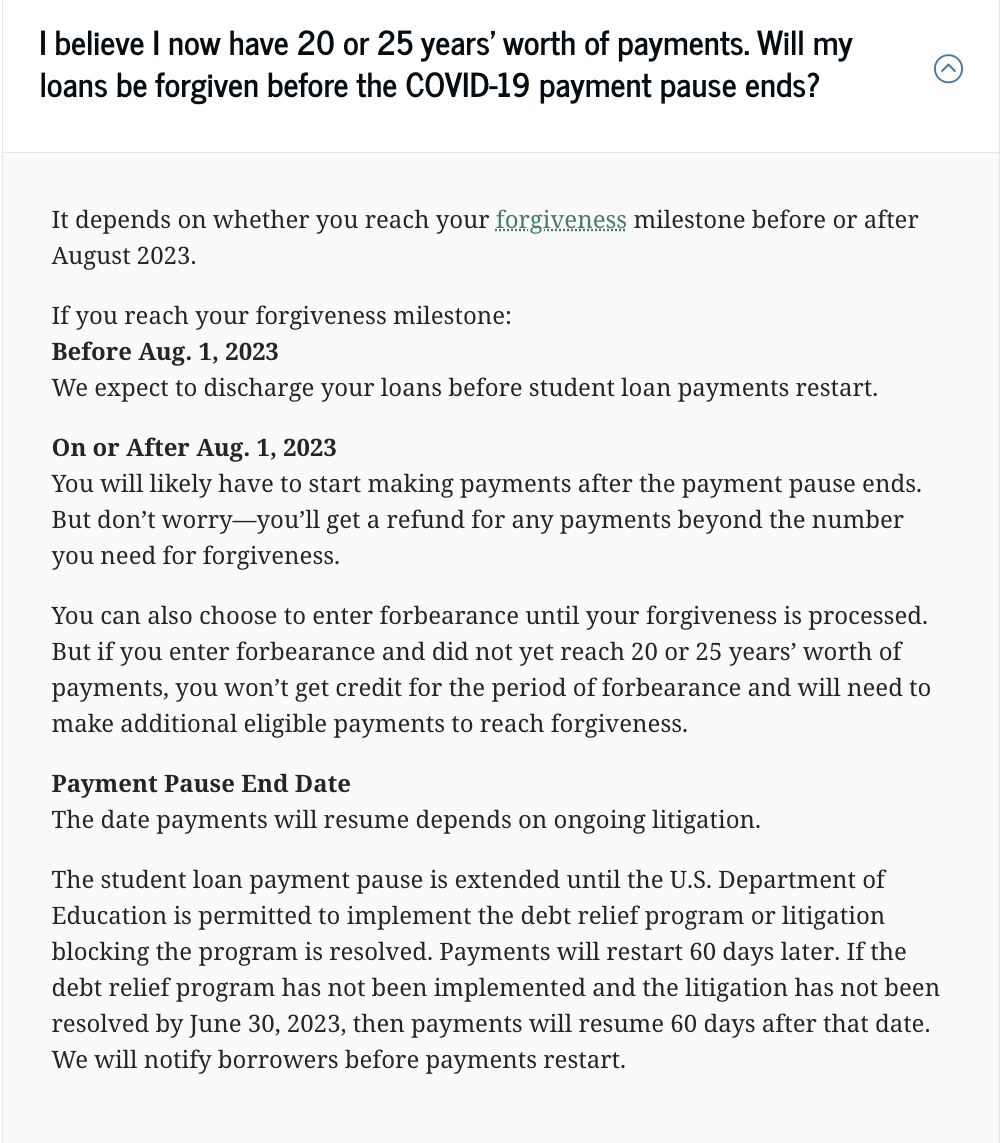

In February, Education Department stated that borrowers with 240 or 300 months of payments or 120 months toward Public Service Loan Forgiveness (PSLF) would see their loans forgiven in spring 2023, with all other borrowers’ accounts updated in the summer.

Some PSLF borrowers have already reported seeing zero balances as a result of the one-time payment adjustment.

The Federal Student Aid (FSA) website was updated this month to state that borrowers with 20 years (240 months) of payments for undergraduate debt or 25 years (300 months) of payments for graduate debt (not enrolled in PAYE income-driven plan) and ParentPlus loans will see adjustments by August 1, 2023.

If you don’t reach your 20 or 25 year milestone before August 1, 2023, you will likely need to begin repayment once the forbearance pause ends, but your adjustment will happen after August 1.

All other borrowers will see the adjustment applied in 2024.

What if I have joint consolidation with my spouse?

The department finally provided guidance for joint loan consolidation borrowers.

The Education Department clarified that if you have a joint (spousal) consolidation, you will need to split or separate the loan with each person applying for a Direct Consolidation Loan to get the one-time account adjustment.

How will I know the one-time adjustment was applied?

Borrowers should go to the Federal Student Aid’s (FSA) website to see if the adjustment has been credited to their accounts.

Do I have to pay taxes on the one-time payment adjustment?

Any debt forgiven due to the one-time IDR account adjustment will not be subject to federal taxes as a result of the American Rescue Plan Act, which included a provision temporarily modifying the tax treatment of discharged student loan debt between December 31, 2020 through January 1, 2026.

However, it could be taxable in some states. Consult a tax professional.

Ronda is a personal finance senior reporter for Yahoo Finance and attorney with experience in law, insurance, education, and government. Follow her on Twitter @writesronda.

Read the latest financial and business news from Yahoo Finance