Student debt: 615,000 borrowers receive public service loan forgiveness

The Biden administration has approved the discharge of student loan debt for more than 615,000 borrowers since October 2021 under temporary changes to the public service loan forgiveness (PSLF) program.

The discharged amount totals $42 billion in debt and is a big increase from the previous administration’s record, which approved just 7,000 borrowers under the PSLF program or only 2% of PSLF applicants, leading to the basis for the expanded program eligibility.

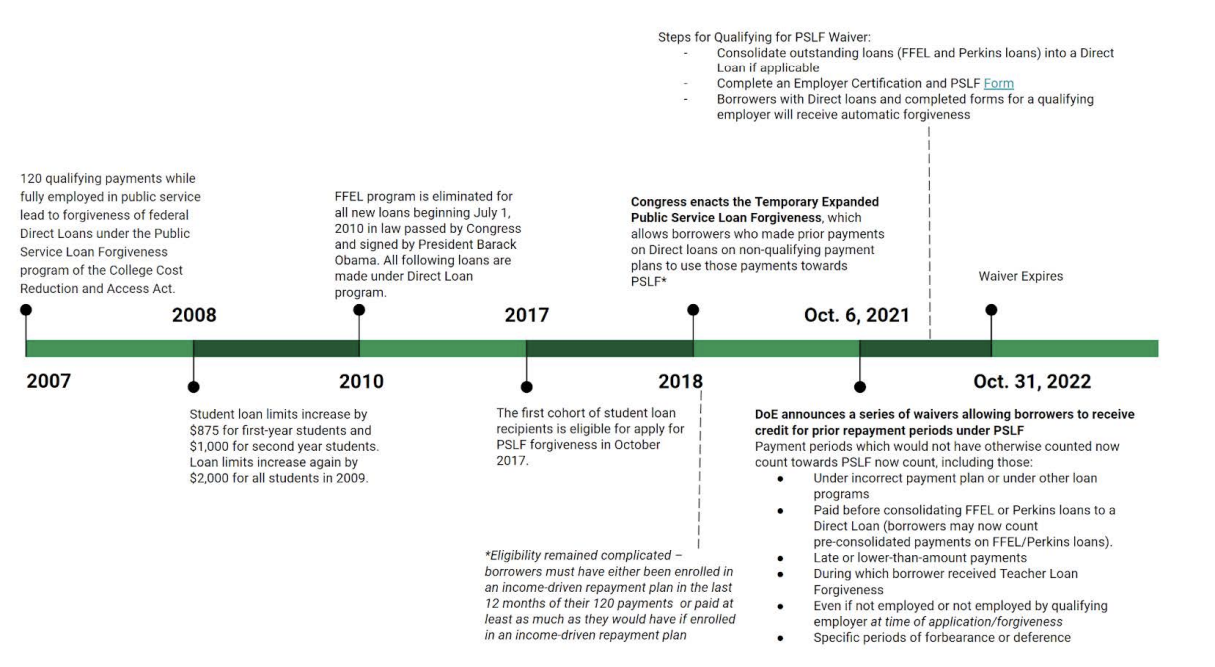

The changes — known as the PSLF waiver — allowed previously denied borrowers to reapply, expanded who qualifies to apply for forgiveness, and counted payments that were otherwise not eligible for the original program.

“The Biden-Harris Administration has worked relentlessly to fix a broken student loan system, including by making sure we fulfill the promise of Public Service Loan Forgiveness for those who have spent a decade or more serving our communities and our country,” Miguel Cardona, US Secretary of Education, said in a press release. “To date, the Biden-Harris team has kept that promise for more than 615,000 teachers, nurses, social workers, servicemembers, and other public servants by approving a combined $42 billion in student loan debt forgiveness.”

Employees who have worked at least 10 years in the public service jobs with federal, state, local, or certain non-profit organizations are eligible for the public service loan forgiveness (PSLF) program — including military service members who don’t qualify for other military loan forgiveness programs.

Under the normal PSLF program, borrowers must work at least 10 years with a qualifying employer and have made at least 120 full on-time payments in a standard payment plan to be eligible. Also, only Direct Loans qualified for PSLF.

But after more than 98% of borrowers who applied for the PSLF program were denied loan forgiveness by the Education Department under former Education Secretary Betsy DeVos, the American Federation of Teachers among others sued the department for how it managed the program.

The PSLF waiver was enacted as part of the 2021 legal settlement of that lawsuit with the Education Department. The changes it enacted expired October 31, 2022, as part of that settlement.

Other PSLF improvements

Additionally, the Education Department announced improvements to the PSLF Help Tool that borrowers use to apply for the program.

In the past, borrowers complained about the amount of paperwork, having to mail documents, and the lack of an easy online process.

The PSLF Help Tool now allows borrowers to “complete the entire PSLF application process online, and submit e-signatures for themselves and request e-signatures from their employers will significantly decrease processing time,” according to the department.

This will significantly reduce the time it takes for borrowers to get certification from employers, a necessary step for the PSLF eligibility process.

Another major improvement is the ability to digitally track the status of the PSLF form in the “My Activity” section of borrowers’ StudentAid.gov account.

“FSA is making the Public Service Loan Forgiveness Program as easy as possible so all public servants can finally get the loan forgiveness they have earned,” Richard Cordray, Federal Student Aid (FSA) chief operating officer, said in the press release. “The improved PSLF Help Tool is another step forward to modernize and simplify the process for people who rely on us to carry out the law effectively.”

Ronda is a personal finance senior reporter for Yahoo Money and attorney with experience in law, insurance, education, and government. Follow her on Twitter @writesronda

Read the latest personal finance trends and news from Yahoo Money.

Follow Yahoo Finance on Twitter, Instagram, YouTube, Facebook, Flipboard, and LinkedIn.