‘We need to stop the cycle:’ Student loan borrowers detail what forgiveness would mean

Rallying for student loan forgiveness on the Supreme Court steps Tuesday, Raymond Collings was there not just for himself or his children. The college professor was also thinking of the students he teaches and his colleagues who grapple with costly student debt.

“Me and my wife have student loans, teach at state universities, and struggled to save for retirement while trying to send our kids to college. We work at a public university and many colleagues share this same story: Promises about obtaining a college education to pursue the American Dream only to spend decades saddled with debt that they may never pay off," Collings, a professor of psychology at SUNY Cortland, told Yahoo Finance.

“We’re teaching middle-income students taking out loans for tuition much higher than we paid. We need to stop the cycle.”

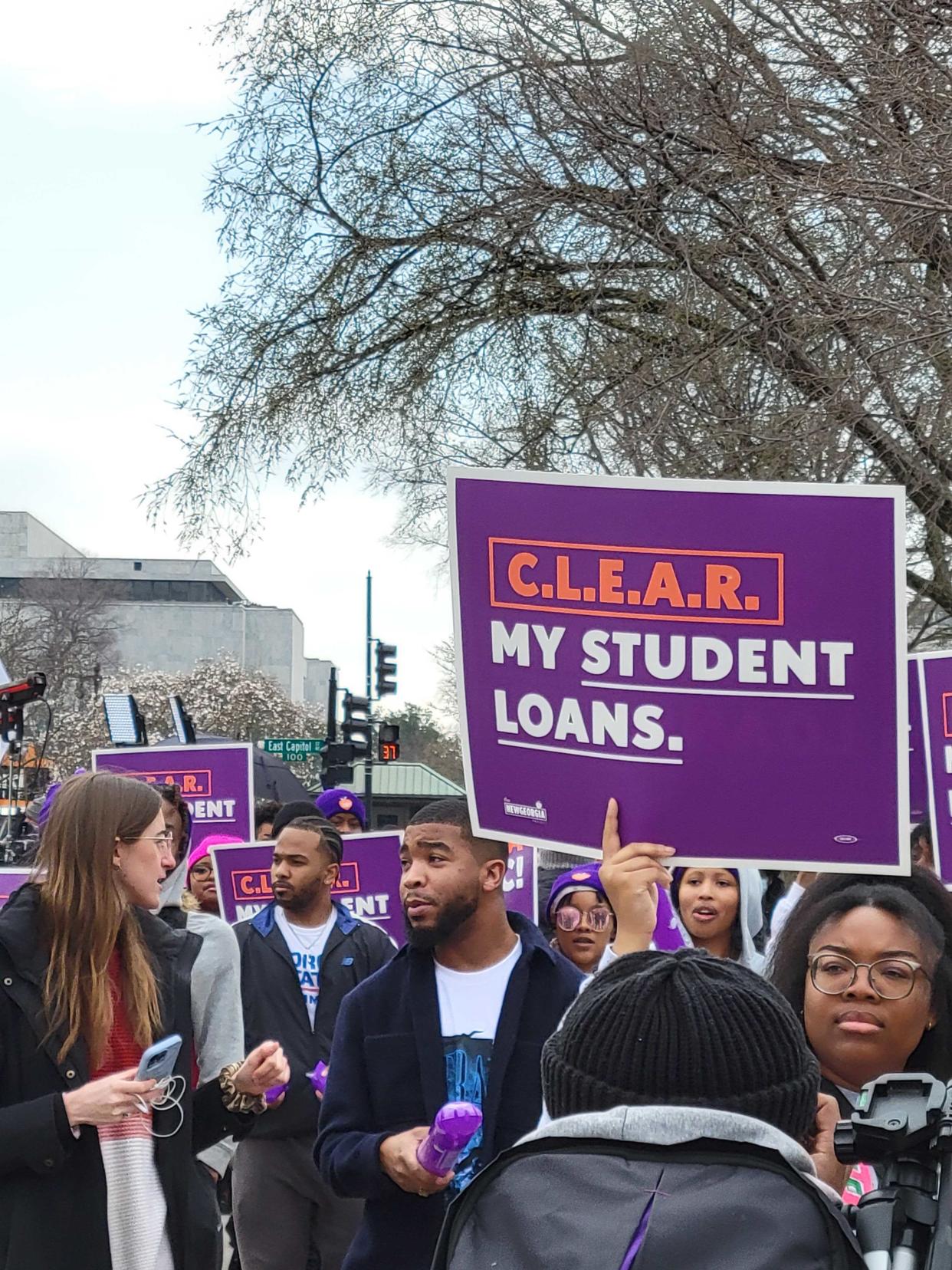

Collings was among the hundreds of borrowers who traveled to the highest court in the land Tuesday to share their stories as arguments over the legality of President Joe Biden’s student loan forgiveness plan started. More than 40 million borrowers stand to benefit from cancellation if the president’s plan is upheld.

“Inside the Supreme Court there are technical arguments on standing and the major questions doctrine, but it’s important to remember the faces of the borrowers impacted by the court’s judgment,” Persis Yu, deputy executive director of the Student Borrower Protection Center (SBPC), a borrower advocacy group, told Yahoo Finance.

“Their financial lives are at stake, making payments from budgets that are already stretched too thin. Borrowers are counting on Biden’s student loan forgiveness.”

'That can’t happen with the debt'

In August, Biden announced the federal government would cancel $10,000 in student loan debt for individuals who make less than $125,000 and for households that earn less than $250,000. An additional $10,000 in forgiveness would go to those who received need-based Pell Grants.

But four weeks after the portal to apply for forgiveness opened in October, it stopped accepting applications in the wake of two lawsuits challenging the plan, which are now before the Supreme Court. Still, 26 million borrowers applied and over 16 million were approved for forgiveness before the portal shut down, according to the Education Department.

Among them was Ryan Rudolph, a graduate student at Duke University who also joined the rally on Tuesday. Rudolph, who carries $80,000 in undergraduate and graduate student loan debt, expects to pay around $800 to $900 per month after graduating.

Rudolph has lined up a job after graduation that would qualify for the Public Service Loan Forgiveness program (PSLF), which offers student loan discharge after 10 years of repayment for borrowers who work in public service jobs. The grad student turned down other, better-paying jobs that wouldn’t be eligible for PSLF — just in case the court strikes down Biden’s plan.

“If Biden’s student loan forgiveness happens, I will get $20,000 forgiven and will be able to pay off my remaining debt in five years. If the Supreme Court rules against Biden’s loan forgiveness, it will take me 10 years to pay off my debt using PSLF,” Rudolph told Yahoo Finance. “I’m 29 years old and want to start a family someday, and that can’t happen with the debt.”

'My parents owe more than $200,000'

The rally on Tuesday was organized by a coalition of over 20 advocate organizations and amicus brief filers — including the SBPC, the Student Debt Crisis Center, Student Borrowers Protection Center, the NAACP, the American Federation of Teachers, and the National Consumers Law Center. Progressive lawmakers such as Sens. Bernie Sanders (D-VT) and Elizabeth Warren (D-MA) and Reps. Ayanna Pressley (D-MA) and Ilhan Omar (D-MN) also showed up.

The rally’s goal, according to Yu, was to show the public and Supreme Court justices the faces of the people who will feel the impact of the ruling, especially since the cost of college has drastically increased since the justices attended college.

Overall, college costs have increased 10% at public institutions and 19% at private schools since 2011, something that can take borrowers by surprise.

“My parents thought they were doing the right thing by taking out ParentPlus loans to send me and my two siblings to college,” Emani Cannady from Virginia, who attended the rally, told Yahoo Finance. “My parents owe more than $200,000 in ParentPlus loans. My mom is a nurse and saved $13,000 for my college fund. In 1996, she thought that was a lot of money for college — it only covered my room and board for one year.”

'She's coming out with significant debt'

Borrowers received unprecedented relief during the pandemic when both the Trump and Biden administrations paused payments on federal student loans. That forbearance is set to end June 30 — nearly two and half years after the pause was enacted — and almost 60% of borrowers say they may not be able to afford loan payments when they restart, according to a Morning Consult poll conducted in November.

“Consolidation locked my loans into a high interest rate and I was never told about income-driven repayment options. My debt was not paid off when my own kids entered college," Leslie Eaton, another professor of psychology at SUNY Cortland, told Yahoo Finance. "Now, I can see no end in sight.”

Overall, two-thirds of those who have federal loans reported they’ve experienced hardship in affording their payments, according to the survey.

That was on the mind of one supporter from Washington, D.C., who came over to the rally during her lunch break. Snapping pictures of the supporters, Traci, who declined to give her last name, was thinking of her niece in college in Arizona.

“Even with scholarships and grants, she's coming out with significant debt,” Traci told Yahoo Finance. “When I graduated from college, I only had $15,000 in student debt but it took me 15 years to pay off. I can't imagine how the younger generation will be able to pay off student debt with college costs these days.”

Ronda is a personal finance senior reporter for Yahoo Finance and attorney with experience in law, insurance, education, and government.

Follow her on Twitter @writesrondaRead the latest personal finance trends and news from Yahoo Finance. Follow Yahoo Finance on Twitter, Instagram, YouTube, Facebook, Flipboard, and LinkedIn