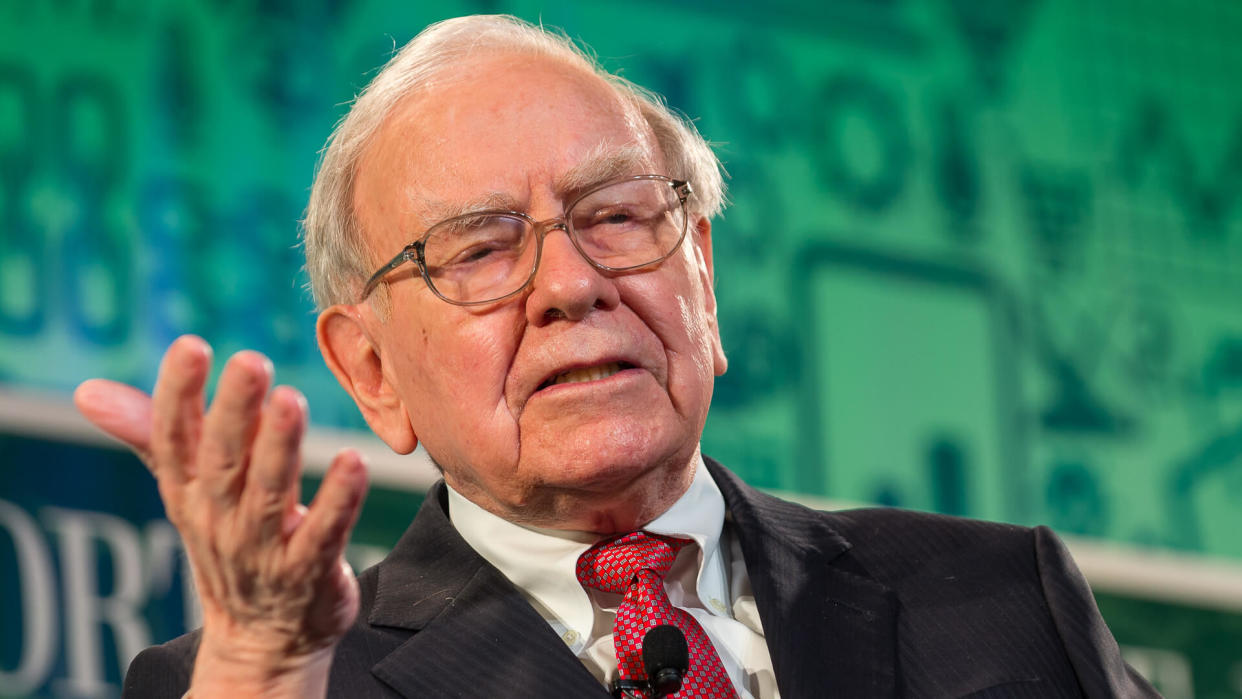

These Are the Stocks Warren Buffett Bought and Sold in 2022

For Berkshire Hathaway chief Warren Buffett, the 2022 bear market was one big Black Friday sale -- and the Oracle of Omaha went on a shopping spree.

See Our List: 100 Most Influential Money Experts

Learn: 5 Things You Must Do When Your Savings Reach $50,000

Every quarter, institutional investment managers who control more than $100 million in assets are required to submit reports called 13-F filings with the SEC. And the three 13-F filings that Berkshire submitted in 2022 show that this was one of the busiest and most consequential years in the company's history.

Occidental Petroleum (OXY)

Buffett entered 2022 without a single share of OXY, but his Q3 filings show that Berkshire now owns 194,351,650 shares -- 4% of the firm's portfolio. He started with a $7.74 billion purchase in Q1 and never stopped buying. It was part of a historical dive into energy for Buffett, whose famous powers of prognostication led him to buy big in a year that saw record-high gas prices and historic profits for big oil.

Chevron (CVX)

Buffett's second major energy play was Chevron. In the closing quarter of 2021, Berkshire held 38,245,036 shares, but by Q3 2022, it was up to 165,359,318 for a gain of 127,114,282. Chevron now makes up 8% of Berkshire's portfolio. According to Motley Fool, energy had accounted for less than 9% of Buffett's holdings for the entire 21st century. Now, Chevron and Occidental make up 12.1% of the firm's portfolio.

Take Our Poll: How Do You Typically Split the Restaurant Bill?

Taiwan Semiconductor Manufacturing (TSM)

Buffett has long been sweet on Apple, which still makes up more than 40% of his portfolio, but Apple is an outlier. Berkshire has never been big on tech, but that all changed in 2022. TSM is a manufacturing company, but it's the exclusive producer of the silicon chips that Apple uses to power its devices.

Buffett bought 60,060,880 shares in the third quarter at a cost of $4.11 billion.

Activision Blizzard (ATVI)

Buffett furthered his expansion into tech with 45,483,745 shares of gaming company Activision Blizzard. The 14,658,121 shares he owned in Q4 of 2021 ballooned to 60,141,866 by the time Berkshire filed in Q3 report in 2022. It now owns $4.47 billion, worth -- 1.5% of the firm's combined holdings. Buffett had owned even more earlier in the year, but he sold some in the third quarter.

Paramount Global (PARA)

Paramount added millions of subscribers to its streaming services in 2022 and hit box office gold with "Top Gun: Maverick." Buffett became a believer, adding PARA to Berkshire's portfolio in the form of roughly 69 million shares in Q1. He brought it up to around 78 million in Q2 and finally to 91,216,510 in Q3, worth $1.74 billion.

U.S. Bancorp (USB)

Buffett did plenty of selling in 2022, as well. After dumping what was left of Berkshire's Wells Fargo holdings, U.S. Bancorp became the Oracle's longest-held bank stock -- but he might be falling out of love.

Buffett owned 126,417,887 shares of USB in Q4 2021, but by the time the third quarter of 2022 rolled around, it was down to 77,788,214.

Bank of New York Mellon Corp (BK)

USB isn't the only bank stock that had a run-in with Buffett's ax in 2022. He also thinned out his holdings of Bank of New York Mellon Corp, slimming down from 72,357,453 shares at the end of 2021 to 62,210,878 in Q3 2022. He's still into the stock for $2.4 billion, but BK now comprises less than 1% of Berkshire's holdings.

Store Capital Corp (STOR)

Buffett offloaded his entire STOR holdings in the third quarter, dumping 6,928,413 shares of the REIT that were worth about $181 million. According to US News and World Report, STOR owns single-tenant properties like gyms, movie theaters, restaurants and other businesses that were hit hard during the pandemic. Buffett first bought into the company in 2017.

General Motors (GM)

Buffett sold exactly 10 million shares of GM, taking his holdings from 60 million at the end of 2021 to 50 million in the third quarter of 2022, with some smaller buying and selling taking place in the quarters in between. His stake went from $3.52 billion, accounting for 1.7% of Berkshire's portfolio, to $1.6 billion, which now represents 0.5% of his holdings.

Kroger (KR)

Buffett also trimmed his stake in the grocery giant Kroger, from 61,412,910 shares at the end of 2021 to 50,268,823 in the third quarter of this year. He chipped away at Kroger throughout the year, selling millions of shares in the first, second and third quarters. Berkshire now owns about $2.2 billion worth of KR.

More From GOBankingRates

Photo Disclaimer: Please note some photos may be for representational purposes only.

This article originally appeared on GOBankingRates.com: These Are the Stocks Warren Buffett Bought and Sold in 2022