Stocks look to build on best week in a year: What to know this week

Another slew of corporate earnings reports awaits investors in the week ahead as the stock market will look to extend its recent rally.

Disney (DIS) highlights the week of quarterly reports while Uber (Uber), Rivian (RIVN), Occidental Petroleum (OXY), and Warner Brothers Discovery (WBD) also highlight the schedule.

The calendar will be quiet on the economic front, with the first reading of November consumer sentiment from the University of Michigan slated for Friday the most notable release.

On Tuesday, Yahoo Finance will host its Invest conference, with voices including DoubleLine founder Jeffrey Gundlach, Meredith Whitney, and media leaders Jeff Zucker and Kevin Mayer among the scheduled speakers.

Stocks enter the first full trading week of November after their best week in roughly a year, as increased investor confidence that the Federal Reserve's rate hiking campaign may be over sent equities soaring into the weekend.

The Dow Jones Industrial Average (^DJI) gained about 5% last week, while the S&P 500 (^GSPC) added nearly 6%. The tech-heavy Nasdaq Composite (^IXIC) soared more than 6.6%, marking the best weekly performance of the major indexes in 2023.

Friday's jobs report showed job growth last month was cooler than expected, with the US economy adding 150,000 jobs in October and the unemployment rate reaching its highest level since January 2022 at 3.9%.

The labor market slowdown is a welcome sign for the Federal Reserve, which has noted more softening in the labor market will likely be needed to keep inflation on its downward trajectory.

"It is still likely to be true — not a certainty, but likely — that we will need to see some slower growth and some softening ... in labor market conditions to fully restore price stability," Fed Chair Jerome Powell said in a press conference last Wednesday.

Powell didn't explicitly turn down the possibility of further rate hikes, noting Fed officials are not discussing rate cuts right now. Still, the market took Powell's comments to mean the central bank is likely done with interest rate hikes for the foreseeable future.

Read more: What the Fed rate-hike pause means for bank accounts, CDs, loans, and credit cards

As of Friday afternoon, markets were pricing in a roughly 95% chance the Fed doesn't raise rates at its next meeting, per the CME FedWatch Tool, up about 15 percentage points from the day prior. A month ago, markets had priced in just a 53% chance the Fed wouldn't hike again.

"The October jobs report seemed tailor-made to match Powell's soft landing message from earlier this week," JPMorgan chief US economist Michael Feroli wrote in a research note on Friday. "At the end of the day, the economic data are going to call the shots, and the data say we're done with rate hikes."

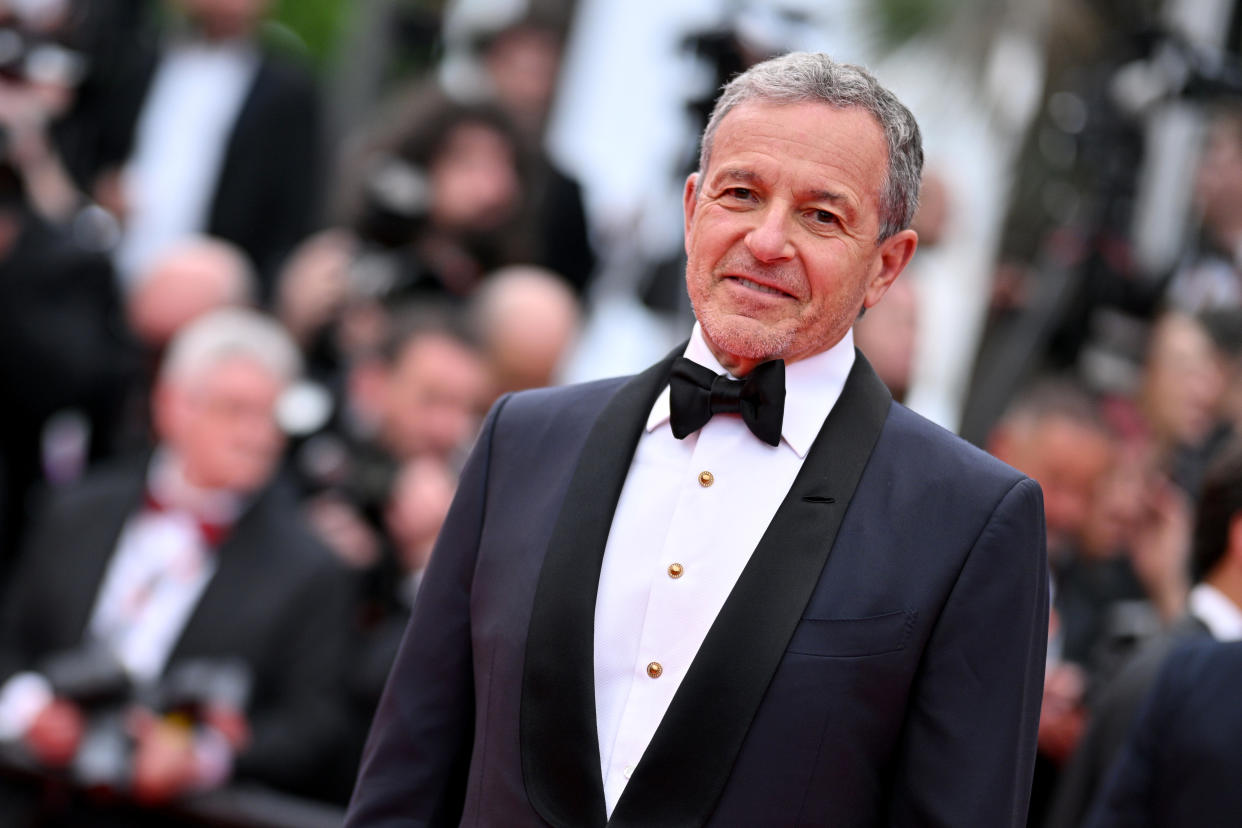

Disney leads the earnings rush this coming week with the media giant set to report results after the bell on Wednesday. Investors will be focused on the company's new reporting structure, specifically any additional details on ESPN, which recently released individual financials for the first time.

In February, Disney CEO Bob Iger restructured the company into three core business segments: Disney Entertainment, Sports (ESPN), and Experiences.

Inside the report, key metrics will include Disney+ subscribers and the success of pay increases on the platform. Investors will likely be on the lookout for any update on Hulu as well, following an announcement last week that Disney is buying Comcast's remaining stake in the streaming platform.

"We expect the new Linear standalone segment to continue to decline from the loss of pay TV subs, and advertising to remain weak," Macquarie media tech analyst Tim Nollen wrote in a research note on Oct. 24.

Broadly, a solid earnings season hasn't served as much of a market catalyst in recent weeks, as higher bond yields and fears of another Fed rate hike have been driving market action leading into the Nov. 1 FOMC meeting.

But those fears are abating, for now, as the 10-year yield hit its lowest level in more than a month on Friday, easing off 16-year highs that Wall Street strategists believed could be a consistent headwind for stocks.

In a note to clients on Friday, Evercore ISI senior managing director Julian Emanuel noted the fact that the 10-year Treasury yield never stayed above 5% during its recent surge has "changed market psychology," given stocks had recently been falling as yields rose.

Importantly, this comes as earnings have largely been better than expected.

According to data from Evercore ISI, 404 S&P 500 companies had reported earnings as of Friday morning. Using updated projections based on earnings reports so far this period, the firm expects S&P 500 companies to report sales growth of 2.2% and earnings growth of 3.6% for the third quarter.

If those stats hold, it would mark the first time companies have reported earnings growth since the third quarter of 2022.

"This week reminds investors that you can make money in stocks with interest rates at these levels or higher; it happened for a decade+ prior to the GFC," Emanuel wrote in a research note on Friday.

"While we continue to view the medium term as challenged in light of earnings uncertainty, troubling geopolitics and the potential for recession, the rationale for remaining hedged in the here and now no longer applies."

Weekly Calendar

Monday

Economic data: No notable economic news set for release.

Earnings: Dish Networks (DISH), Devon Energy (DVN), Freshpet (FRPT), Tripadvisor (TRIP)

Tuesday

Economic data: Trade balance, September (-$60.5 billion expected, -$58.3 billion previously)

Earnings: Celsius Holdings (CELH), Datadog (DDOG), Dutch Bros. (BROS), Fisker (FSR), Occidental Petroleum (OXY), Rivian (RIVN), Toast (TOST), Uber (Uber)

Wednesday

Economic data: MBA mortgage applications, November 3 (-2.1% previously); Wholesale inventories month-over-month, September (0% previously)

Earnings: Disney (DIS), Affirm (AFRM), AMC (AMC), Marathon Digital Holdings (MARA), Trade Desk (TTD), Under Armour (UAA), Twilio (TWLO), Warner Bros. Discovery (WBD)

Thursday

Economic data: Initial jobless claims, week ended Nov. 4 (218,000 expected, 217,000 previously)

Earnings: Novavax (NVAX), Oatly (Oatly), Yeti (YETI), The Trade Desk (TTD), Wynn Resorts (WYNN)

Friday

Economic data: University of Michigan consumer sentiment, November preliminary (64.0 expected, 63.8 previously)

Earnings: No notable earnings set for release.

Josh Schafer is a reporter for Yahoo Finance.

Click here for the latest economic news and indicators to help inform your investing decisions.

Read the latest financial and business news from Yahoo Finance