What stock market pros are saying about midterm elections: Morning Brief

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Tuesday, November 8, 2022

Today's newsletter is by Sam Ro, the author of TKer.co. Follow him on Twitter at @SamRo. Read this and more market news on the go with Yahoo Finance App.

Millions of Americans will head to the polls in Tuesday's midterm elections to vote for their national, state, and local representatives.

The stakes are high and could end with Republicans gaining control of the Senate and/or the House, which increases the likelihood that little new legislation gets passed amid gridlock.

Ironically, gridlock is often thought to be bullish for stocks as it removes some policy uncertainty.

“If Republicans do well and take back control of one or both chambers of Congress, we see the event as a positive for the stock market into year-end,” Lori Calvasina, head of U.S. equity strategy at RBC Capital Markets, wrote on Monday. “We believe the October move [in the S&P 500] was fueled in large part by the shift in momentum away from Democrats and back towards Republicans that we started to see in polling data and betting markets that was building in August and September.”

Michael Wilson, chief U.S. equity strategist at Morgan Stanley, agrees that gains by Republicans would be bullish. But he also cautions that there could be some near-term volatility.

“The results may not be clear on Tuesday night given the delay in counting mail-in ballots, which means we can expect price volatility in equity markets will remain high and provide ammo for bears and bulls alike,” Wilson wrote on Monday.

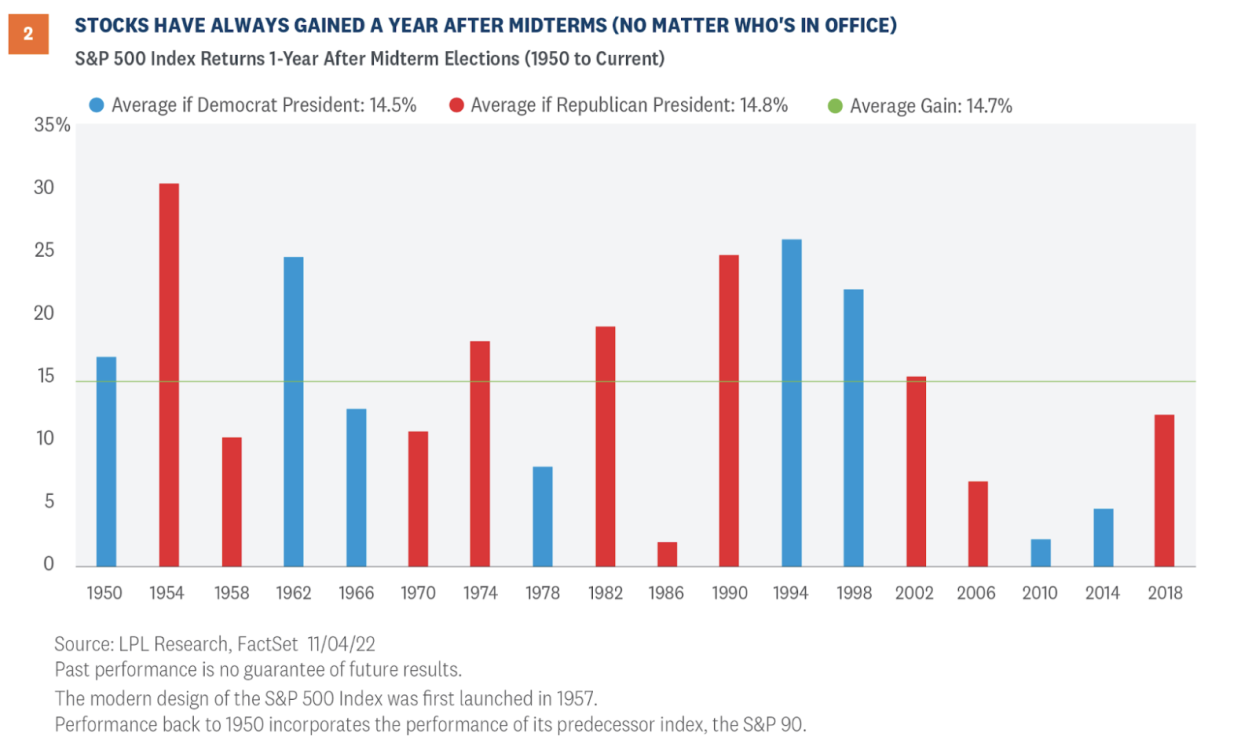

Regardless of the outcome, Wall Street strategists are generally in agreement that the outlook for stocks is favorable once we get the midterm elections behind us. This would be in line with history, which shows the S&P 500 has generated a positive return in every one-year period that followed midterm elections.

“There are a few possible fundamental reasons for market strength following midterm elections,” LPL Financial’s Barry Gilbert and Jeff Buchbinder wrote on Monday. “Primarily, the uncertainty associated with the election is behind us, and markets don’t like uncertainty. But on top of that, midterms usually provide something of a course correction from presidential elections, as discussed above, and markets may anticipate prospects of a better policy balance ahead, regardless of who is in the Oval Office.”

Indeed, post-midterm election periods tend to be stronger than average.

“Since 1950, the average one-year return following a midterm election was 15%,” Capital Group analysts observed. “That’s more than twice the return of all other years during a similar period.”

That said, the outcome of the elections represents just one variable for investors as they think about the longer term outlook for stocks.

“Our main mantra over the past decade is what happens in Washington matters, but collectively factors outside of Washington matter more,” Keith Lerner, chief market strategist at Truist Advisory Services.

“Market history suggests to us that regardless of which party is considered the victor in the midterm elections a rally of some kind is likely in the equity markets near term,” John Stoltzfus, chief investment strategist at Oppenheimer Asset Management, said. “A multiplicity of other factors including monetary policy, economic growth, corporate earnings and revenue growth as well cyclical (current) and secular (longer term) trends are likely to drive market performance to a larger degree into the New Year.”

So before you decide to double down on the stock market because the historical pattern looks good, keep in mind that the broader macro backdrop is very much unprecedented, which means you can’t rule out the possibility that this coming year becomes one where history doesn’t repeat.

What to Watch Today

Economy

6:00 a.m. ET: NFIB Small Business Optimism, October (91.4 expected, 92.1 during prior month)

Earnings

Affirm (AFRM), Allbirds (BIRD), AMC Entertainment (AMC), Constellation Energy (CEG), Coty (COTY), DuPont (DD), GoodRX (GDRX), Lemonade (LMD), Lordstown Motors (RIDE), Lucid Group (LCID), News Corp. (NWSA), Norwegian Cruise Line (NCLH), Novavax (NVAX), Occidental Petroleum (OXY), Planet Fitness (PLNT), Upstart (UPST), Walt Disney (DIS), Wynn Resorts (WYNN)

—

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube